24

MayIs $500,000 A Reasonable Retirement Goal?

What’s on your schedule today? A Hike? Meeting up with friends? Spending time with your family? Working on all the books you bought but never read? Packing for your dream vacation? Retirement dreams often conjure images of endless leisure and financial freedom, but the reality hinges on strategic financial planning and forward-thinking. For most Americans who retire with significantly less than $1 million in savings,(1) here’s what retirement on $500,000 can look like.

From addressing factors that affect your retirement journey to exploring where you will call home, this guide provides information to help you make decisions that can pave the road to a comfortable retirement.

What Life Factors Do You Need to Consider in Planning for Retirement?

Personal finances, life events, and retirement timing are unique. But if your current projection puts your retirement nest egg at $500,000, you’ll need to consider these five key factors and also plan to work with a qualified financial planner to find ways to stretch what you have. As you review this list, we urge you to consider what your life looks like now and what the future could hold.

Health

Regardless of the results of your last annual physical, no one’s health is fully assured. You can take proactive measures like eating a varied diet, moving your body, and getting regular medical checkups. But even healthy, regular aging comes with medical expenses. And unexpected medical costs can swiftly diminish your savings. If you think you’ll be retiring with $500k in the bank, make sure you plan for health insurance coverage and set aside adequate savings to handle routine and unexpected medical expenses. Current estimates say a couple retiring can expect to spend over $350,000 in healthcare costs over the rest of their lifetime. (2) This expense may be even more significant depending on your current health or how long you or your partner live. While it doesn’t make retiring on $500,000 impossible, it does mean you need a strategic financial plan to help you spend and save wisely. An advisor can help you account for health expenses.

Debt

Whether you’re paying off student loans, paying down a mortgage, or recovering from expensive credit card debt, having a good handle on your debt is critical to retirement. Before retirement, aim to reduce or eradicate the amount of high-interest debt you have. Debt can significantly strain your budget when you retire, potentially eating into your savings faster than anticipated—this is critical if you’re looking to retire in the next ten years. Start asking how you can tackle debt now and plan for ways to avoid taking on unneeded amounts of debt. If you’re feeling concerned about your current debt levels or just aren’t sure where to start, going through the financial planning process can give you, partners, and family clarity on how to move forward.

Lifestyle

What does your lifestyle cost you annually? Some hobbies, like hunting, collecting valuable antiques, and traveling, may cost more than others. Will you have to adjust your retirement lifestyle to align with your budget after you retire? Luxuries and high-cost activities may be unsustainable, so set realistic expectations for your post-professional life. The most recent release from the Bureau of Labor and Statistics put the household spending amount for retirees at $50,000 annually.(3) For an individual or family retiring with $500,000 or a similar amount, cash flow planning can help you understand where you are and the changes you may need to make. Financial planning with an independent advisor can help walk you through this planning process. Whether that amount seems high or low, plan for the lifestyle you want tomorrow.

Budget

Budgets are an essential tool for a fulfilling life after you retire. Are you developing a detailed budget that factors in all anticipated expenses? Budgets need to consider all types and amounts of expenses including, as examples only:

- Housing

- Food

- Utilities

- Entertainment

- Home repairs

- Emergency funds

Budgets require regular tracking, assessments, and changes—like any living document. We recommend keeping a close eye on living costs and any changes that could affect your spending. If this seems complex or too time-consuming, an advisor can help guide you through this process.

Inflation

Inflation continues to be a hot topic. The noticeable cost increase for goods and services has many people nearing retirement reassessing their savings and plans. Rising inflation may impact the amount and value of your retirement savings through a decline in purchasing power. While retiring on $500,000 isn’t impossible, a trusted advisor can help you adjust your plans so you can stay independent throughout retirement. Prepare your investment strategy for this erosion by including assets that have the potential to outpace inflation.

Remember, effective retirement planning is an ongoing process. Regular consultations with financial advisors and periodic reviews of your retirement plan can help guide your investments through stock market fluctuations and market downturns, helping you maintain your desired standard of living when you retire.

