20

DecemberPer Stirling Capital Outlook – December

Economist Joseph Schumpeter is probably best known for his commentaries on “the gales of creative destruction”, a term which he used to describe the impact of the kind of essential innovations in strategic thinking and technology that destroy existing economic (and even social) structures to make way for new, more efficient, and more sustainable ones.

On many levels, President-Elect Trump campaigned on promises of “creative destruction”, whether it be his core platform of deregulation, government downsizing, mass deportations, and tariffs, or more recent trial balloons such as eliminating FDIC insurance for U.S. banks, which was proposed by officials from Trump’s newly founded Department of Government Efficiency 1, privatizing the U.S. Postal Service 2, which was done with modest success in Britain with the Royal Mail, or Trump’s social security-related proposals, which the Committee for a Responsible Federal Budget (CRFB) estimates will “increase Social Security’s cash deficit by $2.25 trillion over 10 years”. 3

While only time will tell whether these “Schumpeterian” proposals, if ultimately enacted, will prove to be beneficial or harmful, there is almost no doubt that they will be very disruptive. Indeed, one can argue that these proposals and trial balloons are already introducing very significant levels of uncertainty into the global environment which, based upon historic precedent, would normally be expected to fill the markets with fear and trepidation.

After all, risk markets, like stocks and lesser-quality bonds, have historically abhorred disruptive change due to the uncertainty that it creates. Indeed, if faced with a choice of receiving negative fundamental news or facing significant uncertainty, we believe that the majority of investors would actually prefer receiving the negative news, as it is knowable and can therefore be hedged and/or reasonably discounted into the price of a security or of a market overall. By sharp contrast, something that is unknowable is more difficult to hedge and virtually impossible to rationally price into the value of a security or market.

It is in this light that the reaction to the Trump reelection is so remarkable, whether you are looking at consumer confidence, business confidence, economic bullishness or the capital markets themselves. Rather than being apprehensive about the heightened uncertainty, the more capitalistic segments of the American economy seem to be looking at Trump, and the political bedlam that surrounds him, with excitement and anticipation, almost as if to acknowledge that some “creative destruction” might just be exactly what is called for.

This was perhaps nowhere more evident than during Trump’s recent visit to the New York Stock Exchange, where he rang the opening bell and received rabid applause, amid chants of “USA, USA”. On the same day, Trump was named Time Magazine’s “Person of the Year”.

