31

OctoberPer Stirling Capital Outlook – October

Election Day is fast approaching, and there seems to be a growing consensus that the presidential election, in particular, could be the most important of our respective lifetimes. There is certainly some justification for this perspective as, unlike most previous U.S. presidential elections, which have traditionally offered a choice between slightly left-of-center and slightly right-of-center, this election is between two candidates whose views are generally perceived to be considerably more extreme than those of the average American.

This perspective is detailed in an August 26, 2024, research piece from the Pew Research Center1. Whether it be regarding social issues, geopolitical policy, or the role of the federal government, there were very few issues where the policies associated with the respective presidential candidates were not considerably more extreme than the preferences of the “average” voter.

For the purposes of this commentary, we will limit our observations to the potential economic and capital market-related implications of the upcoming elections. Before we proceed however, we should emphasize that what follows is based primarily on campaign promises, interviews and statements made at political rallies which, by its very nature, requires somewhat of a disclaimer. For that, we turn to former Supreme Court Justice Antonin Scalia, who noted that “Campaign promises are – by long democratic tradition – the least binding form of human commitment.”

A campaign is essentially a very extended job interview, and the objective of most politicians is to say whatever it takes to ultimately get the job. As such, we recognize that Harris may not actually believe that a wealth tax is politically feasible, and that Trump may not actually believe that replacing income taxes with tariffs is even a viable possibility. However, for the purposes of this commentary we will take each candidate at their respective words, despite Justice Scalia’s cautionary insight.

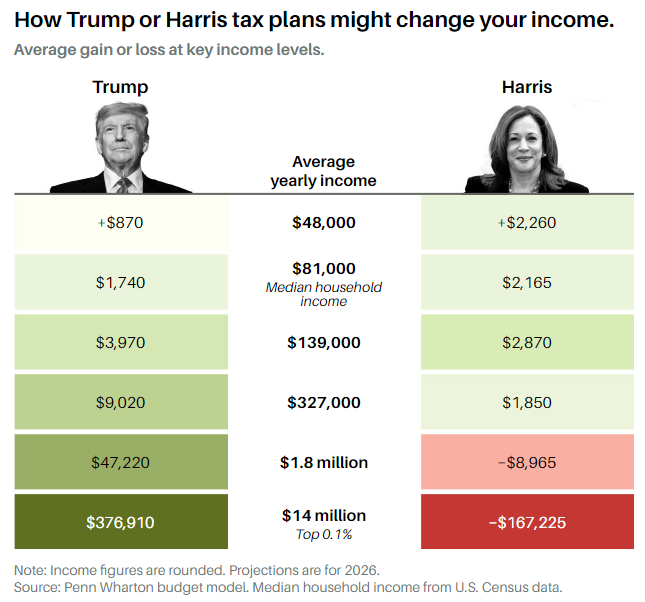

The above chart from the October 21st edition of Barron’s illustrates how the widely divergent priorities of the candidates are reflected in their tax proposals. Under Harris’ proposals, those Americans earning at/or below median household income levels would be the biggest beneficiaries, whereas Trump’s tax-related proposals are generally much more generous, and favor more affluent Americans.

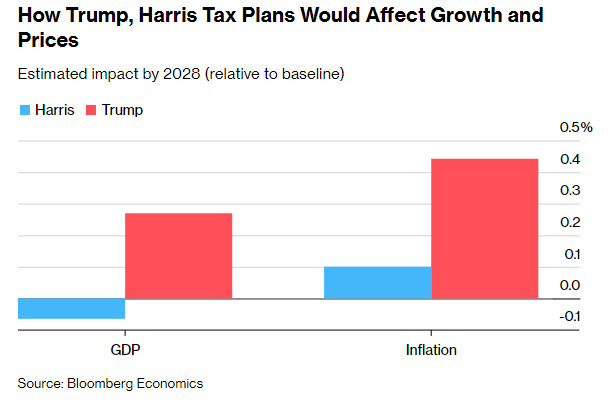

As shown above, it is estimated by Bloomberg Economics that Trump’s deficit spending and tax cut plans would boost economic growth over the course of his prospective term by between two and three tenths of a percent, while Harris’ proposals are actually expected to very modestly slow the economy.