Location, Location, Location

The cost of living is an important consideration when deciding where to retire. Costs can vary significantly across the state of Texas, impacting how long you may be able to retire with a savings of $500k.

Austin Area: To stretch your retirement income amount, you may consider moving to the edges of Austin. Hutto, Leander, Round Rock, and Kyle all offer less expensive housing options but are close to Austin.

San Antonio Area: Enjoy the amenities and culture of San Antonio while lowering your cost of living. Hollywood Park and Olmos Park offer eclectic restaurants, coffee shops, and areas towalk and enjoy the outdoors. Cordillera Ranch is a master-planned community in the Texas Hill Country, only 30 minutes from downtown San Antonio.

Dallas Area: Around Dallas, there are many options for moving out of the city, but you can still be close enough to enjoy it anytime you wish. Cities like Ferris, Cockrell Hill, Cedar Hill, and Mesquite offer more affordable housing but still allow you to attend events across the metroplex.

Houston Area: You can continue enjoying Houston’s arts and food scene while lowering your cost of living in retirement. Galena Park offers lower home prices, dining and entertainment options, and easy access to the Houston Ship Channel and Galveston Island. Pasadena offers easy access to downtown Houston and has its own philharmonic and nature center.

Retirees should also consider factors such as social support, access to healthcare, and climate when considering these cities. Each location offers unique benefits, aside from a low cost of living, which can contribute to a fulfilling lifestyle when you retire.

By approaching your retirement plan with a clear understanding of the costs of living in various areas, you can maximize your retirement savings for a manageable retirement.

How Long Will Your Retirement Savings Last?

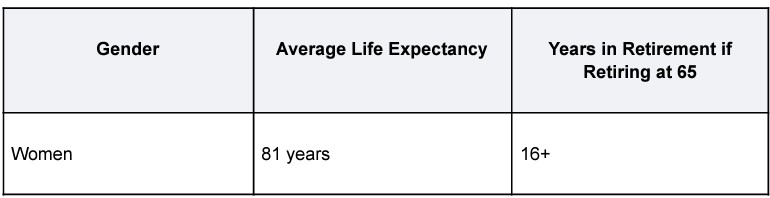

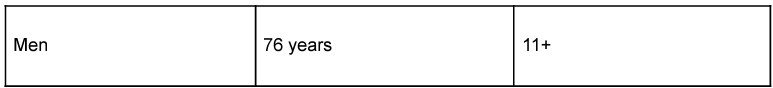

How long your retirement savings need to last once you retire depends on life expectancy. So, if you’re wondering when you can retire with a savings amount of $500k, you need to consider the data. Current data suggests the average life expectancy for women in the U.S. is approximately 81 years, while men tend to live an average of 76 years.4 However, individual health, genetics, and lifestyle choices can shift these numbers any time after you retire.

It’s crucial to consider these statistics when planning for retirement. If you retire at the typical retirement age of 65, women may need to plan for 16+ years of retirement income, whereas men may need a plan for around 11+ years. Given the increase in longevity trends and the possibility of living well into your 90s, it’s wise to plan for a longer retirement to avoid outliving your savings.

Social Security Limitations

The amount of your social security benefit depends on your earnings record and the age at which you retire. Generally, benefits are available from age 62, but claiming before full retirement age results in reduced benefits, while delaying benefits increases the monthly amount up to age 70.

It’s important to note that Social Security was never intended to be the sole source of income after retirement.(5) The benefits aim to replace an estimated 28-42% of an average wage earner’s income after retirement.(6) Still, financial professionals often suggest that retirees need at least 70% to 80% of their pre-retirement income to live comfortably.(7) This gap means that additional savings, whether through employer-sponsored retirement plans, personal savings, or other investments, are crucial for maintaining one’s standard of living in retirement.

Making Up Income Gaps

Discovering that your retirement savings might not stretch as far as you’d hoped can be daunting. Your ability to make up the gap between Social Security and your income needs will largely determine when you can retire. If you are unsure, consider working with a financial advisor who can help you make the most impactful decisions possible and avoid mistakes that might jeopardize your future.