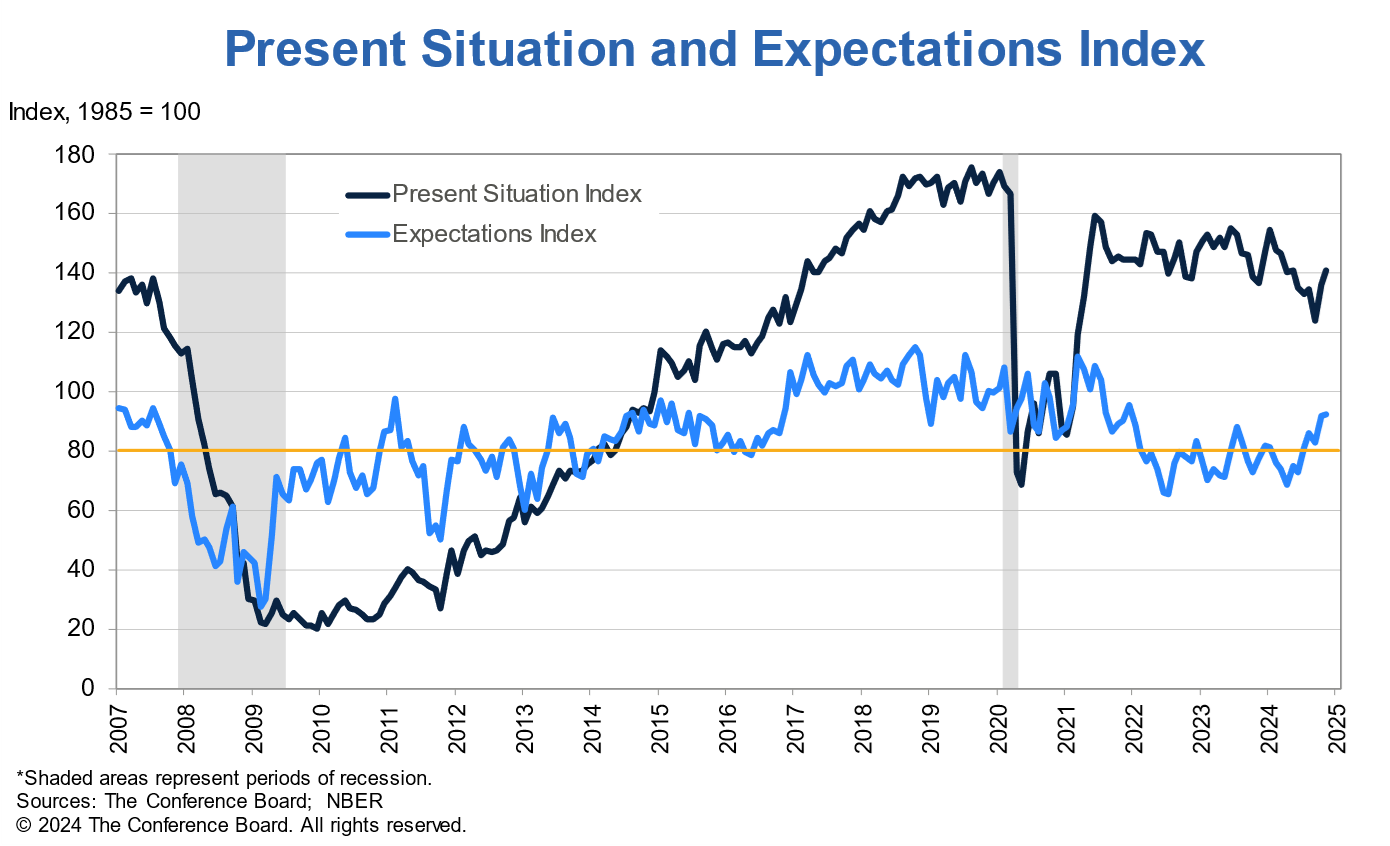

The impact of Trump’s election is already tangible, starting with consumer confidence, which is of paramount importance, as consumer spending represents 68% of the size of the U.S. economy. 4 We find it particularly noteworthy that, while this Conference Board survey shows a sizable post-election bounce in the perception of current circumstances (black line), there is an even larger bullish surge in expectations for the future (blue line).

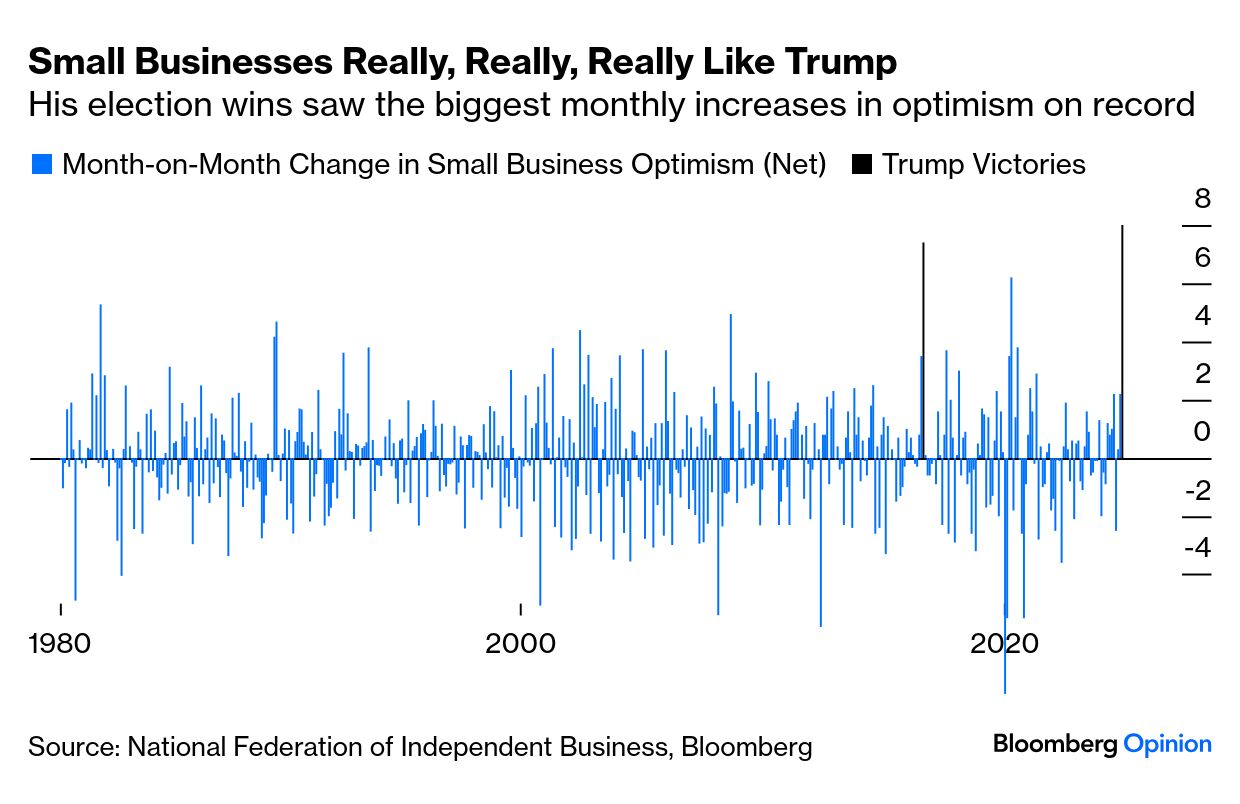

However, this surge in optimism is not limited to American consumers. The post-election period has also seen the largest jump in small business confidence (according to the National Federation of Independent Business) in the long history of their member survey (illustrated above). It should be noted that the second largest surge in small business optimism took place after the first Trump victory.

