20

DecemberPer Stirling Capital Outlook – December

piv·ot

/ˈpivət/

“To completely change the way in which one does something.”

We concluded last month’s Outlook commentary by expressing our opinion that “while there are still some reasons for caution in the intermediate term, the short and longer-term outlook for portfolio values is starting to look better than it has in years”.

Our optimism was largely based upon what we described at the time as the “presumed end to the Fed’s interest-rate-hiking cycle combined with expectations of a ‘soft landing’”.

As we had noted, we were already seeing the signs of a return of “animal spirits”, despite the fact that, at the time, Fed Chairman Powell was still warning that “it would be premature to conclude with confidence” that the Fed has raised its benchmark interest rate high enough to fully defeat inflation and that it was too early to “speculate on when policy might ease”. 1

However, in a remarkably abrupt about-face, Chairman Powell just reversed this Fed guidance entirely. A mere two weeks after the above comments, Powell’s guidance has changed from it being too early to take further rate hikes off the table and it being too soon to start talking about rate cuts, to monetary policy already being “well into restrictive territory” and that the Fed would need to start cutting rates “way before” inflation reached its 2% target. 2

Further, the Fed removed its November warning that “reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions”, and even expressed a new concern that if they wait too long to start cutting rates, monetary policy could become overly restrictive as inflation falls, and force the economy into an unnecessary recession.

Just three weeks ago, the Fed was warning that they might need to slow the economy significantly and reduce the demand for labor in order to ultimately return inflation to their 2% target, and that a certain level of “pain” in the economy and labor markets would be absolutely essential to bring inflation back down on a sustainable basis. Now they are warning that they will need to drop rates well before they reach their inflation goals if they hope to avoid recession.

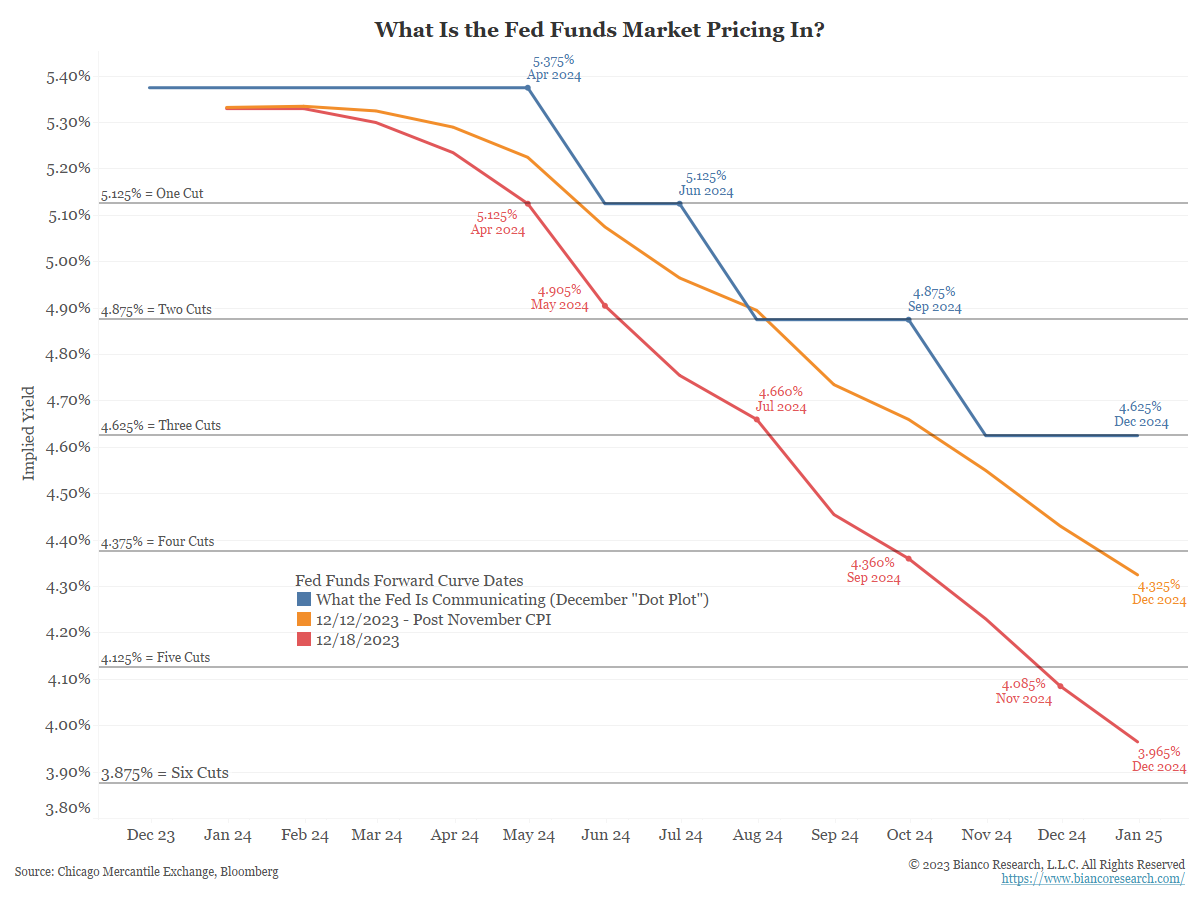

Indeed, as recently as November 21st, Fed Chairman Powell stated in a press conference that “the Committee is not thinking about rate cuts right now at all” 3. However, when the Fed “dot-plot” was released just three weeks later, it showed that the average expectation amongst Fed governors is for the Fed to cut rates three times in 2024 (blue line), for a total of 0.75%.