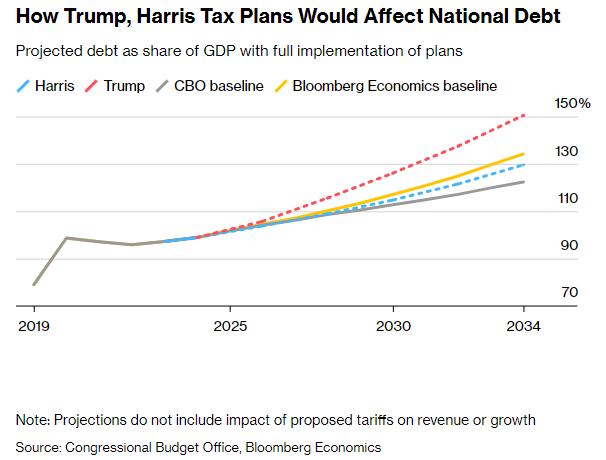

However, as per the charts immediately above and below, Trump’s approach is estimated to also increase inflation by between four and five tenths of a percent over the course of his prospective term and to balloon the deficit to 150% of the size of the entire US economy.

According to The Penn Wharton Budget Model, a nonpartisan research project at the University of Pennsylvania, “It’s important to note how the candidates’ plans would affect the swelling national debt; in the long term, Trump’s plans would add $4.1 trillion to the national debt, about twice as much as Harris”.2 And then there are Trump’s proposed tariffs.

David Kelly, chief global strategist at JPMorgan Asset Management, characterized Trump’s tariffs as “economic proposals that can actually cause inflation and put you into a recession – at the same time”. He called them the “perfect stagflation machine.”3

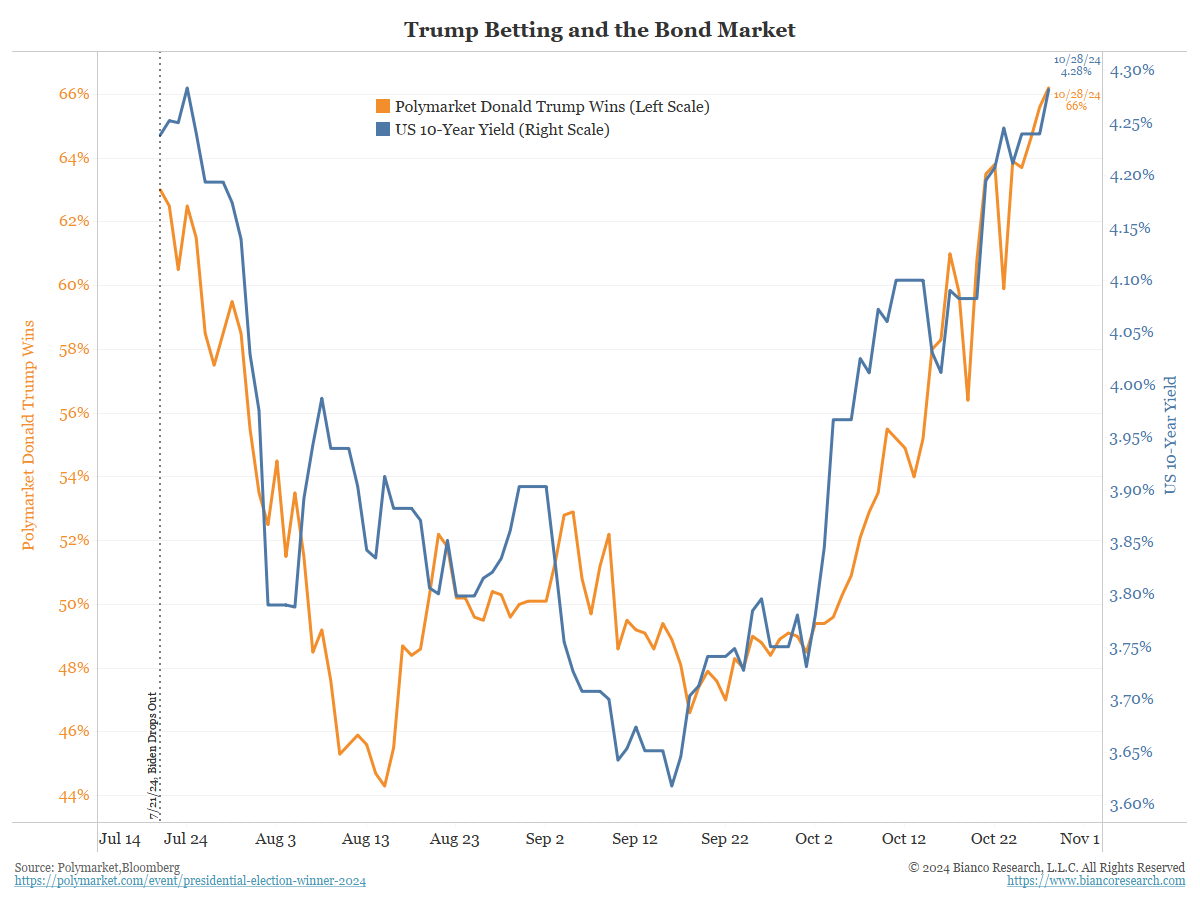

Larger deficits and higher inflation also represent a huge headwind in the face of the bond market, and we believe that the recent move higher in yields (lower in bond prices) is at least partially being catalyzed by Trump’s recent ascent in the polls, the betting markets, and the research of many of the major political analysts.

