28

FebruaryPer Stirling Capital Outlook – February

The month of January has traditionally been given some element of special consideration by more tactical investors for a variety of reasons. One of those is the so-called “January Barometer”, which holds that, as January goes, so goes the rest of the year in stocks.

While we would never encourage an investor to use such a seasonal tendency as a primary driver of an investment decision, this one at least has some basis in history. According to tradingacademy.com1:

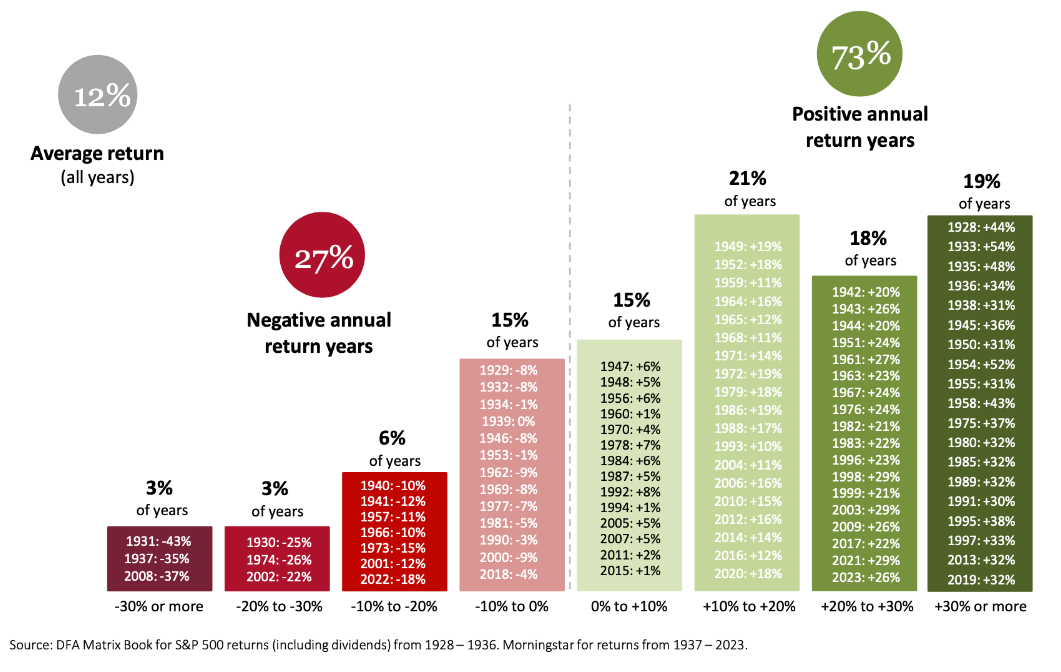

“Since 1950, the January Barometer has been accurate about 75% of the time, meaning that in years when January was positive, the market ended up higher for the year, and in years when January was negative, the S&P 500 closed lower for the year about 60% of the time.” We believe that this statistic is at least noteworthy, when you consider that the S&P 500 has produced negative returns in less than 27% of all years from 1928 through 2024.

Equity investors can only hope that this is one of the years when the “January Barometer” is correct because the S&P 500 gained 2.7% in January and is already up an impressive 4.1% on a year-to-date basis, as of the February 15th date of this commentary.

We believe that the start of 2025 is of particular importance not just because of January’s potential seasonal significance, but also because it is our first opportunity to discern between what were potentially simply campaign promises on the part of candidate Trump and the policies that President Trump actually intends to implement.