Moreover, just as the markets were convinced that the Fed was too slow in initially raising rates to battle inflation, they are now convinced that the Fed is underestimating (by half) how far short-term rates need to fall in 2024. While the Fed is guiding the markets to expect three quarter-point (0.25%) cuts, the Fed Funds futures contract is currently pricing in expectations for almost six 0.25% rate cuts, totaling almost 1.50% (the red line above).

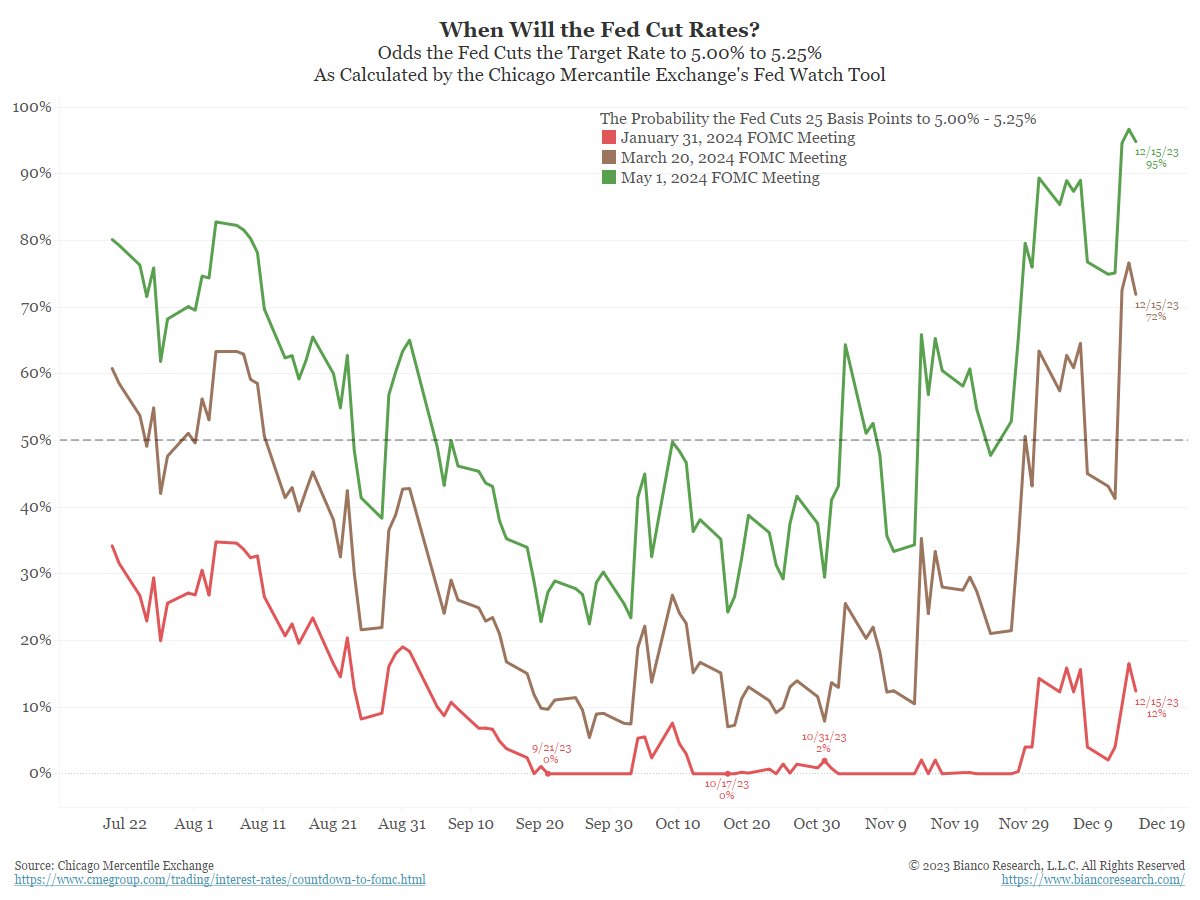

expecting much more aggressive rate cuts than the Fed is suggesting, but also that the Fed will start lowering rates almost immediately. The Fed Funds futures market is pricing in a 72% likelihood of the first rate cut occurring at the Fed’s meeting in March, and a 95% likelihood that the first rate cut will take place no later than the Fed’s meeting in May.

The response in the capital markets to this suddenly dovish Fed guidance has been nothing short of spectacular.

Indeed, last week’s Fed policy announcement and press conference marked the strongest “Fed Day” for financial assets in general (including domestic stocks, government bonds, investment-grade corporate bonds, high-yield “junk” bonds, and commodities) in fourteen years 4, and that was on top of very impressive gains for most stocks and bonds since the start of November. As we discussed at length in last month’s commentary, it was during the first two weeks of November that an end to Fed rate hikes and a non-recessionary slowdown in the economy became the consensus expectation.

What has made this dovish shift even more extraordinary is that it is happening at a time when historic precedent suggests that Fed Chairman Powell should be playing the role of “Grinch”, by moderating investor expectations and pushing back against current expectations for rapidly declining rates, as this newly dovish guidance is contributing to the current dramatic loosening of financial conditions, which threatens to reaccelerate the economy and potentially reignite the spike in inflation that the Fed has spent most of the past two years fighting so diligently against.