Likely also causing concern for fixed income investors is Trump’s aforementioned high tariff regime, which he can implement without congressional approval.4

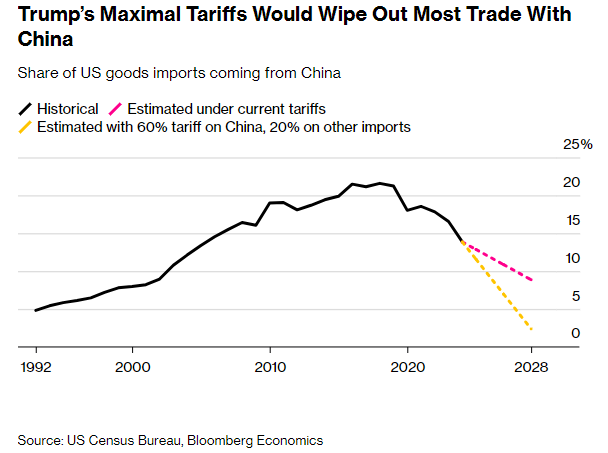

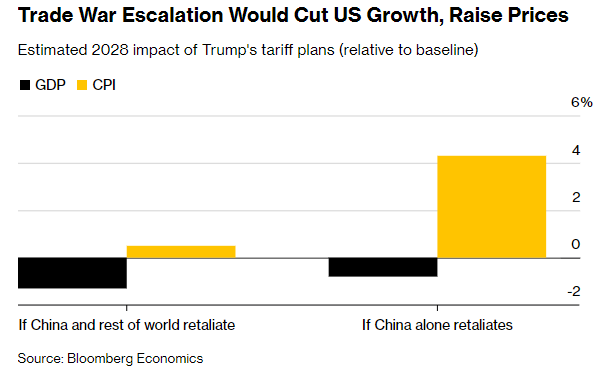

According to Bloomberg Economics (see below), Trump’s 60% tariffs on Chinese goods would eliminate almost all trade with China which, when combined with his proposed 20% tariffs on non-Chinese imports, would increase inflation (CPI), slow the economy (GDP), and likely catalyze trade retaliations from other countries.

As recently as October 25th, German Finance Minister Christian Lindner warned that, if the U.S. kicked off a trade war with the European Union, “We would have to consider retaliation”. As he put it in an October 25th interview on CNBC, “Trade controversy sees never winners, only losers”.5

According to Ernie Tedeschi, director of economics at the Budget Lab at Yale University, under such a trade retaliation scenario “prices would rise, and real household incomes would decline… Consumers would face price increases of 1.2% to 5.1% depending on the specific proposal. That’s like suddenly getting between seven months and 2.5 years’ worth of normal inflation.”6

On October 23rd, The International Monetary Fund (IMF) warned against increased global protectionism should Donald Trump win the election, due to the fact that it would depress global economic growth. The IMF “expects the world economy to expand 3.2% this year and the next, but should higher tariffs be implemented this would be reduced by 0.8% in 2025 and 1.3% in 2026”.7

As noted, longer-term interest rates have moved sharply higher, particularly since mid-September. This move could be attributable to any number of factors, including the economy remaining stronger than expected, inflation remaining higher than expected, or even a growing fear in the bond market that the Fed is cutting rates too soon and too aggressively, and that this error will catalyze a reemergence of undesirable high inflation.

However, it could also be attributable to the perceived increasing probability of a Trump victory and the potential for a resulting surge in both inflation and the federal deficit (both of which are normally detrimental to income portfolios).

Frankly, while it is impossible to know whether the primary driver behind the recent surge in rates has been political or economic, it is difficult to overlook the notable and potentially significant correlation (shown above) between 10-year Treasury yields, in blue, and the largest betting market’s odds of a Trump victory, in gold. Ever since the day of Biden’s withdrawal from the race, interest rates and the betting odds for a Trump victory have moved in near unison and, since bond prices and interest rates move in the inverse of one another, this trend is proving quite painful to fixed income investors.

In sharp contrast to bonds, there are many reasons why the equity markets generally favor a Trump presidency, including his platform of lower taxes, greater stimulus, and lower regulation, each of which should boost corporate profitability and presumably allow the markets to support higher valuations (at least over the near term). The longer-term challenge may be that these policies also create a need for the Fed to again push interest rates higher, as a means of bringing inflation back under control.