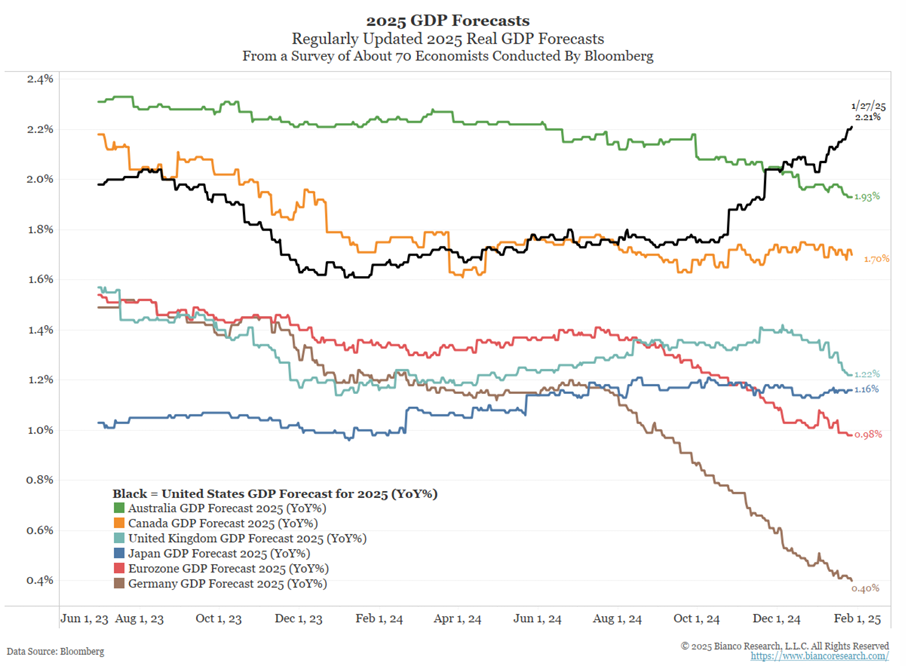

For most of this commentary, we will concentrate on the state of the economy, which continues to grow at a very impressive rate. The New York Fed Nowcast2 estimates that, in the current quarter, the U.S. economy is growing at 3.02%, which is quite notable for such a large and mature economy. And, while the level of nominal growth is impressive, U.S. economic growth is even more remarkable when compared to the world at large.

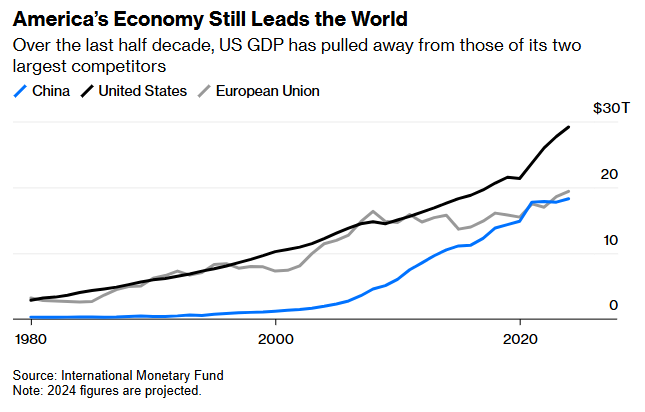

Indeed, from an economic perspective, evidence of “American exceptionalism” is nothing new. As an example, less than a generation ago, the U.S. economy was the same size as the European Union’s economy. Now it is a third larger than that of Europe. Perhaps equally impressive, after decades of speculation that it was just a matter of time before the size of the Chinese economy surpasses that of the U.S., “over the past half-decade, the overall gap between the US and Chinese economies — as measured by gross domestic product — has been getting larger”.3 In other words, China has been falling further behind the U.S.

Further, as was noted in a recent Bloomberg article4, if you “look beyond GDP,… the picture is even brighter. In recent decades, US labor productivity has risen faster than that of any other advanced economy. US firms account for more than half of global profits in high-tech sectors, compared to 5% for Chinese firms. America’s research and development investments, the lifeblood of future innovation, lead the world. China is a stronger economic rival than the Soviet Union ever was. But the US is well-positioned to remain the world’s richest, most dynamic economy for a long time to come”.