Instead, on December 13th, Chairman Powell pronounced that “inflation keeps coming down, the labor market keeps getting back into balance and, it’s so far, so good”. 5 It’s no wonder that virtually all financial markets are soaring.

Markets were largely priced for rates to stay “higher for longer” and for there to be at least a mild recession in 2024. Now the Fed is telling investors (with unusual clarity) that their expectations are too bearish and that they need to price-in a more optimistic outlook.

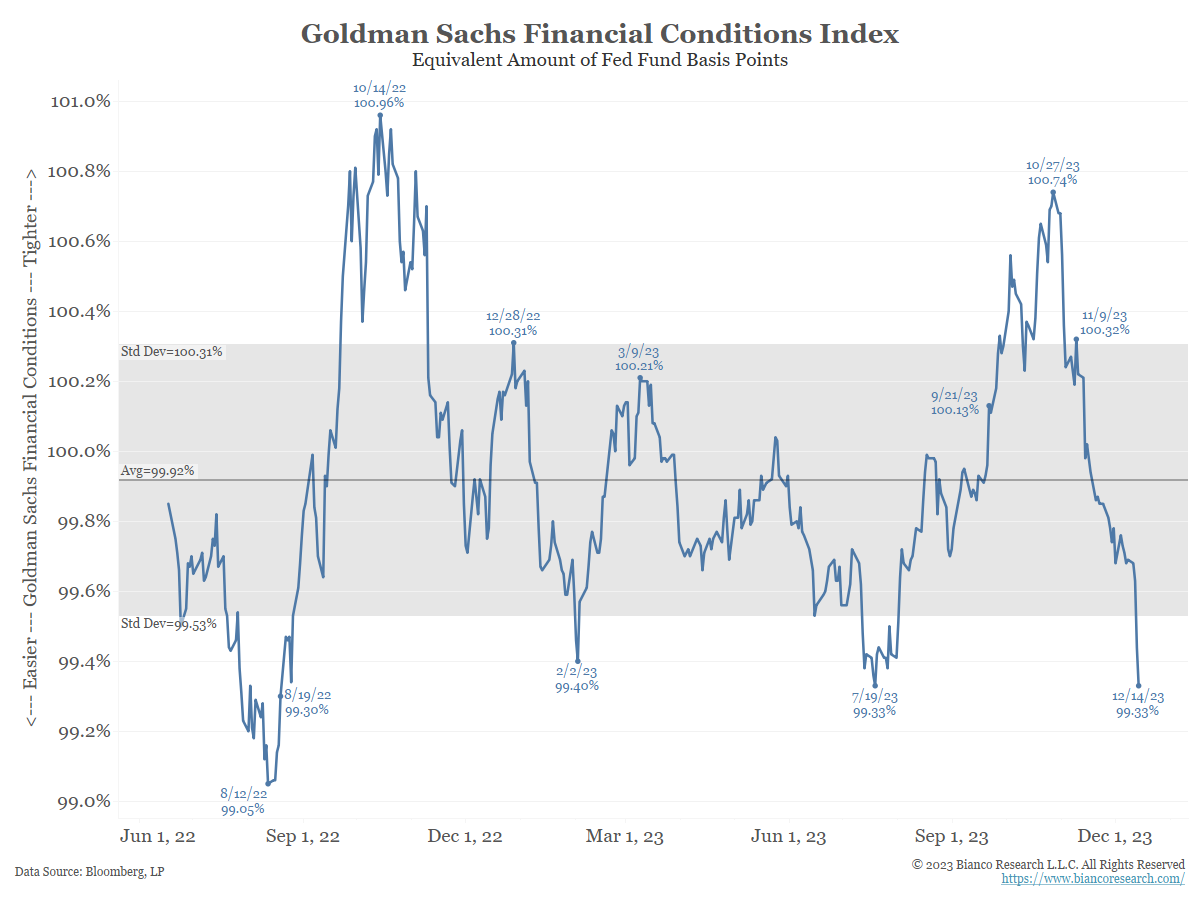

As noted, a likely unintended consequence of this change in Fed guidance is that it is causing market-set interest rates to fall sharply, stock prices to move higher, the dollar to move lower, bank lending standards to loosen, and the yield difference (credit spread) between lower-rated and higher-quality debt to narrow, each of which improve financial liquidity (illustrated by the downwards move on the above chart), thus accelerating growth and theoretically potentially reviving inflation.

The above chart also shows that, largely as a result of this pivot, financial conditions are now as accommodative (stimulative) as they have been since August of 2022, when the range for the Fed Funds Rate was 3.00% to 3.25% 6, which is remarkable when you consider that today’s range is 5.25% to 5.50%.