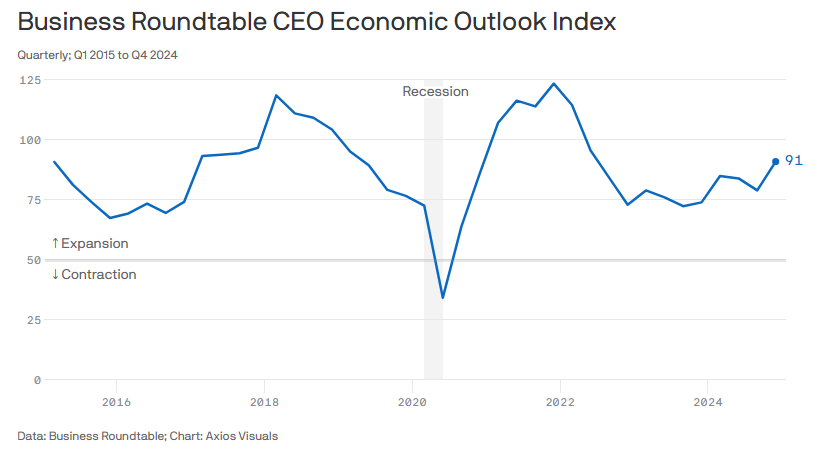

This improving outlook is being further echoed in the latest Business Round Table survey of the CEOs of many of America’s largest companies (above), and we would certainly expect for both large and small business confidence to surge even more if Trump makes good on his pledge, made during his visit to the New York Stock Exchange, to cut corporate tax rates from 21% to 15%. 5

Lower corporate taxes are music to the ears of equity investors, as they free up cash flow and are likely to enhance profitability. However, the president-elect did not stop there and is reportedly “talking with his advisers about cutting levies on capital gains and dividends, changes that would be well-received by investors and would likely spur a market bump”. 6 That is not even to mention deregulation, where Trump has promised the “most aggressive regulatory reduction” in the country’s history.

These promises “include an executive order on his first day in office that would broadly target regulations, putting Elon Musk in charge of a “government efficiency commission” aimed at cutting rules and ordering the government to eliminate at least 10 rules for every new one.” 7

While deregulating too much can have very negative longer-term implications (the global financial crisis is a recent example), it can be very beneficial to both corporations and investors if done properly, by introducing efficiencies, streamlining operations, lowering costs and even helping to restore “animal spirits” 8 to the economy and the markets.

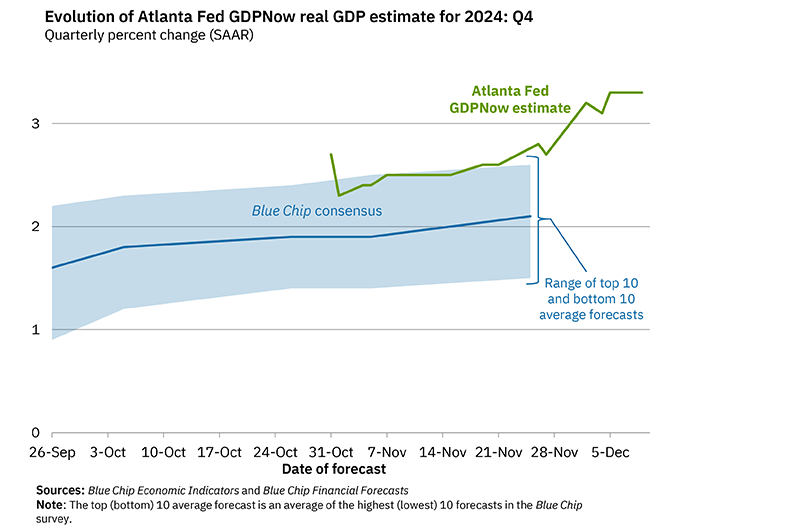

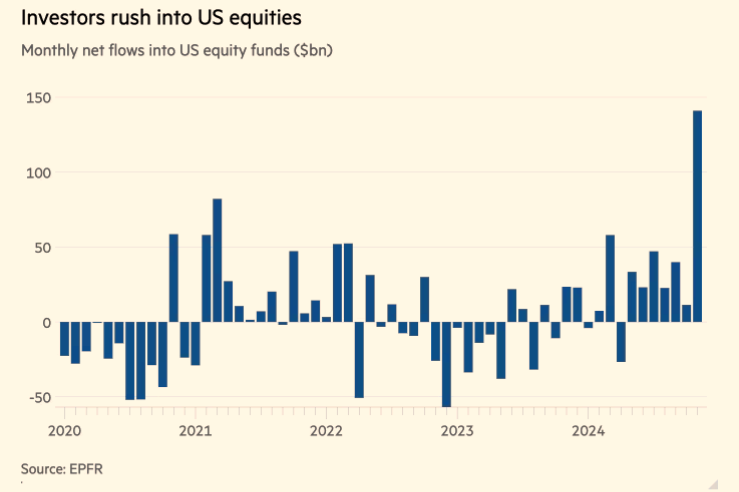

Throw in a rapidly growing economy (3.3% in the latest Atlanta Fed GDP Nowcast, above) 9, relatively impressive (although modestly slowing) corporate profit growth, and a Federal Reserve that is still likely to lower short-term interest rates, albeit much less than the markets were anticipating just a few months ago, and it is little wonder that, as is illustrated below, we have recently witnessed extraordinary flows of new money into the domestic equity markets.