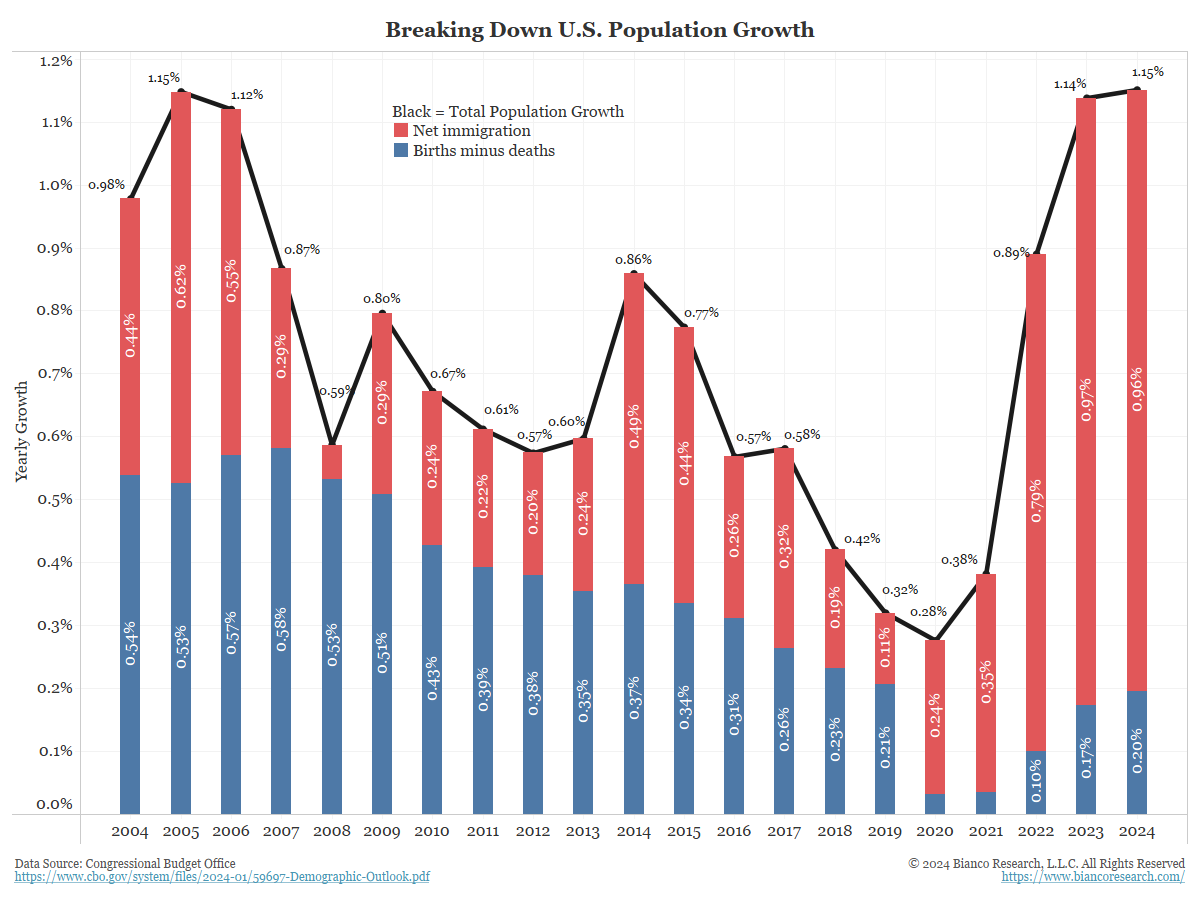

One of the major reasons for this optimistic perspective is demographics. As noted in that same article, “the US also has a better demographic future than any other major power. Russia’s already dicey demography has been made even worse by the death or flight of so many young men during the war in Ukraine. China, meanwhile, is headed for demographic catastrophe, due to the long tail of its one-child policy: By 2100, its population will likely be less than half of what it is today. Well before then, China’s workforce will dramatically contract, and its elderly population will explode — a phenomenon that will only undermine its economic prosperity, social stability and global power”.5