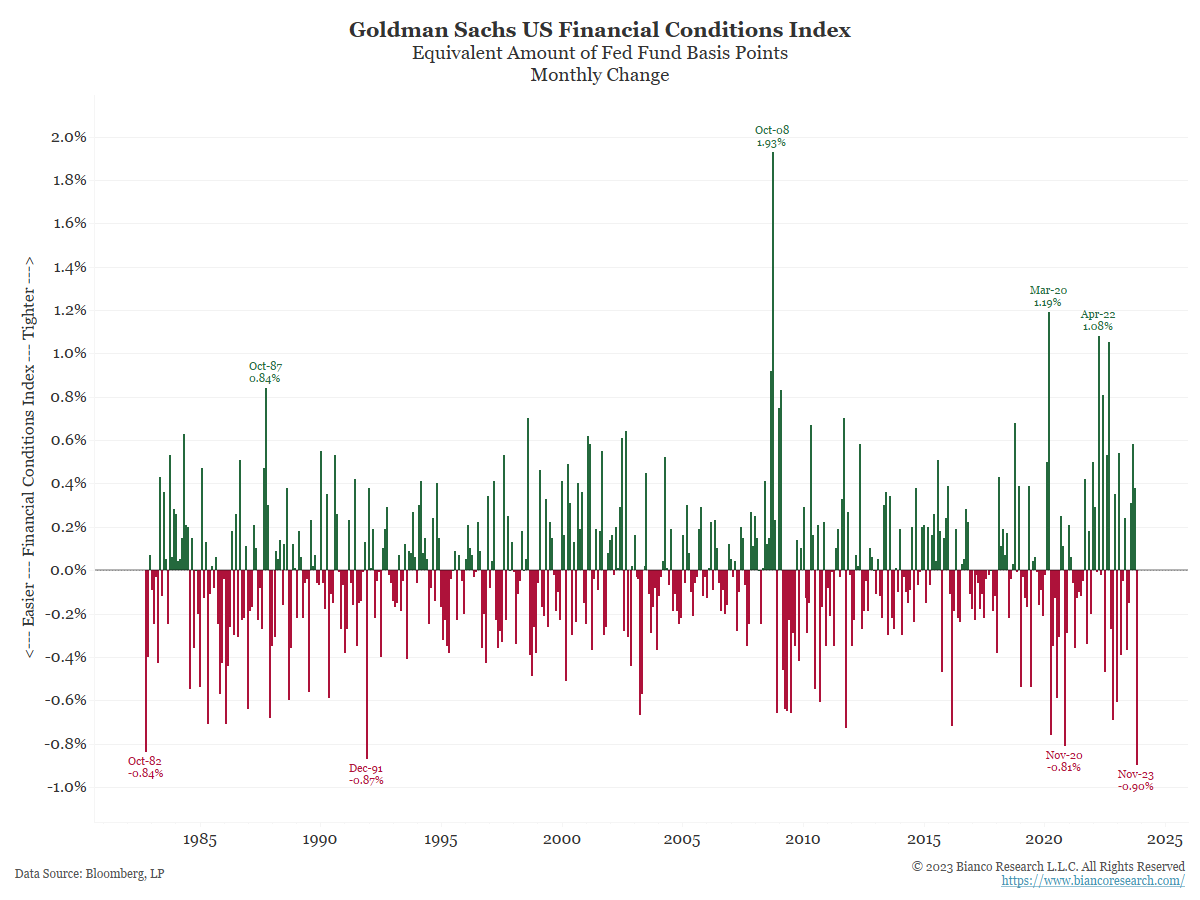

The red and green chart (above) helps to put this dramatic surge in financial liquidity into some perspective. According to this measure from Goldman Sachs, the November improvement in financial conditions provides the same stimulus to the economy of the Fed cutting rates by 0.90% (almost four 0.25% rate cuts).

This significant loosening of financial conditions, and the potential risk to inflation that it entails, probably help to explain why, only a few days after Chairman Powell’s dovish comments, New York Fed President John Williams pushed back against market expectations in an interview on CNBC, where he emphasized that “we aren’t really talking about rate cuts right now”, and that “we’re very focused on the question in front of us, which as chair Powell said… is, have we gotten monetary policy to a sufficiently restrictive stance in order to ensure the inflation comes back down to 2%? That’s the question in front of us.” 7 Federal Reserve Bank of Chicago President Austan Goolsbee reinforced that more cautious sentiment a few days later when he noted that “we’ve got to get inflation down to target. Until we’re convinced that we’re on path to that, it’s an overstatement to be counting the chickens.” 8

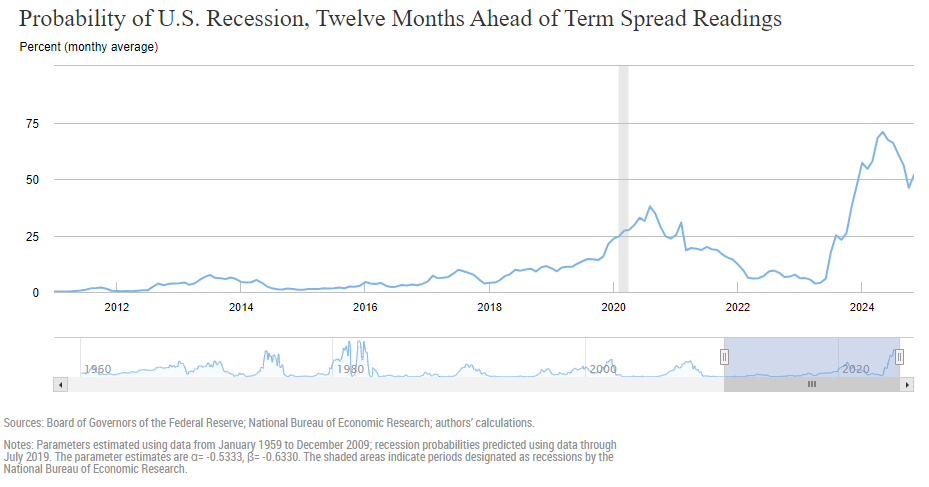

Nonetheless, from a macroeconomic perspective, this major improvement in financial conditions should theoretically eliminate any risk of a 2024 recession, due to its stimulative effect. However, we find it noteworthy that the New York Fed’s recession probability model just ticked back up above 50% again, after spending one month just below that level. Just what is the Fed seeing, and why do markets expect such aggressive and almost immediate rate cuts?