According to Jeff Bush of The Washington Update, “Trump is promising a significant effort in deregulation. He’s vowed to cut 10 regulations for every new one”. In contrast, indications are that a Harris administration would likely continue, or even intensify, President Biden’s more onerous regulatory approach.8

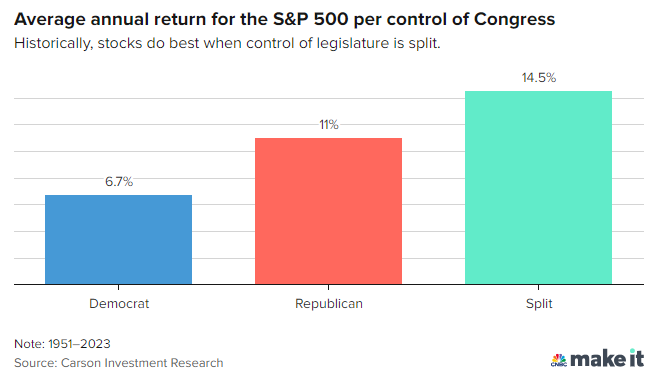

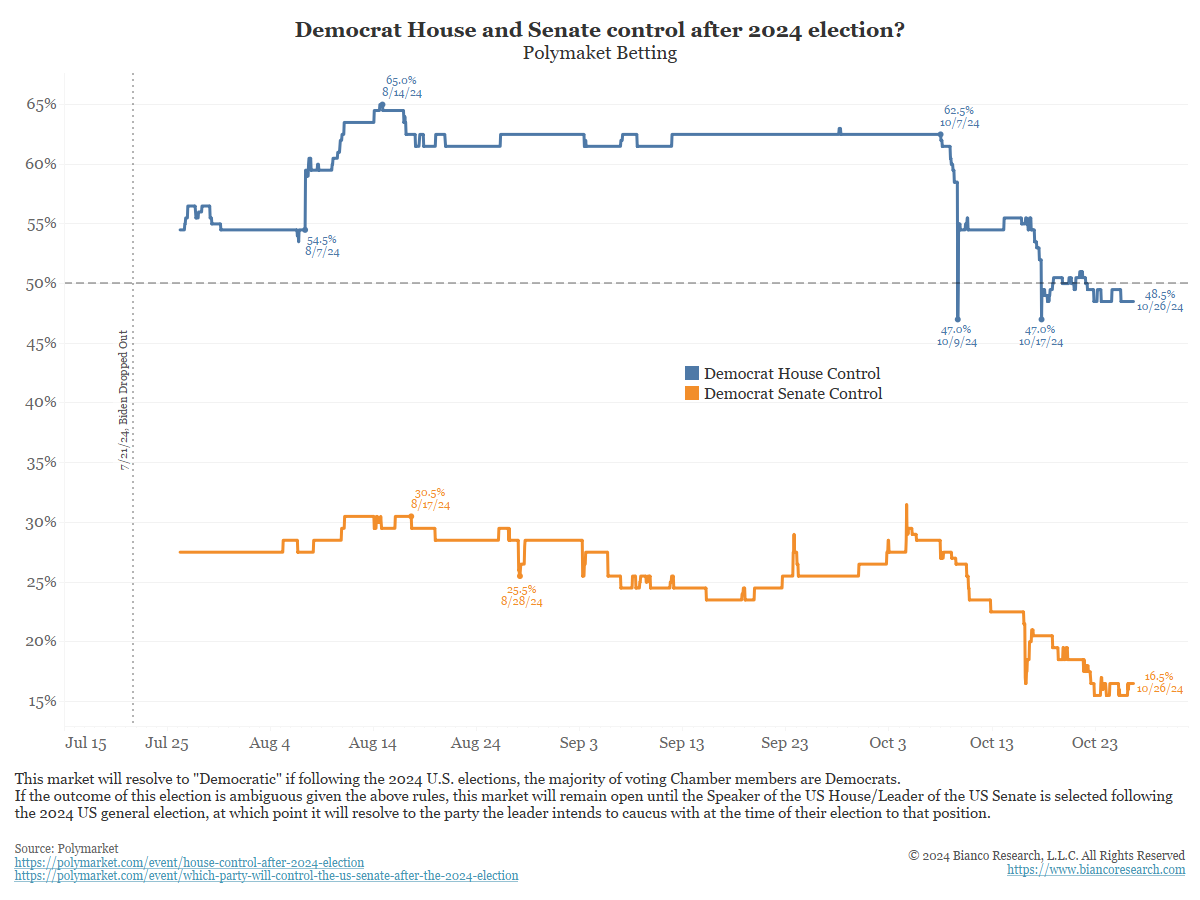

Markets have historically performed better under divided government, which means that, from an investor’s perspective, Harris may be the safer candidate, as there appears to be very little possibility of the Democrats controlling both the House and Senate. By contrast, there appears to be a growing potential for a Republican sweep.

