17

March7 Questions You Must Ask Your CPA at Tax Time

Today’s post comes from Per Stirling Partner, Ryan Joyce, CFP®, CPA.

As we enter peak tax preparation season, it’s important not only to consider your previous year (2014) taxes, but your present year (2015) taxes as well. Remember: your financial advisor may not always have access to your entire tax picture. While reviewing important documents, like your 1040, can reveal many important things, it might also paint an incomplete picture as tax planning is integrated into your overall financial plan going forward. After all, a lot can happen in one year, so having more accurate tax-related information can help your financial advisor make investment recommendations and other financial planning strategies for the present and near future.

So what’s the best way to get more detailed tax planning information to boost your financial plan and strategy? Here are 7 questions to ask your CPA while preparing your 2014 taxes that will help with planning for your 2015 taxes. Your CPA’s advice and input in response to these questions are essential to your overall tax planning process, and are also great opportunities for you to better understand your personal tax situation.

1. “What will my tax bracket be in 2015?”

We’re not asking you to predict the future, here. But even an estimate can be profoundly helpful, as it’ll help your financial advisor calculate the tax efficiency of your investment strategy and financial planning proposals.

2. “Do I have any remaining loss carryforwards going into 2015?”

Loss carryforwards are tax losses as a result of selling investments at a loss. The IRS only allows up to $3,000 a year in loss deductions to offset active income, with any remaining loss to be carried forwarded for use in future years. Even though the word “loss” is normally a negative, understanding loss carryforwards as a tax asset can play a significant role in your investment strategy and tax planning.

3. “Am I eligible for a Roth IRA conversion? Is it recommended?”

A Roth IRA conversion allows you to convert traditional IRA assets to a Roth IRA (essentially converting tax-deferred growth into tax-free growth), and avoid taking required minimum distributions (RMDs) and paying taxes on those distributions. But before you get too excited, a Roth conversion also involves paying taxes on the assets converted in the year of conversion, so it is vital to get your CPA’s opinion on this transaction. Also consider asking your CPA for an estimate on what the tax liability would be on a partial Roth conversion – such as one that might bring you up to the top of your current tax bracket – so you can convert the maximum amount of IRA assets without triggering entry into a higher tax bracket.

4. “Should I increase my retirement plan contribution?”

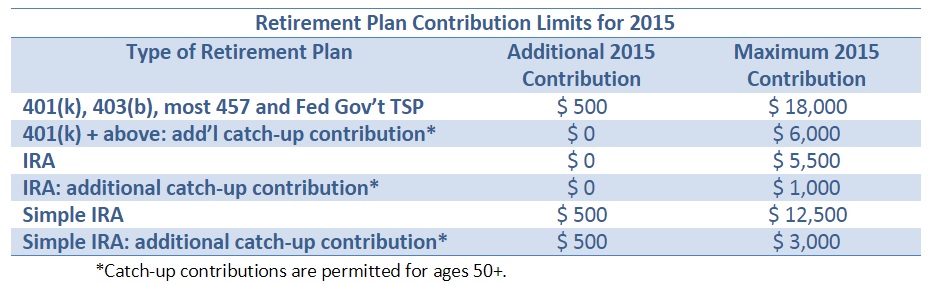

The IRS has increased the contribution limits for most retirement plans in 2015:

See if you can increase your contribution, thereby increasing your associated tax deduction.

5. “Should I change my tax withholding for 2015?”

If you’re faced with paying an additional bill at tax time – or are owed a refund from the IRS, it’s time to check your tax withholding amount. While a refund may seem like a nice surprise, what it really means is you just gave the government a loan without charging any interest! (Compare that to a bond, where you are loaning money to the government, but gaining some interest from the transaction.) Ideally, your tax withholding should match your actual liability. So whether it means adjusting your W-4 to change your tax withholding on your paycheck, or tweaking the withholding your retirement plan distributions, your CPA can provide vital insight to match up your withholding with your actual tax obligation.

6. “Do you have any recommendations for reducing my 2015 taxes?”

A variety of new laws, such as the Affordable Care Act (ACA), have dramatically changed the income tax landscape. Your CPA may have some ideas with regard to these new laws that could substantially reduce your tax liability for 2015 and beyond.

7. “Is there anything my financial advisor can do to help my tax situation?”

As members of your advisory team, your CPA and financial advisor can provide you with the best financial and tax planning advice through collaboration: sharing information and ideas with each other. The better informed all of your financial experts are, the more effective they can be in planning and managing your investment and financial affairs.

Remember: your financial plan is not fixed in stone, and should evolve to adapt to all the changes you and your family experience from one year to the next. While taxes are an inevitable part of life, coordinating details and communication between your CPA and financial advisor can enhance many aspects of your financial plan, providing more clarity efficacy towards achieving your personal financial goals.

CPAdeductionsIRSloss carryforwardsretirementRoth IRAtaxtax planningwithholding