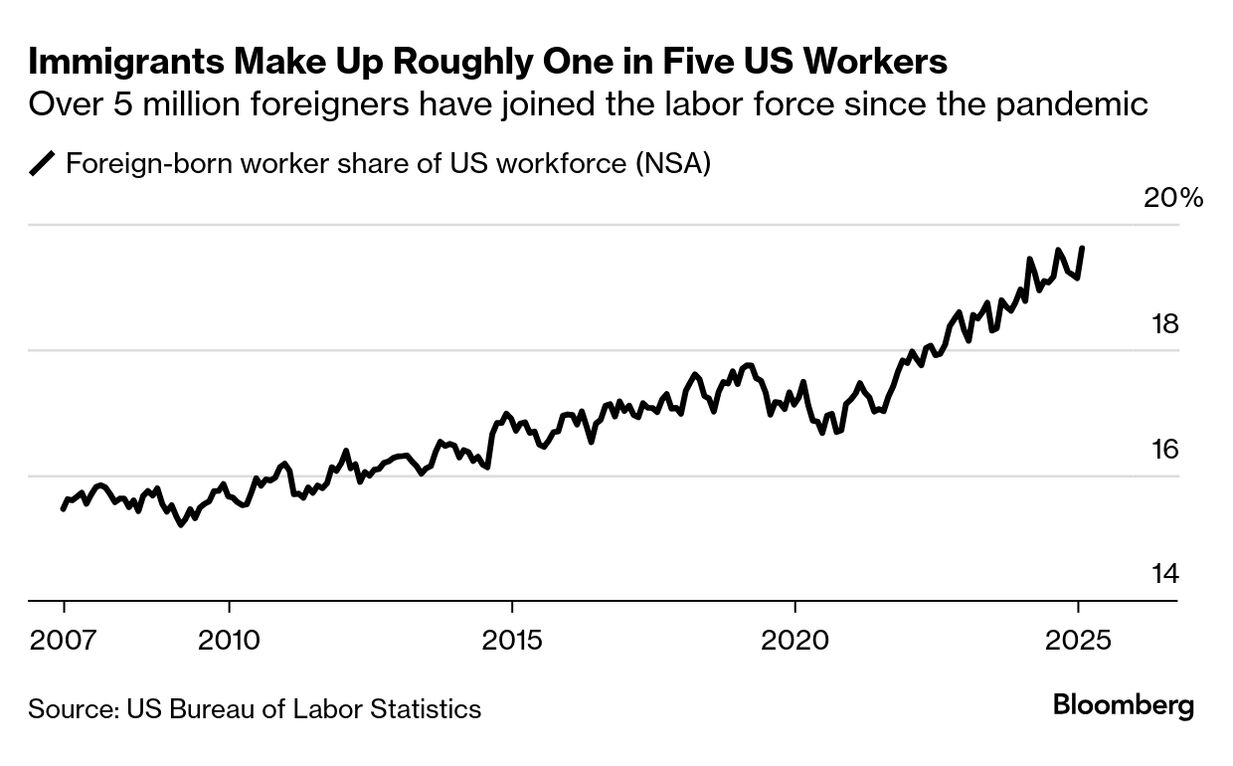

According to Bloomberg, the outlook for “Japan, South Korea and much of Western Europe is bleak. But in a world of shrinking populations, the US is a healthy outlier: Thanks to a decent fertility rate and high immigration, its population isn’t projected to peak for another half-century”.6 Of course, that projection could be impacted by Trump’s stricter immigration policies.