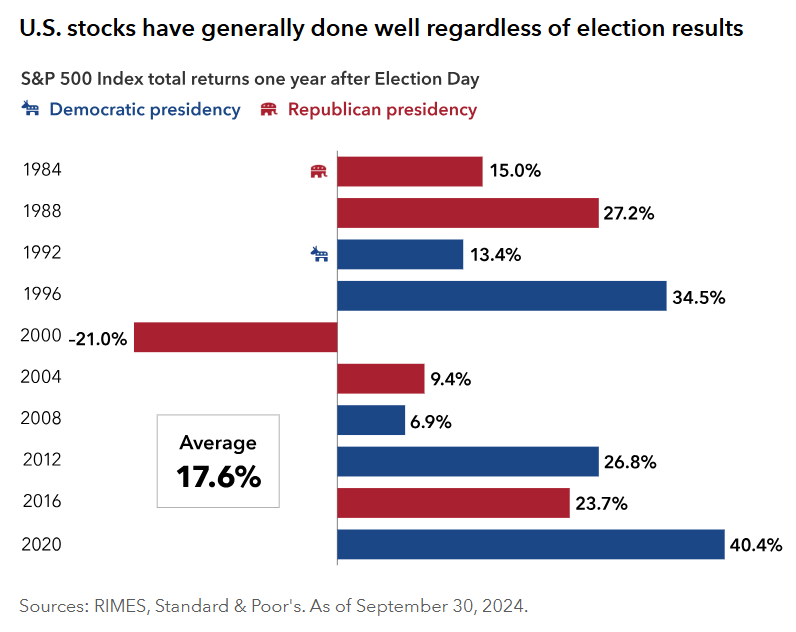

(Past performance is not a guarantee or indication of future results).

If you look at Polymarket, which is the largest of the betting sites, as an indication of the odds of congressional control, there is now only a 48.5% likelihood of the Democrats taking control of the House of Representatives and a very small 16.5% likelihood that the Democrats will maintain control of the Senate. As will be discussed, betting markets can be purposely manipulated by large inflows of money.

Of note, without a “blue wave” giving Harris control of both houses of Congress, she would have little chance of passing some of her more controversial proposals, like the taxation of unrealized capital gains. That said, some tax hikes under a Harris presidency would not require legislative approval, as many of Trump’s tax cuts are set to expire automatically in 2025 unless the Tax Cuts and Jobs Act provisions are extended, and she has already stated that she would not extend them, at least not for wealthier Americans.

While Harris’ policies are expected to modestly slow economic growth, they are also expected to be less inflationary and to add less to the federal deficit than Trump’s proposals. Unfortunately, neither candidate is proposing any steps to address America’s burgeoning federal debt, which we believe will ultimately prove to be the biggest challenge to the sustainability of the U.S. economy.

Investors have historically celebrated the passage of Election Day, almost regardless of the outcome, because it has traditionally provided clarity and removed uncertainty (investors traditionally abhor uncertainty).

However, this is not likely to be an “average election”. It could very possibly be challenged in the courts, if not in the streets. It could take time to resolve, and that could introduce a significant dose of uncertainty into the markets. Despite these obvious risks, the markets appear fairly complacent regarding election-related risks. Could investors be paying too little attention?

According to Jean Boivin, managing director of the BlackRock Investment Institute, the answer is “yes”. According to him, financial markets aren’t taking the threat of a disputed election seriously enough and that there could be “weeks of very disrupting legal battles” that will upset markets.

As he noted in a recent Bloomberg interview, “I don’t think that’s in the price. And if you want to prepare for some scenario where you need to react, I think that’s one of those scenarios that could be bad for markets.” Of note, he also recommended against short-term trading around the election, calling it “a fool’s errand.”9

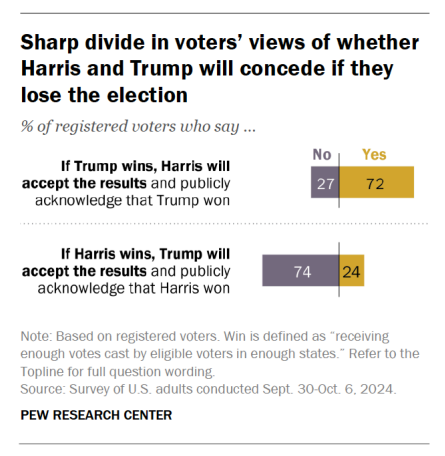

Indeed, this year President Trump and his campaign are already laying the groundwork for electoral challenges, and Trump himself has said that, “if everything’s honest, I’ll gladly accept the results. I don’t change on that… If it’s not, you have to fight for the right of the country.”10