As we have discussed at length in recent commentaries, the Fed normally starts cutting rates under one or more of three conditions: 1) a surge in unemployment, 2) a non-de minimis economic contraction, or 3) dysfunction in the financial system. We believe that there could be an unusual and fourth potential catalyst this cycle, a surge in “real” (inflation-adjusted) interest rates.

From our perspective, there are no indications of dysfunction in the financial system, and there are few, if any, signs of job losses.

Indeed, at 3.7%, the unemployment rate is still about the same level as it was in March of 2022, when the Fed first started raising rates. However, that is not to suggest that there are no signs of moderation in the job market.

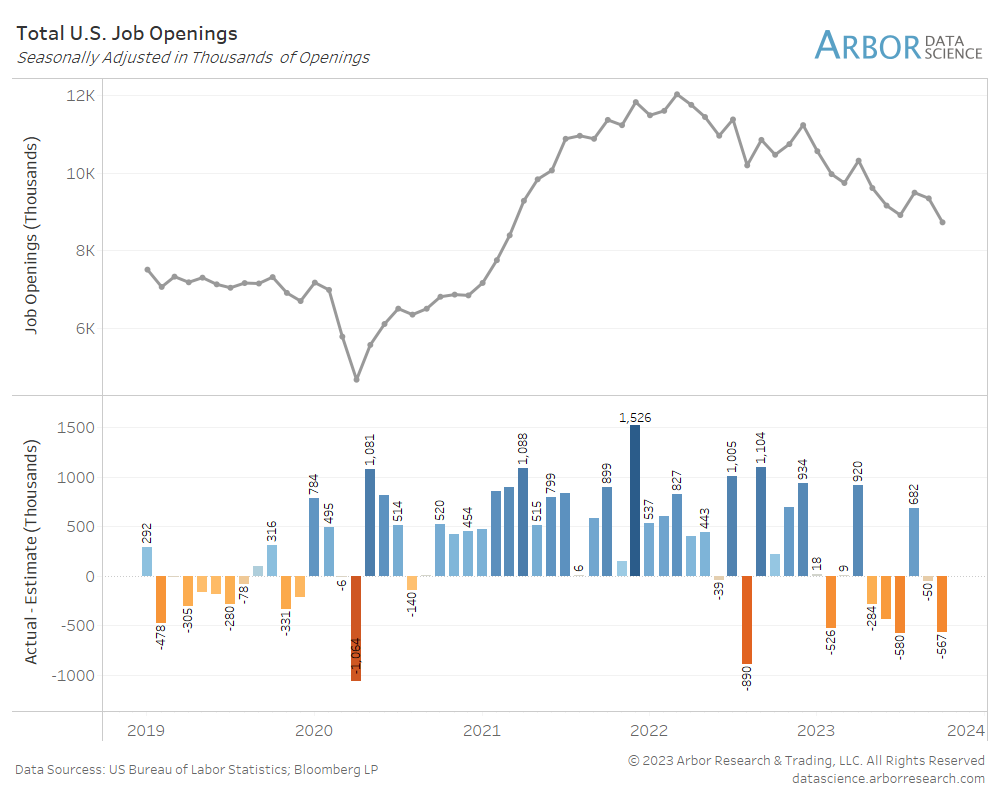

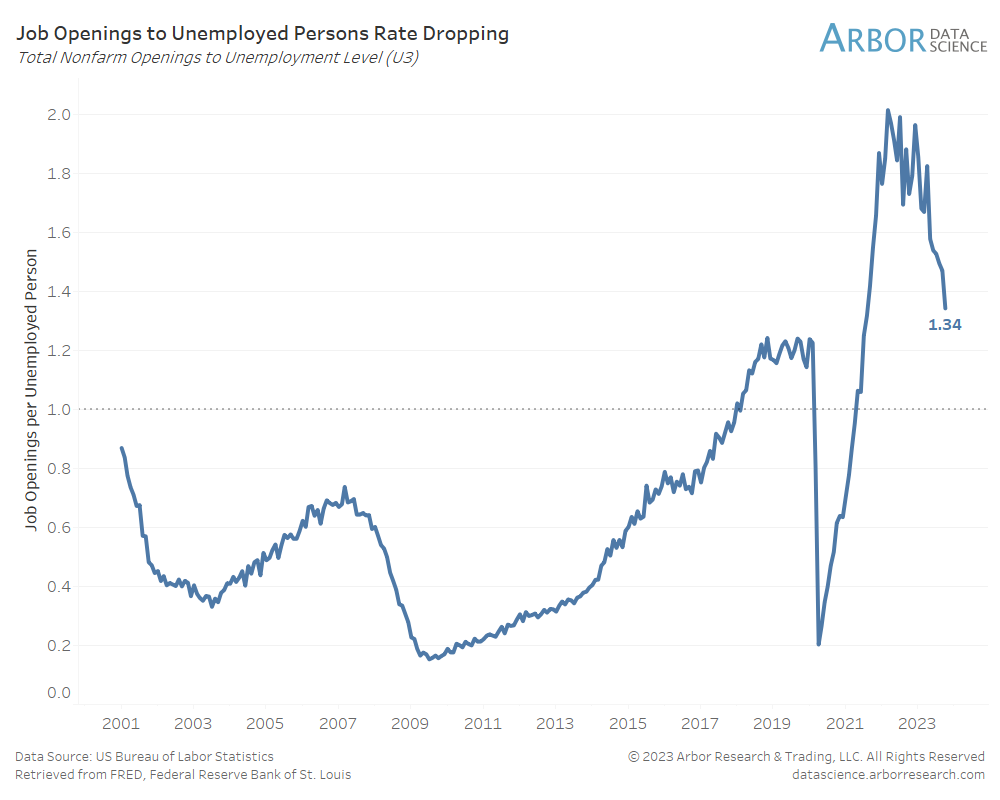