In our opinion, this fact is noteworthy, as it suggests that much of this bullish news may already be priced into the markets and because, as we have noted in past writings, markets very rarely go up or down on the same news twice. It also makes us question whether we are seeing some evidence of investors looking at markets through “rose colored glasses”, where the good news is being celebrated, while the potentially negative implications of these “Schumpeterian” proposals are being treated as something to be dealt with only if and when they actually get passed. In this instance, that may not be an unreasonable approach.

After all, that is essentially how the Fed is addressing monetary policy. As per Chairman Powell, “We don’t know what the timing and substance of any policy changes will be. We therefore don’t know what the effects on the economy would be—specifically whether and to what extent those policies would matter for the achievement of our goals…We don’t guess, we don’t speculate, and we don’t assume”. 10

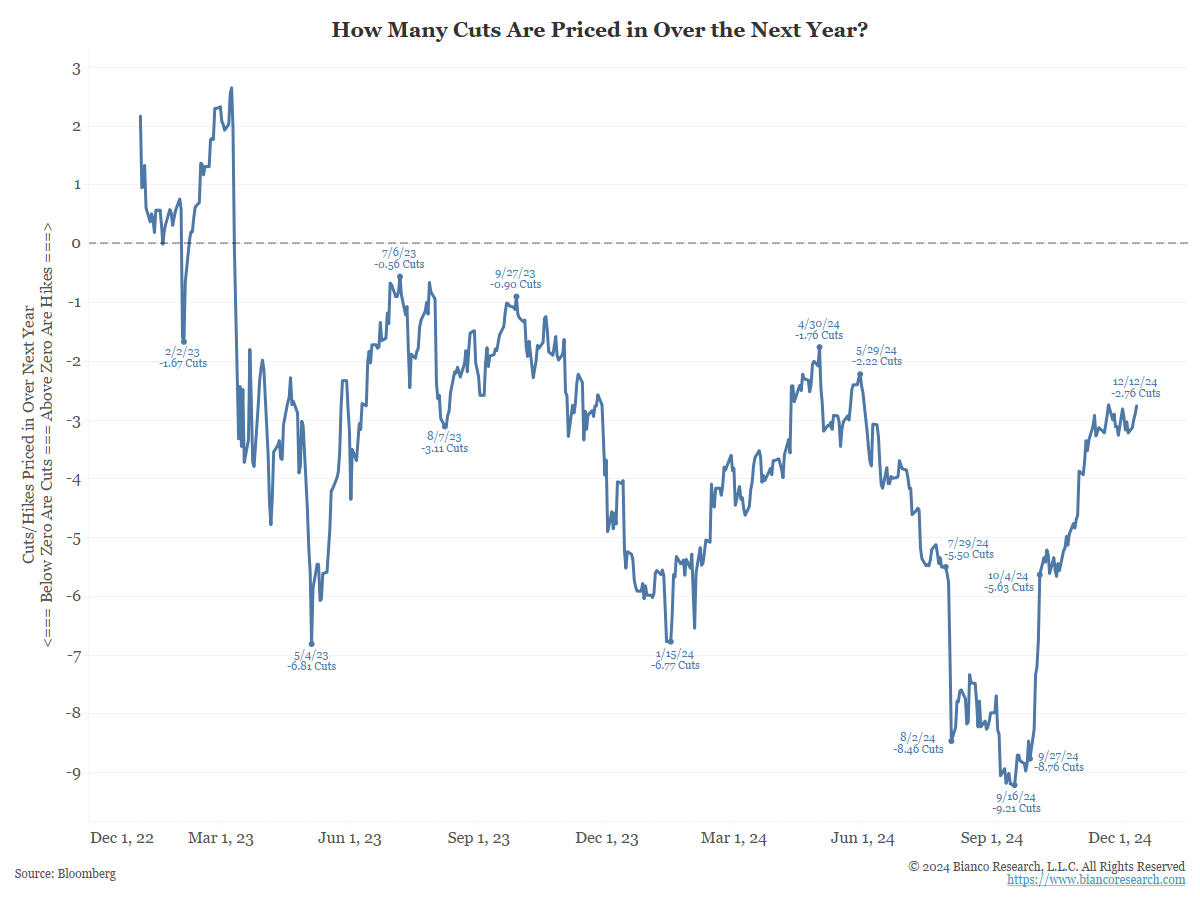

While the Fed itself is taking a wait-and-see approach, the Fed Funds futures market is decidedly not. As recently as September 16th of this year, the futures market was expecting over nine ¼ percent rate cuts. However, largely in response to the perception that Trump’s proposals will accelerate inflation, economic growth and the deficit, the market is now pricing in the likelihood of less than three ¼ percent rate cuts. (The Fed Funds Rate is the short-term borrowing rate that is set by the Federal Reserve, and the Fed Funds futures market reflects expectations for the future level of the Fed Funds Rate.)

