In recent years, there has been a significant rise in cases of dementia, or diminished cognitive capacity, which most commonly manifests as Alzheimer’s disease. The Alzheimer’s Association® estimates that the number of Americans with Alzheimer’s disease and other dementias will escalate rapidly in coming years. By 2050, the number of people age 65 and older with Alzheimer’s disease may nearly triple, from 5.8 million to as many as 14 million, unless medical breakthroughs are developed to prevent, slow, or stop the disease.

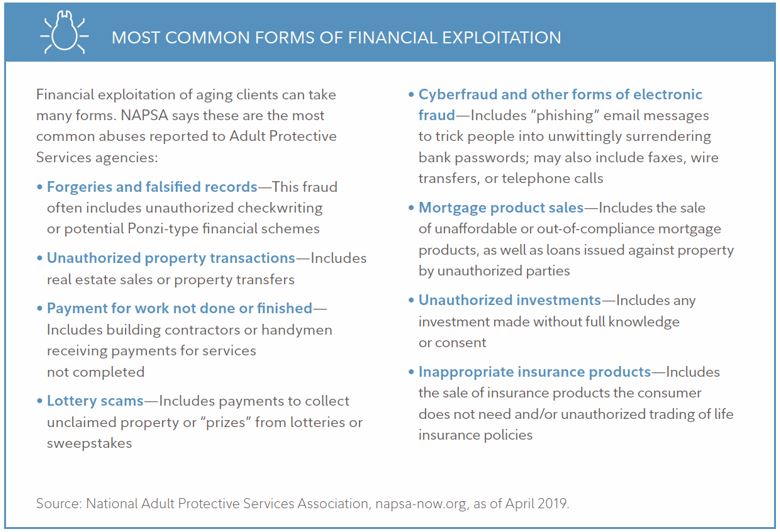

Subsequently, older adults are a prime target for financial scams and other unscrupulous acts, regardless of their physical and mental condition. According to the SIFMA Senior Investor Protection Resource Center, one in five seniors (age 65 and older) have been victimized by financial fraud, and seniors lose an estimated $2.9 billion annually to financial exploitation. Unfortunately, it is estimated that only 1 in 44 of these elder financial abuse crimes is ever reported to authorities, a motivating factor for perpetrators.

To ensure your senior loved ones do not become a victim of elder financial fraud, here are some steps to consider:

In addition to providing various forms of training on how to detect elder fraud throughout the year to our Advisors and staff, Per Stirling has also developed multiple forms to assist with this growing concern. The “Emergency Contact Form” was created to assist your Per Stirling Advisor in the event that he or she suspects you are having difficulty understanding your financial situation, are the target of financial abuse, are showing signs of diminishing mental capacity, or are having a medical emergency. If you have not yet provided us with an Emergency Contact, please contact us at your earliest convenience so that we can update your information on file accordingly.

This form is not intended to replace our additional “Third-Party Authorization Form”, which allows for your Advisor and their team to share your personal investment and financial planning information with the trusted contacts you have listed on this form. Per Stirling will never share your personal or account information without your written consent.

In addition, trusted family members or friends are always welcome to attend meetings to assist you in implementing financial safeguards.

Most custodians offer additional information and, in some cases, additional services to assist clients in protecting themselves. Please feel free to contact your Advisor if you are interested in learning more.

We also encourage you to visit some of the online resources listed below for additional education and tools to assist you and your family with this sensitive subject.

Online Resources:

- The Alzheimer’s Association

- The Elder Justice Initiative

- National Adult Protective Services Association

- FINRA Senior Investors

- NASAA Senior Investor Resource Center

- Serve Our Seniors

- SIFMA Senior Investor Protection Toolkit

Sources:

https://www.fidelity.com/viewpoints/wealth-management/elder-fraud

alz.org/alzheimers-dementia/facts-figures

sifma.org/explore-issues/senior-investors