They were particularly evident in the most recent JOLTS report from the Labor Department, where the number of unfilled jobs in the U.S. dropped to 8.73 million from over 12 million last year, and where the unfilled jobs per available worker has plummeted from over 2.0 to only 1.34 9. Importantly, even at that level, the ratio remains very high by historic standards.

We actually view this as good news, as it is indicative of the number of available jobs and the number of available workers finally approaching the kind of equilibrium that will help to support a sustainable reduction in service-sector inflation.

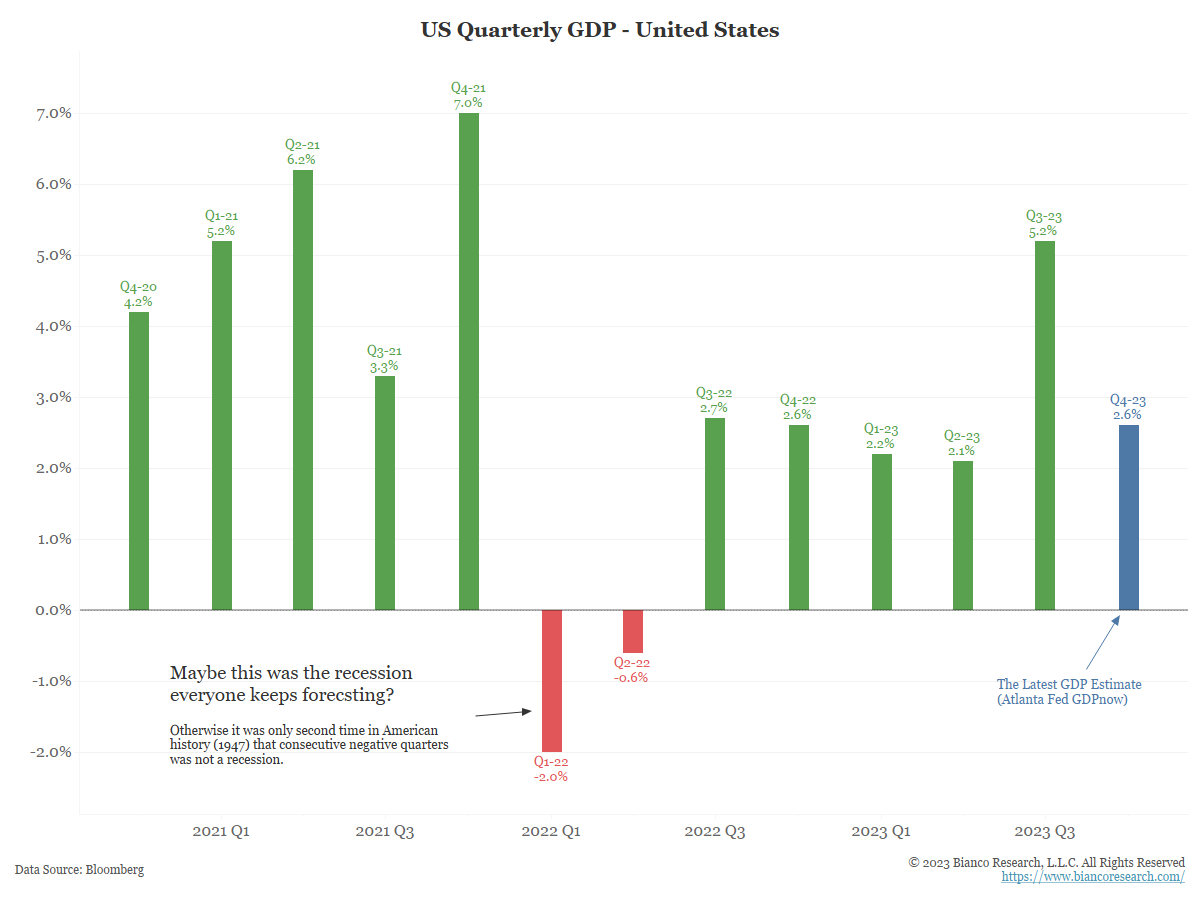

What about the economy itself? Is it showing signs of the kind of dramatic slowing normally required to generate such a dovish policy shift at the Fed? It is certainly not showing up in current data. At least, not yet.