A financial advisor can develop strategies to help bridge the income gap and convert your savings into a steady income to fund your retirement years. Many different types of financial plans exist, depending on your assets and risk profile.

You Don’t Have to Navigate the Transition to Retirement Alone

After decades of receiving a regular paycheck, suddenly relying on Social Security and your savings can be challenging. But if you think you’re stepping into retirement with a total of $500k, having a well-designed financial plan can be very helpful in creating a budget and helping you to stretch the value of your savings.

Financial planning can play an important role in creating a comfortable retirement. A well-crafted plan, developed with the guidance of financial advisors, can help you envision and plan for the kind of retirement lifestyle you desire.

Working with a financial planner can equip you with the necessary tools to handle market downturns and adjust your investment strategy accordingly. This proactive approach can help shield your nest egg from volatility in the stock market. A financial advisor can also provide valuable insights into maximizing your monthly Social Security benefits by advising on the optimal retirement age to start collecting regular Social Security income.

Build Your Plan

Having and adhering to a personalized retirement plan can lead to a more positive outcome. Take time to make a plan.

Estimate Your Retirement Needs

Start by creating an estimated retirement budget, encompassing:

- Expected monthly and annual expenses

- Projected Social Security benefits

- Factors such as inflation and interest rates

Consult Professionals

Working with financial advisors or planners can help you construct a personalized retirement plan. They bring knowledge and experience in:

- Designing and allocating portfolios

- Helping to mitigate the impact of market declines

- Tax strategies

- Adjusting for life expectancies and cost of living changes

Optimize Income Sources

Optimize and help protect your sources of income by considering the following:

- Social Security timing for maximum monthly benefit

- Rental or investment income amounts

- Apart-time job

- Strategies for inflation protection to help maintain your purchasing power

Minimize Expenses

A comfortable retirement is about living within your means. Explore:

- Reducing the amount of discretionary spending

- Lowering costs of living for a sustainable standard of living

Adapt as Necessary

Markets ebb and flow. Align your approach to handle market downturns.

Are you looking for a partner as you plan to retire?

Everyone’s retirement needs are different. Life expectancy, retirement goals, and how you want to spend your retirement can change how much you need to plan for. Financial planning can help you know what you need. Partnering with an advisor helps you create a financial plan that considers a wide array of factors, including life expectancy and your other retirement goals.

Whether your expected retirement nest is $500k or more, our advisors can help you create a plan, maximize tax efficiencies, and manage what you have. We want you to find a way to pursue the lifestyle you imagine when you retire. How can we help you make planning for retirement less challenging? Our advisors are standing by.

Connect With a Per Stirling Advisor Today

Disclosures:

-

Rosen, Andrew. March 2, 2023. “How Your Retirement Savings Compare to the National Average.” Forbes. Accessed April 10, 2024. https://www.forbes.com/sites/andrewrosen/2023/03/02/how-your-retirement-savings-compare-to-the-natio nal-average/?sh=2c13ae486b2a.

-

“Health Care Costs Climb for Retirees. See How Much They Need to Save, Even with Medicare.” February 18, 2024 USA TODAY. https://www.usatoday.com/story/money/personalfinance/2024/02/18/how-much-to-save-for-retirement-hea lthcare/72588899007/.

-

U.S. Bureau of Labor Statistics. 2022. “CONSUMER EXPENDITURES–2022.” Bls.gov. September 8, 2022. https://www.bls.gov/news.release/cesan.nr0.htm

-

CDC. 2023. “FastStats- Life Expectancy.” Centers for Disease Control and Prevention. February 7, 2023. https://www.cdc.gov/nchs/fastats/life-expectancy.htm.

-

“Understanding the Benefits.” 2017. https://www.ssa.gov/pubs/EN-05-10024.pdf.

-

“Understanding the Benefits.” 2017. https://www.ssa.gov/pubs/EN-05-10024.pdf.

-

Waggoner, John. 2021. “How Much Money Do You Need to Retire.” AARP. January 6, 2021. https://www.aarp.org/retirement/planning-for-retirement/info-2020/how-much-money-do-you-need-to-retire .html