In many regards, while we are monitoring each of these issues, we are employing a similar wait-and-see approach when it comes to the impact of politics on portfolio-related decisions. That said, we are also monitoring three things outside of the political realm that are potentially timelier, as they could be hinting that the post-election euphoria is starting to wane, and that equity investors should at least temporarily temper some of their enthusiasm.

They include market breadth, sentiment, and potential signs of speculative froth. Market breadth is probably the least concerning of the three. While there was a significant expansion of market breadth (the number of stocks participating in the bull market) once Trump became the favorite to win, breadth has narrowed rather dramatically since the start of December. Indeed, despite the S&P 500 reaching a record high during the period, every trading day thus far in December has seen more stocks decline than advance.

According to Bespoke Investment Group, “the last time the index had nine straight days of negative breadth was back in late September 2001 following the 9/11 terrorist attacks.” 11 Meanwhile, “the S&P 500 equal-weight index, which assigns the same weighting to all stocks, has fallen in eight of the nine trading days in December so far. The S&P 500 Value Index is down nine straight days, according to Dow Jones Market Data”. 12

While market advances with broad participation are generally stronger and more sustainable, history has shown that narrow breadth markets can last for prolonged periods, and many of the mega-cap growth stocks that have continued to move higher in December are the same stocks that led the narrow breadth bull market of recent years.

High equity valuations are also a point of concern. However, valuation has traditionally been a much better indicator of long-term potential than shorter-term market direction.

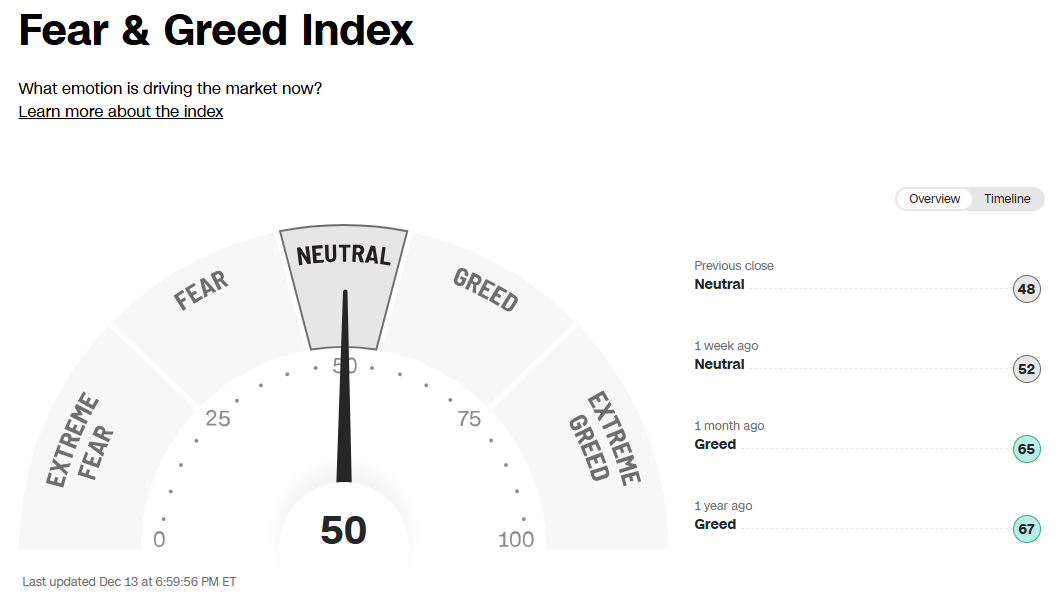

Investor sentiment presents a somewhat more mixed picture. Some indicators like the CNN Fear and Greed Index 13, which is a composite of measures of risk appetite, are giving no indications of excessive risk taking, which is rather remarkable when you consider both the size of the recent market advance and the surge of new money into the domestic equity markets.

On the other hand, the average equity weighting in portfolios of National Association of Active Investment Managers members is a very heady 99.24% 14, which is a bit concerning when you consider the sage words of Sir John Templeton that “bull markets begin in despair, grow on pessimism, mature on optimism, and die in euphoria”.