Indeed, if you look at the Atlanta Fed’s GDPNow (a real-time estimate of growth in the current quarter), you will see that it is showing an expected slowdown from the economy’s blistering 5.2% third quarter growth rate, but to a still very respectable 2.6% growth rate in the fourth quarter. At minimum, it is not a growth rate that should motivate the Fed to cut interest rates.

If a slowdown is not evident in the current data, is it showing up in the forward-looking data? You could certainly make that argument, as the Conference Board’s Index of Leading Economic Indicators has been predicting a recession for almost two years, and because it would be unusual for the most aggressive tightening of monetary policy in over forty years not to catalyze a recession. And yet, even the Leading Economic Indicators have recently been showing signs of improvement (blue line).

In any event, it is difficult to look at the economy and find any justification for such a violent reversal in monetary policy guidance.

That brings us to the issue of “real”, inflation-adjusted rates. Economic theory holds that it is “real rates” (i.e., the nominal rate minus the inflation rate) rather than the nominal level of interest rates that determine whether monetary policy is stimulative, neutral or restrictive. As such, if the Fed were to keep nominal rates unchanged and inflation rates were to continue to decline, it would mean that “real”, inflation-adjusted rates would keep moving higher, which could cause a recession.

If you look at the Fed’s new guidance in that light, it starts to make more sense, as they are forecasting short-term rates moving lower by three-quarters of a percent and inflation declining by a similar amount. If that is the case, they could theoretically move rates as they describe without making monetary policy more stimulative, as it keeps “real rates” essentially the same. That makes sense for the 75 basis points that the Fed is projecting, but probably not the 150 basis points in cuts that the market is projecting, which is why we believe that market expectations for rate cuts are overly aggressive and need to be adjusted lower.

That said, if market expectations do prove correct, and the Fed actually cuts rates six times in 2024, it would likely foretell a recession, which should be great for the prices of high-quality bonds but negative for earnings and therefore most equity prices. In contrast, if Fed guidance proves correct, it will imply that inflation is continuing on its downward path, despite continuing economic growth, which should benefit both stocks and bonds.

Yes, risks to the Fed’s “Goldilocks” outcome do remain on both ends of the risk spectrum. On one hand, the Fed pivot could accelerate the economy and exacerbate inflation (the porridge is too hot). On the other hand, all of the monetary policy tightening to-date could eventually catch up with the economy (with its traditional “long and variable lag”) and ultimately cause a recession (the porridge is too cold). However, at least for the time being, it is looking increasingly likely that the economic “porridge” will turn out to be “just right”.

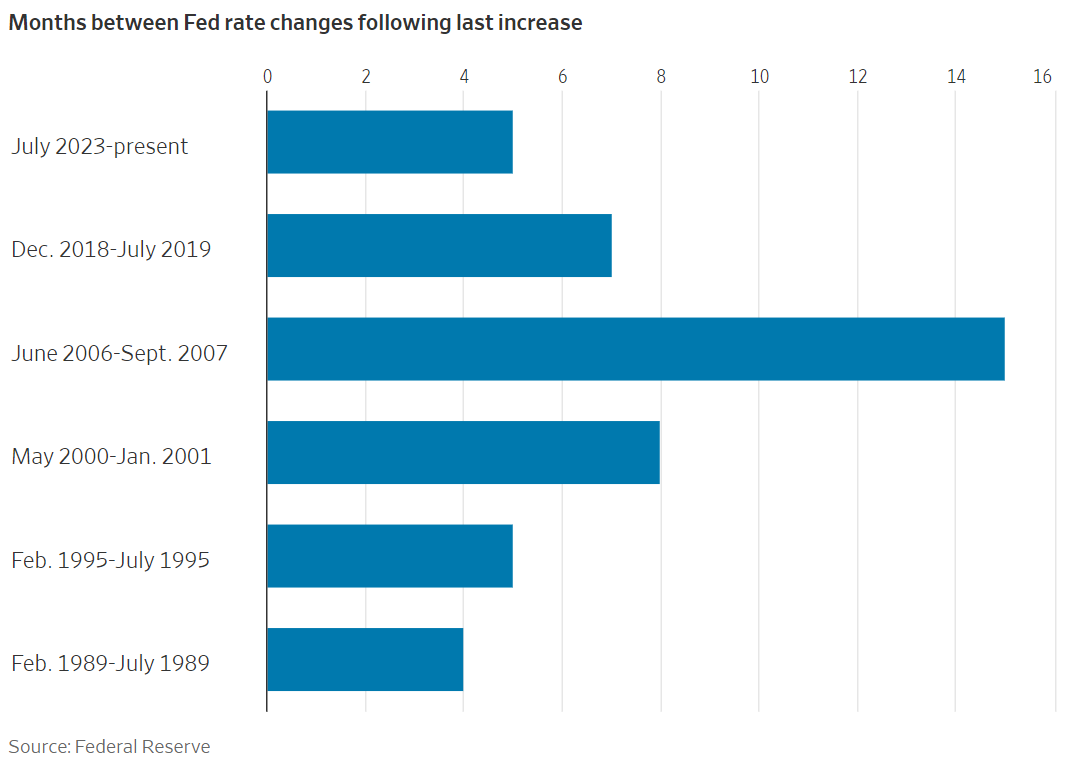

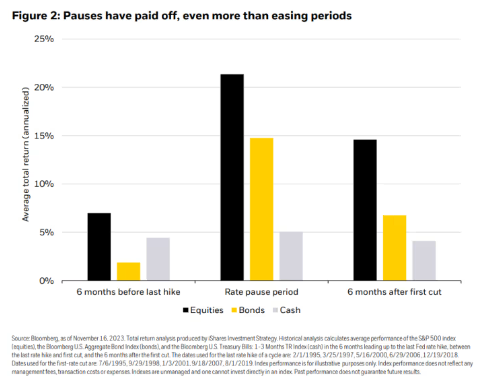

While the past is not necessarily prelude, monetary policy “pause periods” (the period between the last rate hike and the first rate cut) have historically been very bullish for both stocks and bonds and, while historically not quite as strong, the six months following the first rate cut also tends to be bullish for both asset classes.