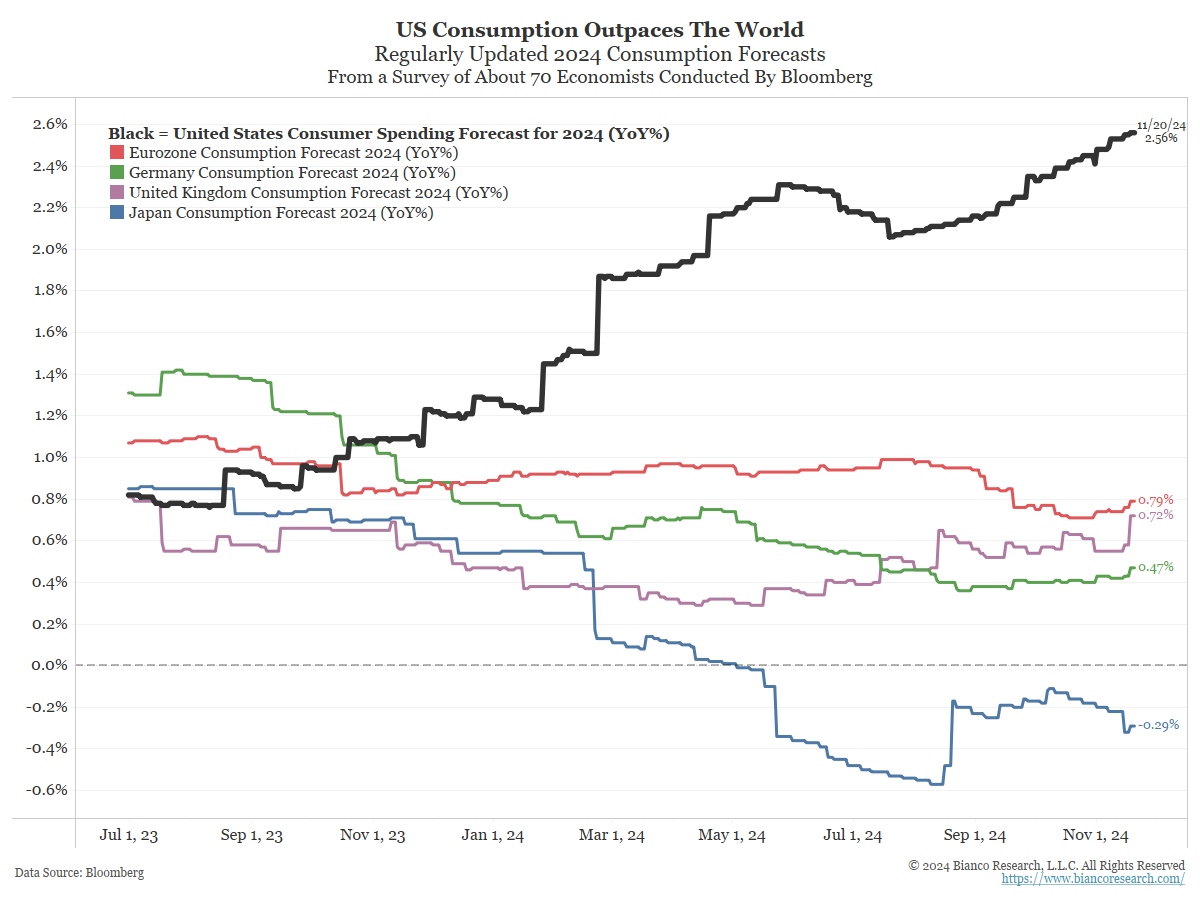

Much of the dominance of the domestic economy is due to the seemingly insatiable demand of the American consumer. According to a November 2024 survey of economists (see the following chart), U.S. consumption was growing at a 2.56% pace, which contrasts to 0.79% consumption growth in the Eurozone and a -0.29% consumption contraction in Japan.

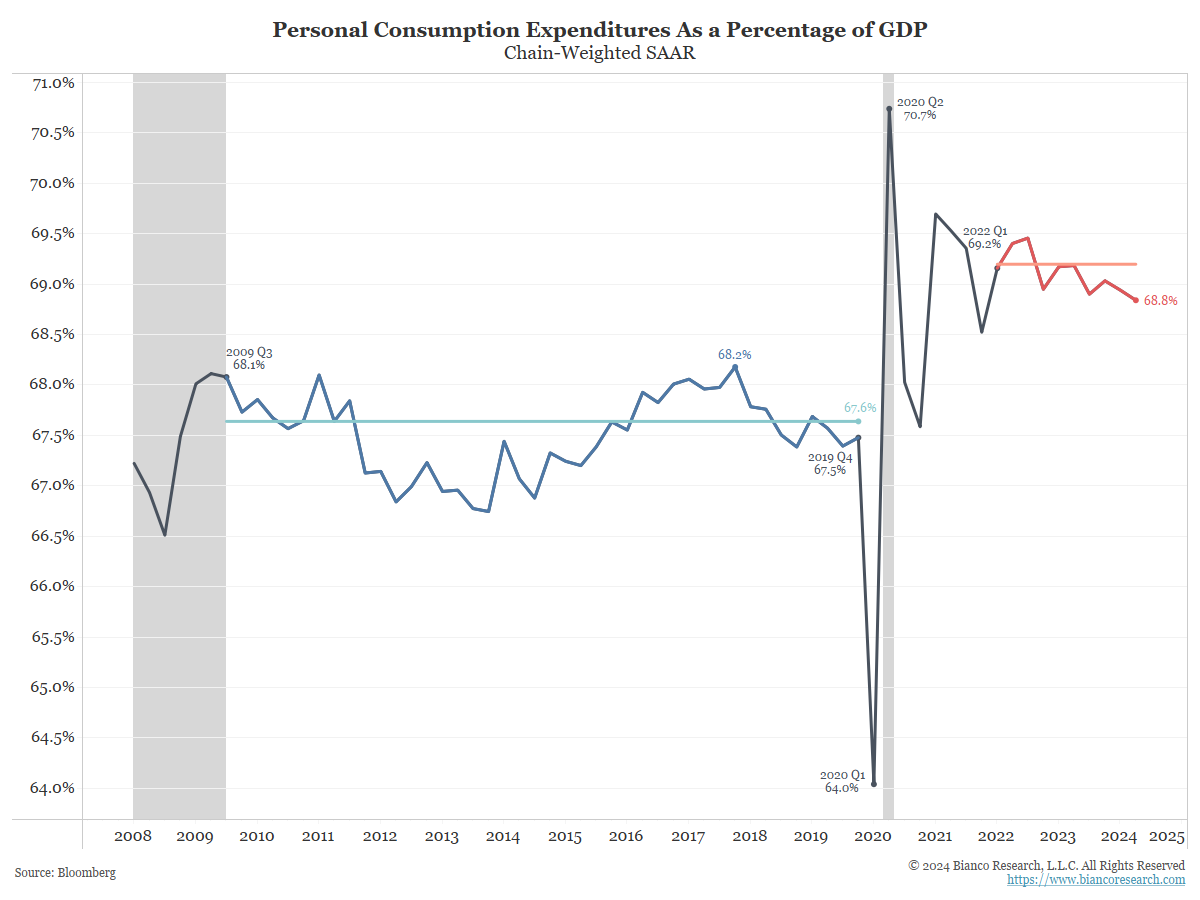

Indeed, consumer spending accounted for more than 100% of total U.S. economic growth during Q4 of 2024. While the economy grew by 2.4% over the period, 2.8% of U.S. Gross Domestic Product (GDP, or the size of the economy) came purely from consumer spending.