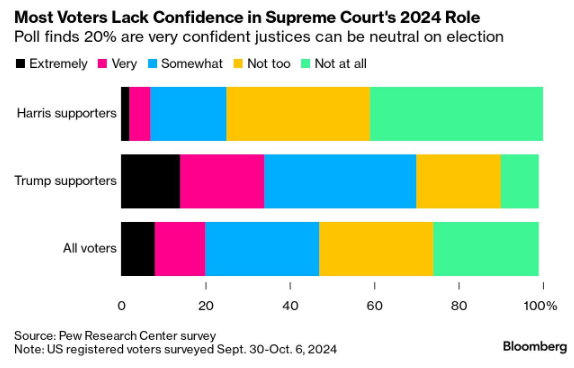

Complicating matters is the fact that, unlike during the “election indecision” in 2000, only 20% of polled American voters currently have confidence that the Supreme Court would address court challenges to the election results in a way that is fair and impartial.

There have been two contested elections in modern American history. The first was due to Florida’s statewide recount in 2000 in the contest between Bush and Gore, and the associated court battles. The resulting fears of a potential constitutional crisis helped to catalyst a 12% decline in the S&P 500 from Election Day to when the markets finally calmed down on December 20th.11

In sharp contrast, as was pointed out in a recent Reuters article12, “Markets were largely unperturbed by Trump’s attempt to overturn the results of the 2020 election. U.S. stocks rallied in the week’s remaining trading days after election day, even though Biden wasn’t officially declared the winner until that weekend.”

That said, we suspect that the markets weathered the “election indecision” of 2020 better than it did in 2000 because investors had seen a similar crisis peacefully resolved twenty years before, and because the 2020 crisis seemed to revolve around the threat of contained violence and protests, rather than the arguably bigger threat of a constitutional crisis.

Indeed, this may be the “good news” again in 2024 as, according to an October 10th study by the Pew Research Center13, 74% of polled voters already believe that Trump will challenge the results if he loses, which suggests that the potential of a contested election could already be largely priced into markets. Markets rarely sell off on the same news twice.

While the election and its aftermath could quite likely be a source of uncertainty, there are two things that we feel very confident about. The first is that the Republicans will end up with control of the Senate. The second is that Trump will do everything in his power to challenge the results if he were to lose. Beyond that, almost everything else is up in the air.

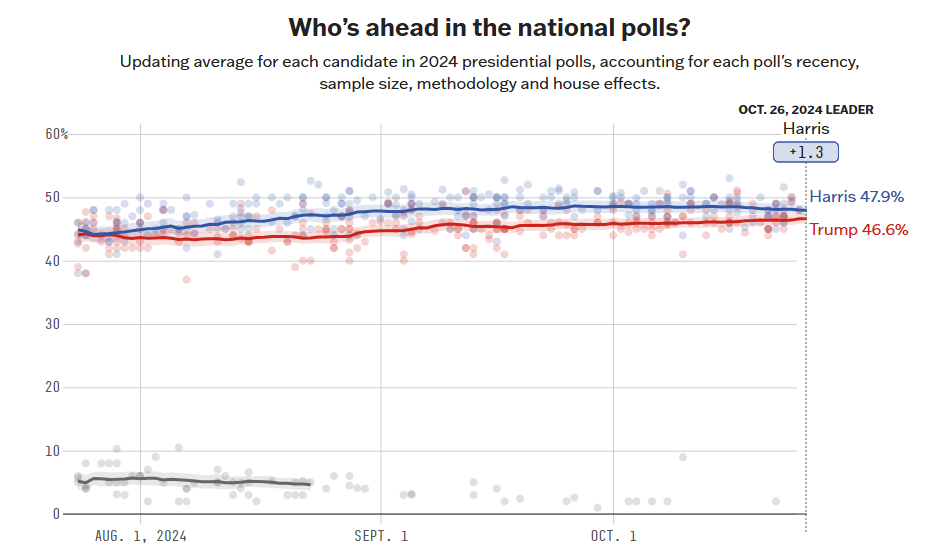

Control of the House of Representatives appears to be a toss-up, as does the occupancy of the White House. At this point, the polls still give a very slight edge to a Harris victory, although her 1.3% lead in the FiveThirtyEight composite of polls14 is marginal at best.

