17

MarchPer Stirling Capital Outlook – March

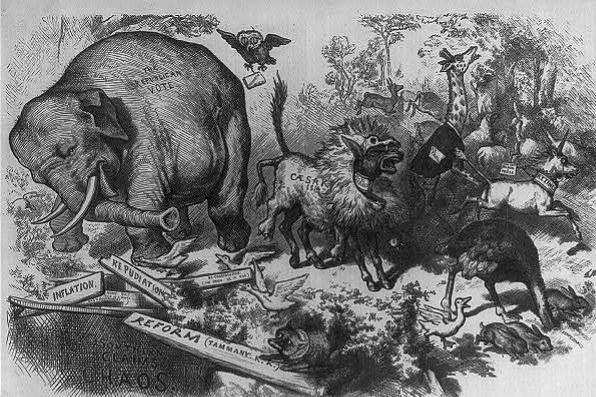

To paraphrase Sir John Templeton, “Bull markets are born in despair, grow in pessimism, mature in optimism, and die in euphoria”. Stock market declines can be a wonderful thing. It just does not feel like it when you are in the midst of the storm. Bear markets (declines of 20% or more) and corrections (declines […]