The U.S. is currently fortunate that consumer spending accounts for such a remarkably large 68.8 percent of the economy, because the above statistics indicate that much of the non-consumer sector of the economy actually contracted during the quarter.

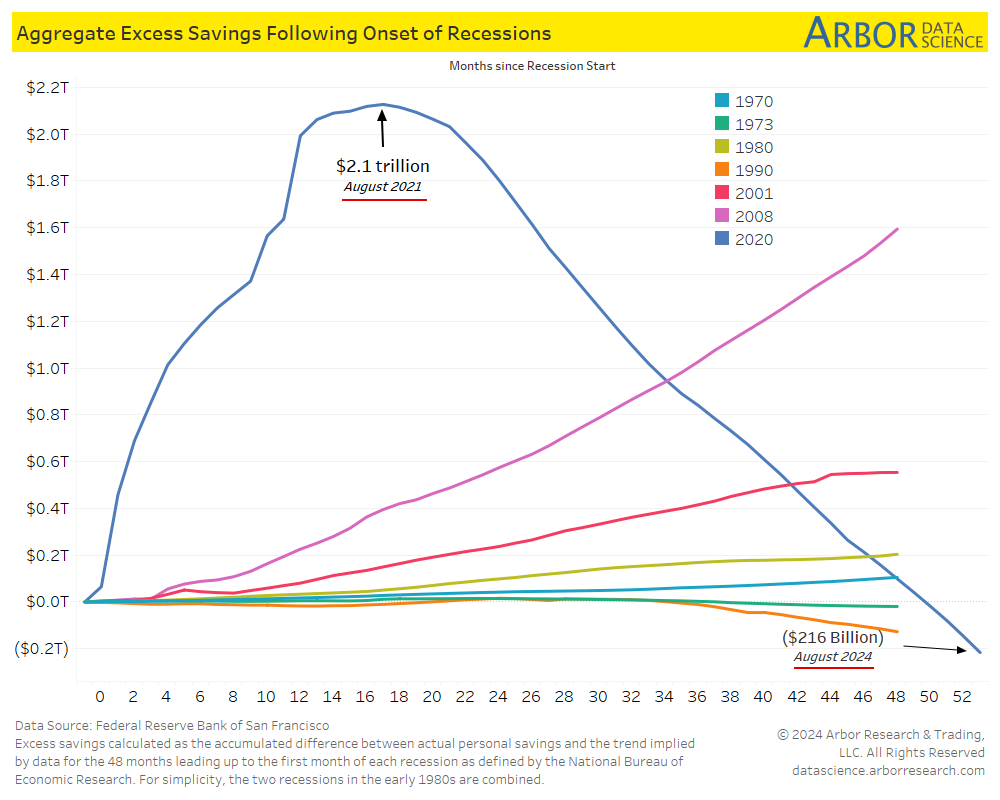

Given the significant importance of consumer spending to America’s economic health, it merits keeping a close eye on the strength of the American consumer, which has already lost one of its primary benefactors: the $2.1 trillion dollars that was distributed to most American consumers during the COVID crisis, as a means of encouraging consumption and lifting the American economy out of its pandemic-driven recession.

Indeed, one of the major reasons why the U.S. rebounded much more strongly from the pandemic shutdown than the world at large is that, while most countries lowered interest rates and increased money supply (monetary stimulus), the U.S. was the only major economy to also distribute massive sums of money directly to its citizens (fiscal stimulus). However, at this point, the stimulus money has been spent and, as of last August, the savings rate had actually retreated to below its pre-pandemic trendline. This is illustrated below.