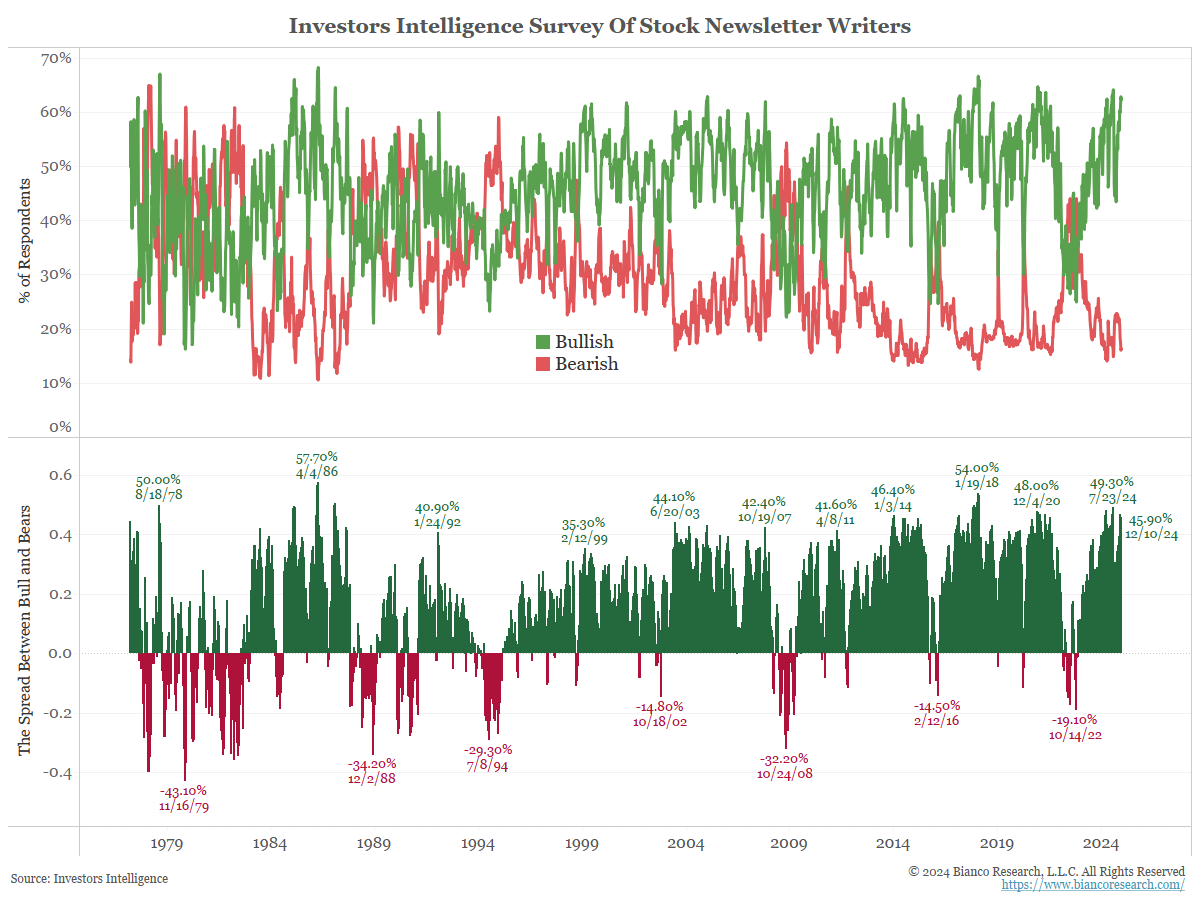

You can see similar indications of potential bullish excess in the American Association of Individual Investors Bull/Bear Survey (below), where the percent of bullish respondents (green) dramatically outnumbers that of respondents who expect for equity markets to decline over the next six months (red). This suggests that much of the money available for investing in equities may already be invested.