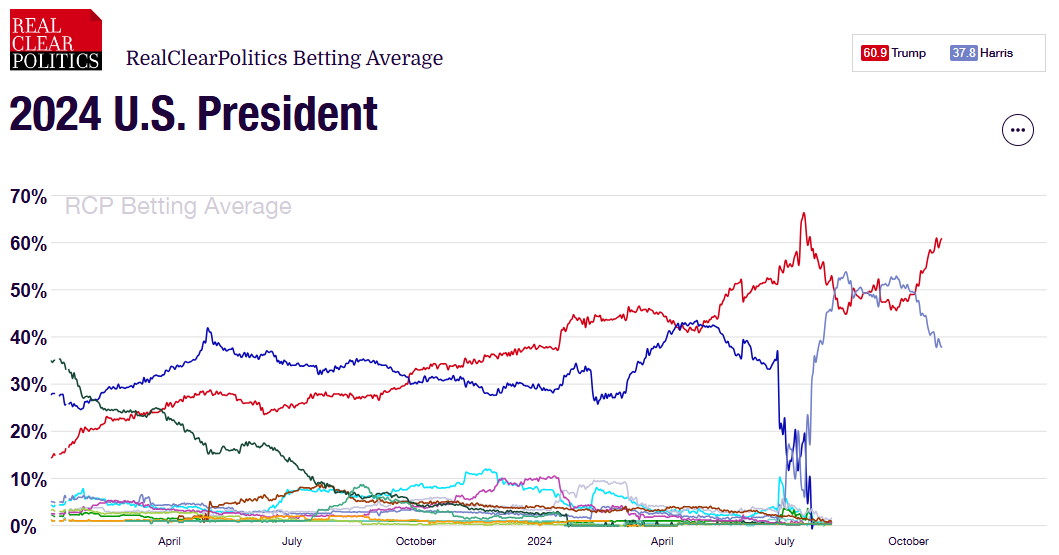

By contrast, the Real Clear Politics composite of the betting markets15 gives a fairly definitive edge to Trump, as do most of the major election analysis firms16.

It should be noted that, according to reporting by Bloomberg17, since the start of October, there has been an effort underway on the part of a few very large betters to distort the betting markets to make a Trump election look more likely. As such, there may be reason to view the betting markets with additional skepticism this election.

We will close with a slightly longer-term perspective from Stephanie Aliaga, global market strategist at JPMorgan Asset Management, who reminds us that whatever volatility a potentially contested election causes would likely be mitigated once the uncertainty subsides.

“Elections create uncertainty, but election results ultimately diminish and reduce that uncertainty,” she said. “At the end of the day you do end up with this almost post-election boost or rally because the uncertainty is cleared.”18

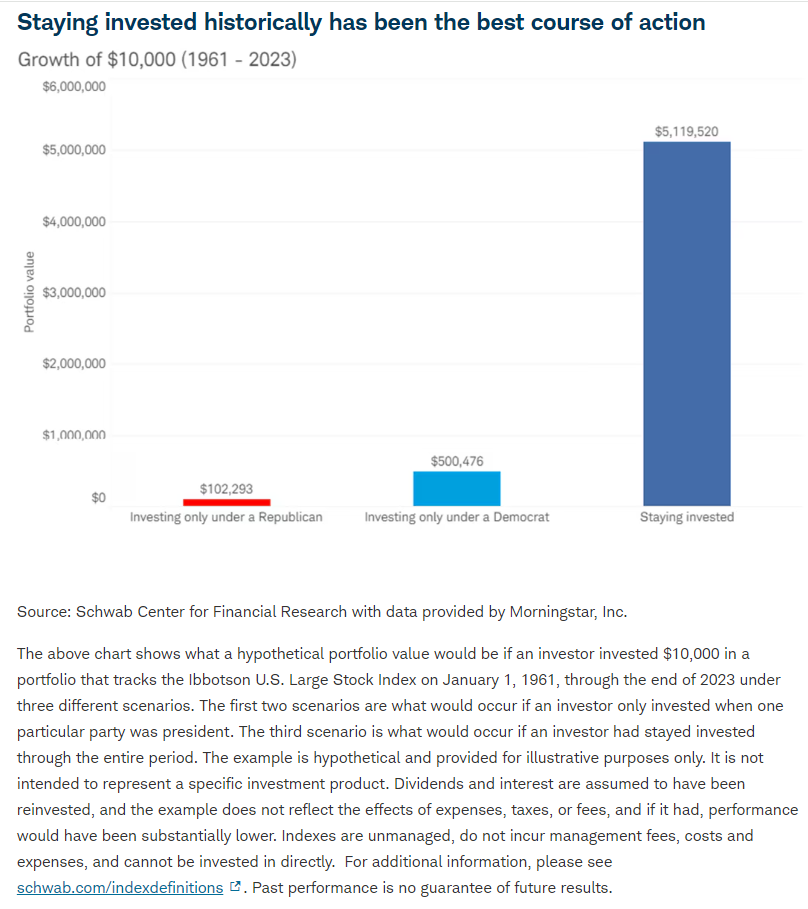

In the meantime, we encourage everyone to go out and vote, and to keep your eyes set on your longer-term investment horizon. After all, history suggests that, over the long term, the occupant of the White House has traditionally not had a big influence on the performance of the stock market.