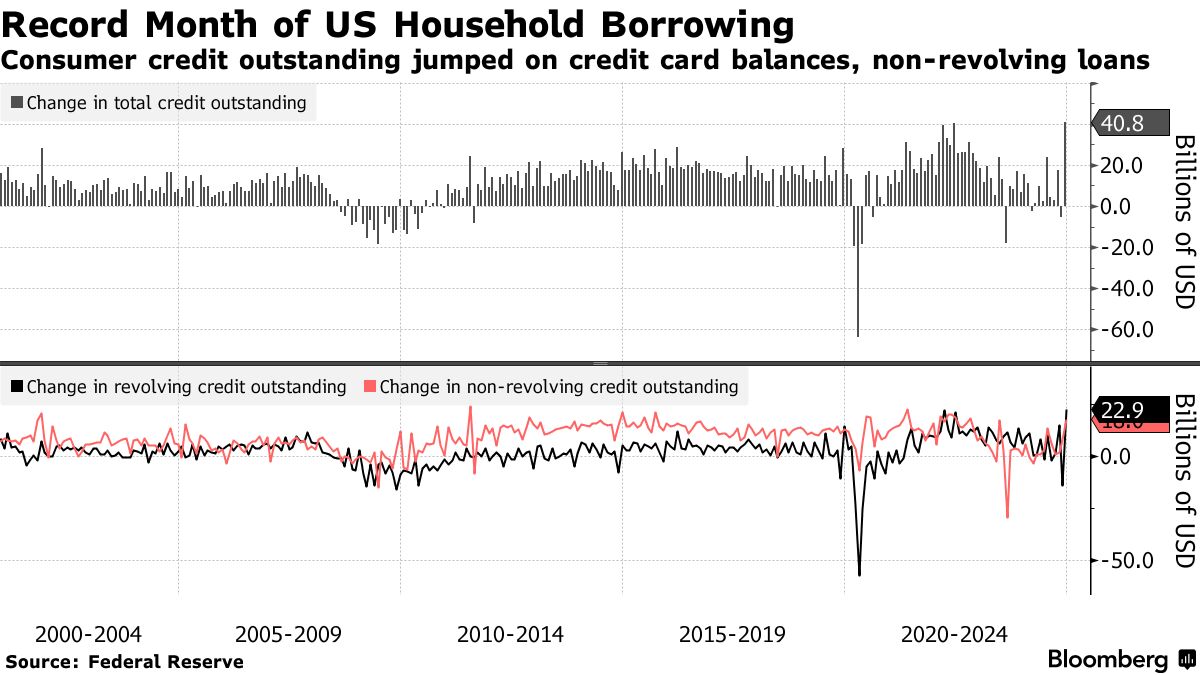

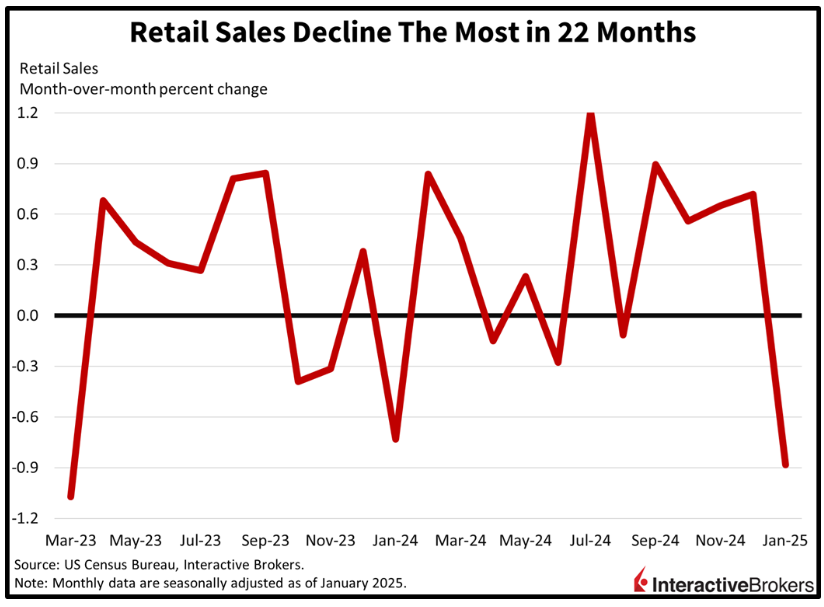

Importantly, job growth remains quite strong, which is critical to maintaining consumer spending, and it is only very recently that we have started to see some signs of consumer distress, including a record monthly increase in consumer indebtedness (below) and the biggest monthly drop in retail sales in almost two years.

Importantly, it is very possible that these numbers could be changed, as seasonal adjustments to economic data tend to be unusually problematic at the beginning of the year and can thus lead to substantial revisions.

We are confident that the Trump administration is aware of the importance to the economy of sustained consumer spending, which helps to explain its emphasis on bringing interest rates and, to a lesser extent, inflation down. Both objectives are likely critical to the maintenance of a healthy consumer and the sustenance of strong consumer spending.