We expect both to significantly outperform cash and short-term debt over the next year or so, and that it makes sense from a risk-adjusted return perspective to consider putting cash to work either locking in relatively high yields or investing for growth.

In the short term, markets have priced in a lot of bullish news over recent weeks, which has left both stocks and bonds technically overvalued (they may have risen too far too fast), and potentially vulnerable to profit-taking. Equity market valuations also appear particularly elevated and bullish sentiment is extremely high (normally a contrarian sign). The December 14th release of the latest AAII Sentiment Survey showed the highest bullishness in five months and the lowest bearishness in six years 10, which is another potential catalyst for profit-taking.

The problem with waiting for a pullback to invest is that markets with this kind of momentum often frustrate market timers by depriving them of an attractive entry point. Moreover, with an estimated $6 trillion still sitting in money market funds, and with this cycle’s highs in interest rates very likely behind us, we would expect for any pullbacks to be relatively modest, and for the path of least resistance for both stocks and bonds to be higher.

Unlike 2023, when global portfolio returns were dominated by seven extraordinarily expensive mega-cap technology stocks, we expect 2024 to be much more inclusive, with the potential for relatively attractive returns in an array of asset classes and across most regions of the world. Monetary conditions have changed from a headwind to a tailwind and, while there is always risk in investing, it almost never pays to “fight the Fed”.

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

Neither asset allocation nor diversification guarantee a profit or protect against a loss in a declining market. They are methods that can be used to help manage investment risk.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

Goldman Sachs Financial Conditions Index is a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.

Real gross domestic product (GDP) is a comprehensive measure of U.S. economic activity. GDP measures the value of the final goods and services produced in the United States (without double counting the intermediate goods and services used up to produce them). Changes in GDP are the most popular indicator of the nation’s overall economic health.

Citations

-

“Fed’s Powell notes inflation is easing but downplays discussion of interest rate cuts.”, Christopher Rugaber, Posted 12/1/2023, https://apnews.com/article/inflation-economy-interest-rates-federal-reserve-powell-2200b5e3da872a349550ea707d4d6d42

-

“Powell Pivots Toward a Happy New Year”, John Authers, Posted 12/13/2023, https://www.bloomberg.com/opinion/articles/2023-12-14/powell-pivots-on-rates-toward-a-happy-new-year

-

“Fed gave no indication of possible rate cuts at last meeting, minutes show”, Jeff Cox, Posted 11/22/2023, https://www.cnbc.com/2023/11/21/fed-minutes-november-2023.html

-

“Wall Street Cheered Best Fed Day Since 2009 on Rate Cut Elation”, Le Wang, Posted 12142023, https://www.bloomberg.com/news/articles/2023-12-14/wall-street-cheered-best-fed-day-since-2009-on-rate-cut-elation

-

“Federal Reserve keeps key interest rate unchanged and foresees 3 rate cuts next year”, Christopher Rugaber, Posted 12/12/2023, https://www.msn.com/en-us/money/markets/federal-reserve-may-shed-light-on-prospects-for-rate-cuts-in-2024-while-keeping-key-rate-unchanged/ar-AA1lqcBb

-

“Federal Funds Rate History 1990 to 2023”, Taylor Tepper, Posted 10/17/2023, https://www.forbes.com/advisor/investing/fed-funds-rate-history/

-

“Fed’s John Williams says the central bank isn’t ‘really talking about rate cuts right now’”, Yun Li, Posted 12/15/2023, https://www.cnbc.com/2023/12/15/feds-john-williams-says-the-central-bank-isnt-really-talking-about-rate-cuts-right-now.html?&qsearchterm=john%20williams

-

“Fed’s Goolsbee Says Too Early to Declare Victory Over Inflation”, Catarina Saraiva, Posted 12/17/2023, https://www.bloomberg.com/news/articles/2023-12-17/fed-s-goolsbee-says-too-early-to-declare-victory-over-inflation

-

“Job openings slide to 8.7 million in October, well below estimate, to lowest level since March 2021”, Jeff Cox, Posted 12/5/2023, https://www.msn.com/en-us/money/careers/job-openings-slide-to-87-million-in-october-well-below-estimate-to-lowest-level-since-march-2021/ar-AA1l2odU

-

“AAII Sentiment Survey: Optimism Rises to Highest Level in Five Months; Pessimism Falls to Lowest Level in Six Years”, AAII Staff, Posted 12/14/2023, https://www.aaii.com/latest/article/115898-aaii-sentiment-survey-optimism-rises-to-highest-level-in-five-months-pessimism-falls-to-lowest-level-in-six-years