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

The information presented is not intended to be making value judgements on the preferred outcome of any government decision or political election.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“The Political Values of Harris and Trump Supporters”, Pew Research Center, Posted 8/26/2024, https://www.pewresearch.org/politics/2024/08/26/the-political-values-of-harris-and-trump-supporters/

-

“What the Trump and Harris Tax Plans Mean for Your Wallet”, Ian Salisbury, Posted 10/21/2024, https://www.barrons.com/articles/trump-harris-tax-rates-plans-cuts-income-e8db90ee?mod=BRNS_ENG_NAS_EML_BULLETIN_AUTO_NAH

-

“Opinion: Economists agree another Trump term would ruin the US economy — will voters listen?”, Paul Bledsoe, Posted 10/2/2024, https://www.msn.com/en-us/news/politics/opinion-economists-agree-another-trump-term-would-ruin-the-us-economy-will-voters-listen/ar-AA1rA2LN?oc

-

“Presidential Tariff Powers and the Need for Reform”, Clark Packard, Scott Lincicome, Posted 10/9/2024, https://www.cato.org/briefing-paper/presidential-tariff-powers-need-reform#introduction

-

“German finance minister warns of retaliation if U.S. kicks off trade war”, Sophie Kiderlin, Posted 10/25/2024, https://www.cnbc.com/2024/10/25/german-finance-minister-warns-of-retaliation-if-us-kicks-off-trade-war.html

-

“Opinion Today”, Tobin Harshaw, Posted 10/10/2024

-

“IMF warns of global growth risk amid tariff threats”, Modern Money SmartBrief, Posted 10/23/2024

-

“The Big Post-Election Surprise Awaiting Investors”, Melanie Waddell, Posted 10/23/2024, https://www.thinkadvisor.com/2024/10/23/the-big-post-election-surprise-awaiting-investors/?kw=The

-

“Major asset manager warns on election, stocks risk”, Dan Weil, Posted 10/24/2025, https://www.msn.com/en-us/money/markets/major-asset-manager-warns-on-election-stocks-risk/ar-AA1sSmiI?ocid=hpmsn&pc=AV01&cvid=3c1e90eb

-

“Takeaways from Donald Trump’s Wisconsin rally: economy, immigration, early voting”, Hope Karnopp, Posted 5/1/2024, https://www.jsonline.com/story/news/politics/elections/2024/05/01/economy-and-immigration-takeaways-from-donald-trumps-wisconsin-rally/73501778007/

-

“What happens to the stock market if there’s an unclear outcome on Election Day?”, Kelly Bogdanova, Posted 10/5/2024, https://ca.rbcwealthmanagement.com/barbados/blog/2652680-What-happens-to-the-stock-market-if-theres-an-unclear-outcome-on-Election-Day

-

“Risks from potentially contested US election appear on market’s radar”, Lewis Krauskopf, Saqib Iqbal Ahmed, Posted 10/10/2024, https://www.reuters.com/markets/us/risks-potentially-contested-us-election-appear-markets-radar-2024-10-10/

-

“Most Voters Say Harris Will Concede – and Trump Won’t – If Defeated in the Election”, Pew Research Center, Posted 10/10/2024, https://www.pewresearch.org/politics/2024/10/10/most-voters-say-harris-will-concede-and-trump-wont-if-defeated-in-the-election/

-

“Latest Polls”, 538, As of 10/28/2024, https://projects.fivethirtyeight.com/polls/president-general/2024/national/

-

“Betting Odds – 2024 U.S. President”, RealClear Polling, As of 10/28/2024, https://www.realclearpolling.com/betting-odds/2024/president

-

“Donald Trump Now Favorite With Five Major Election Forecasters”, Ewan Palmer, Posted 10/21/2024, https://www.msn.com/en-us/news/politics/donald-trump-now-favorite-with-five-major-election-forecasters/ar-AA1sE8fP?ocid=hpmsn&pc=AV01&cvid=5

-

“How 1% of Polymarket Bettors Are Boosting Trump’s Odds”, Andre Tartar, Tom Fevrier, Posted 10/27/2024, https://www.bloomberg.com/news/videos/2024-10-29/1-of-polymarket-bettors-are-boosting-trump-s-odds-video

-

“Risks from potentially contested US election appear on market’s radar”, Lewis Krauskopf, Saqib Iqbal Ahmed, Posted 10/10/2024, https://www.reuters.com/markets/us/risks-potentially-contested-us-election-appear-markets-radar-2024-10-10/