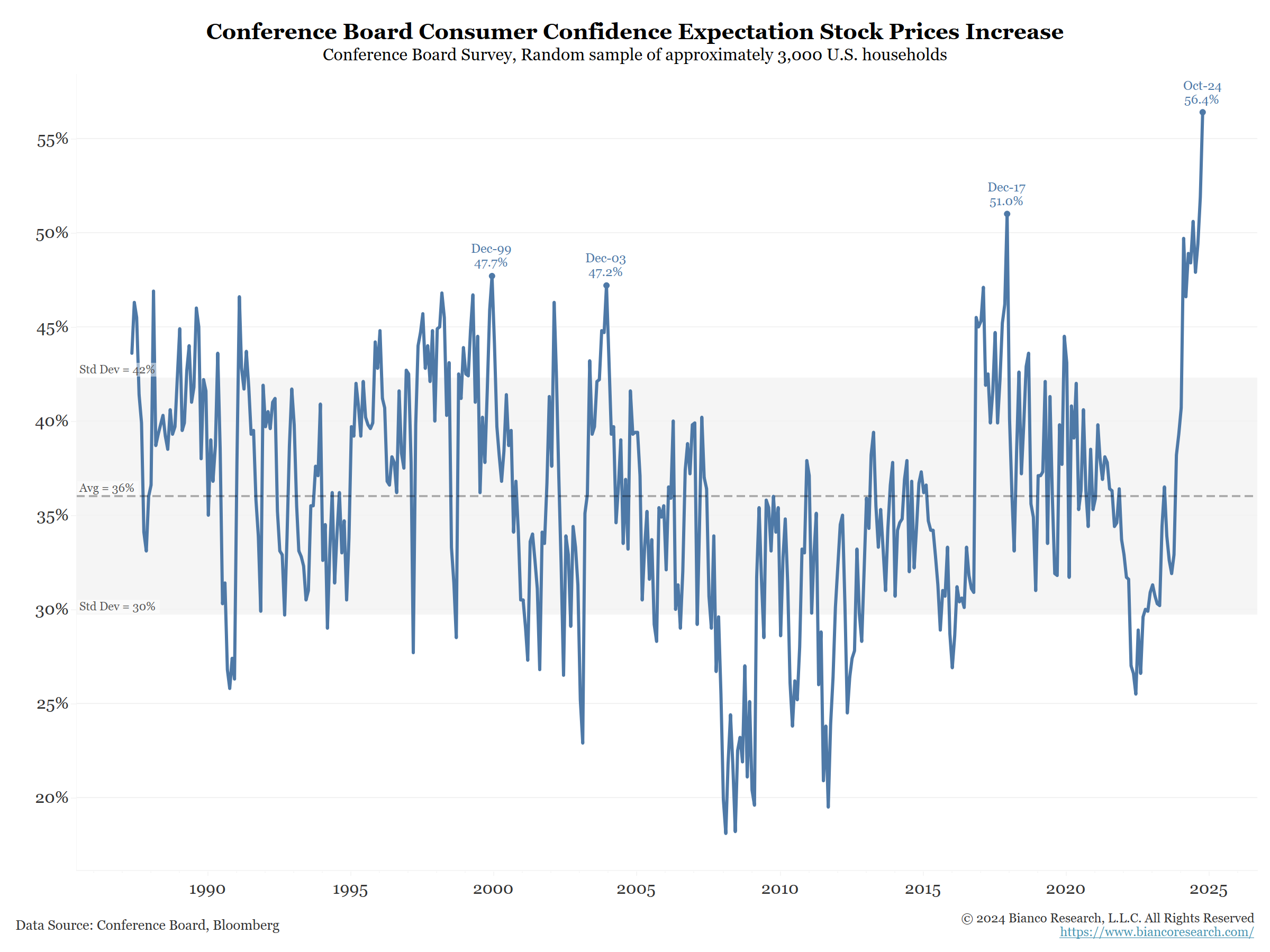

The latest Conference Board Survey (above) shows even more excessive bullishness, and even that “U.S. consumers have never been so bullish on stocks… [and] their expectations for equities relative to their own incomes has never been greater.” 15

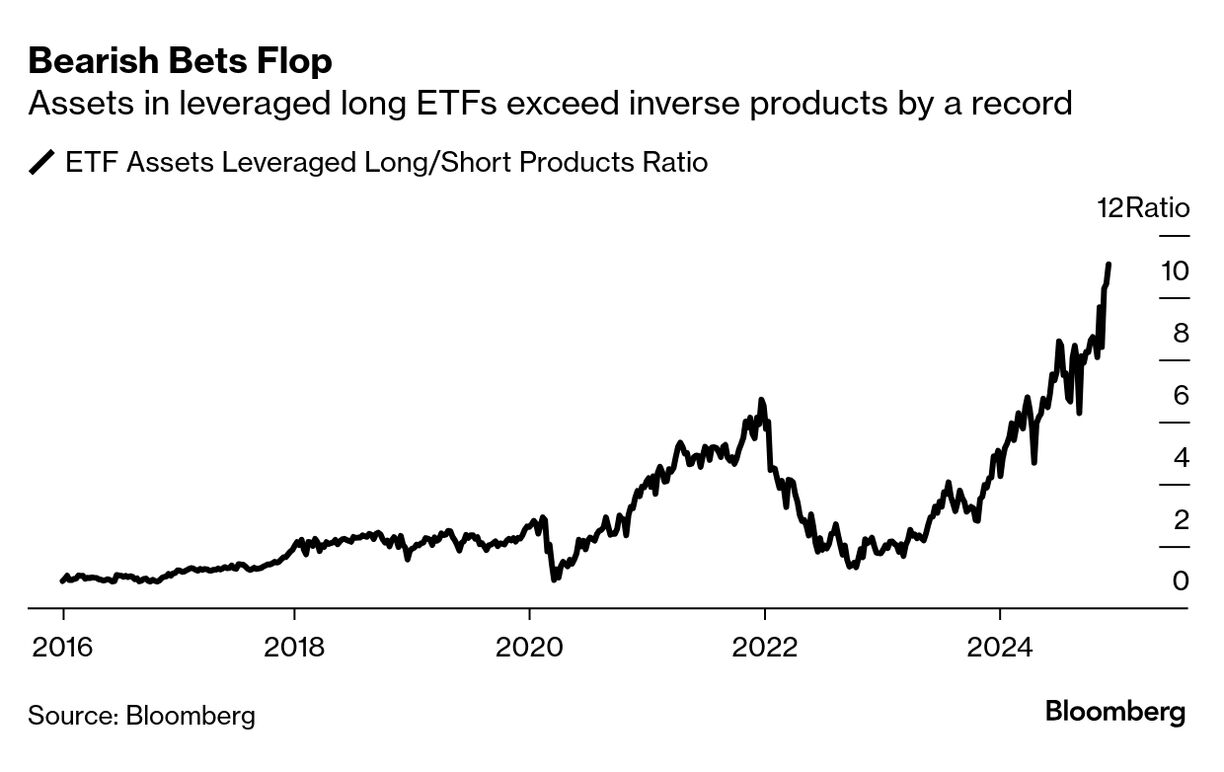

While poor market breadth and signs of excessive bullishness are sources of concern, we are even more focused on indications of market froth. This includes significant money flowing into many of the most aggressive investment vehicles, ranging from crypto currencies and unprofitable technology stocks, to leveraged ETFs (funds that trade at two or more times the price movement of the equity indexes or even individual stocks) and industries related to cutting edge innovation like artificial intelligence (AI).

Indeed, since the release of ChatGPT two years ago, the fifty stocks that make up the Bespoke AI Basket have increased by “$13.1trn or 131%. That accounts for 45% of the total increase in global market cap over the same period” and those companies now represent almost one fifth of the value of the equity market capitalization of the entire globe 16.

This bull market has clearly come a long way over the past two years, and there is a growing array of indications that the equity markets may have come too far, too fast, and that a short-term pullback may be both healthy and necessary.

That said, from our perspective, the longer-term bullish narrative remains largely intact, despite the variety of reasons for at least some shorter-term caution, ranging from the potential signs of excessive bullishness to the political and “Schumpeterian” risks that may reveal themselves once Trump returns to The White House.

We will conclude with a presumably bullish and potentially significant observation, which is that it looks likely that Trump will once again use the stock market as a “report card” on his administration, and that he therefore has a reason to avoid policies that might cause it to decline. If there was any doubt, consider his statement made to CNBC during his visit to the New York Stock Exchange that “I think I’ve always said, to me, the stock market is all of it”. 17

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

The information presented is not intended to be making value judgements on the preferred outcome of any government decision or political election.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“The Trump II Destruction Is Already Well Underway”, David Kurtz, Posted 12/13/2024, https://www.msn.com/en-us/news/politics/the-trump-ii-destruction-is-already-well-underway/ar-AA1vOqc6?ocid=hpmsn&pc=AV01&cvid=673c53a48e7

-

“’Our big fear’: How Trump’s plan to privatize USPS could have ‘disastrous consequences’”, Carl Gibson, Posted 12/14/2024, https://www.msn.com/en-us/news/politics/our-big-fear-how-trump-s-plan-to-privatize-usps-could-have-disastrous-consequences/ar-AA1vRkL3?ocid=hp

-

“President-Elect Donald Trump’s Social Security Proposal Comes With Unintended Consequences”, Sean Williams, Posted 12/14/2024, https://www.msn.com/en-us/money/retirement/president-elect-donald-trump-s-social-security-proposal-comes-with-unintended-consequences/ar-AA1v

-

“How does consumer spending impact the health of the economy?”, U.S. Bank, Posted 12/12/2024, https://www.usbank.com/investing/financial-perspectives/market-news/consumer-spending.html

-

“Trump Woos Wall Street With Corporate Tax Cuts at NYSE Visit”, Skylar Woodhouse, Jenny Leonard, Posted 12/12/2024, https://www.bloomberg.com/news/articles/2024-12-12/trump-vows-to-build-strong-economy-in-celebratory-trip-to-nyse?sref=YfRIauRL

-

“Trump Woos Wall Street With Corporate Tax Cuts at NYSE Visit”, Skylar Woodhouse, Jenny Leonard, Posted 12/12/2024, https://www.bloomberg.com/news/articles/2024-12-12/trump-vows-to-build-strong-economy-in-celebratory-trip-to-nyse?sref=YfRIauRL

-

“Trump vows anti-reg blitz”, Robin Bravender, Posted 11/04/2024, https://www.eenews.net/articles/trump-vows-anti-reg-blitz/

-

“Animal spirits (Keynes)”, Wikipedia, As of 12/14/2024, https://en.wikipedia.org/wiki/Animal_spirits_(Keynes)

-

“GDP Now”, the Federal Reserve Bank of Atlanta, As of 12/14/2024, https://www.atlantafed.org/cqer/research/gdpnow

-

“Election Results Will Have No Effect on Fed’s Policy Decisions”, Megan Leonhardt, Posted 11/7/2024, https://www.barrons.com/livecoverage/fed-november-meeting-interest-rate-decision-today/card/election-results-will-have-no-effect-on-fed-s-policy-decisions-0aDb2mJBwo9AjShoiGyY

-

“The Bespoke Report”, Bespoke Investment Group, Posted 12/13/2024, Bespoke Report 12-13-24.pdf

-

“The S&P 500 Isn’t as Strong as It Looks. Why Markets May Face a Santa Slump.”, Callum Keown, Posted 12/13/2024, https://www.barrons.com/articles/stock-market-what-to-know-today-d0c31038

-

“Fear and Greed Index”, CNN Business, As of 12/14/2024, https://www.cnn.com/markets/fear-and-greed

-

“NAAIM Exposure Index”, NAAIM, As of 12/14/2024, https://naaim.org/programs/naaim-exposure-index/

-

“Crypto, Stocks, and Wacky ETFs Are Going Wild. Will Things End Well?”, Randall W. Forsyth, Posted 12/13/2024, https://www.barrons.com/articles/stock-market-crypto-etfs-88aa2496?mod=djem_b_This

-

“The Bespoke Report”, Bespoke Investment Group, Posted 12/6/2024, Bespoke Report 12-6-24.pdf

-

“Trump Woos Wall Street With Corporate Tax Cuts at NYSE Visit”, Skylar Woodhouse, Jenny Leonard, Posted 12/12/2024, https://www.bloomberg.com/news/articles/2024-12-12/trump-vows-to-build-strong-economy-in-celebratory-trip-to-nyse?sref=YfRIauRL