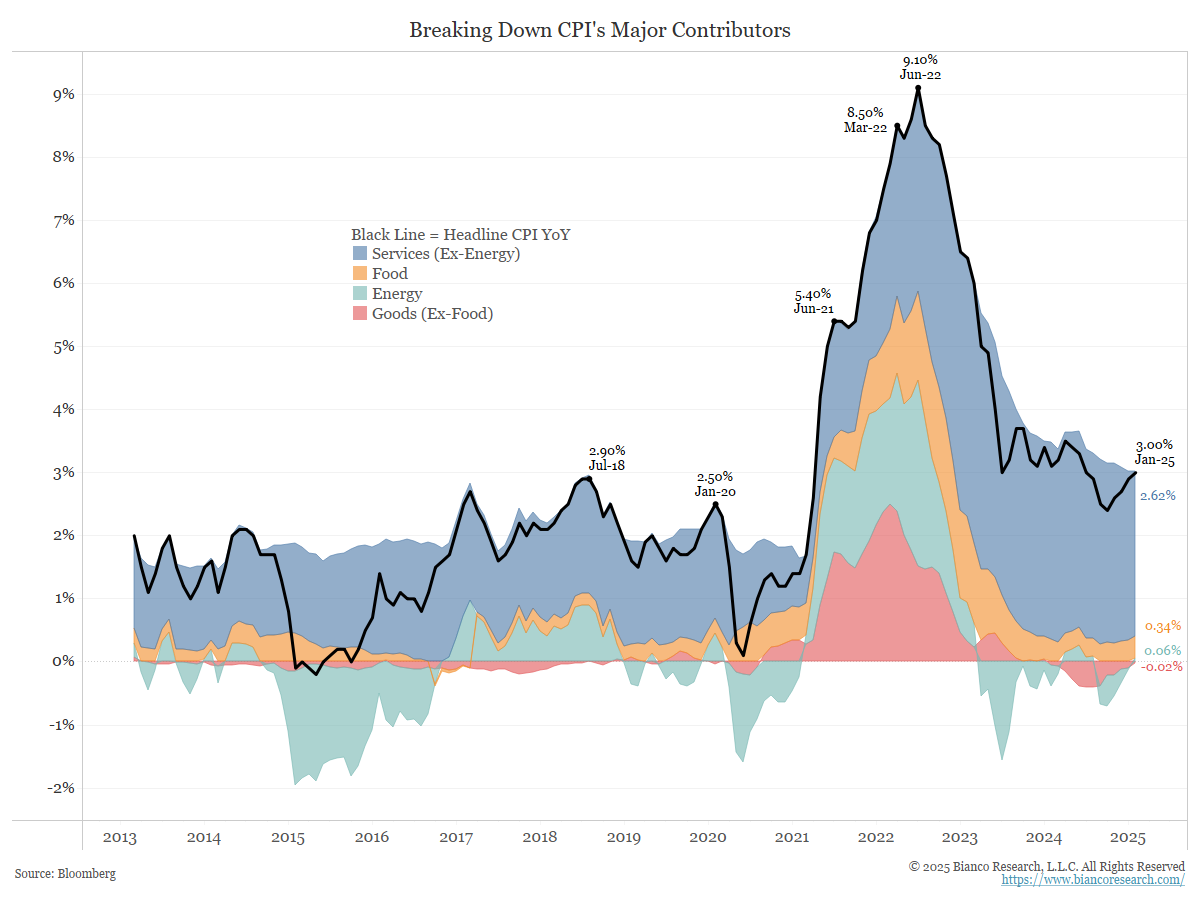

Inflation remains at undesirably high levels and is rebounding from last year’s lows. It seems as if it may have reached a point of equilibrium, with higher wages and a modest rebound in food, energy and goods prices putting upward pressure on inflation, and slowly declining shelter costs putting downward pressure on overall prices.

All other things being equal, we would expect for a modestly slowing economy, moderating shelter costs, and some cooling in consumer spending to slowly move inflation towards the Fed’s 2% target.

That said, if tariffs are relied upon to either generate revenues (whether to finance tax cuts, reduce the deficit, or fund the proposed sovereign wealth fund), or if they are used on a more permanent basis to protect or reshore U.S. industry, then we would expect for this to both exacerbate inflation and potentially prevent the Fed from lowering short term rates. At minimum, we believe that this bears watching.

Even if we are incorrect and tariffs prove to be nothing more than a negotiating tool to extract concessions from our trading partners, there is still a risk to inflation if the new immigration-related policies shrink the workforce substantially. This could significantly impact a variety of industries such as construction, manufacturing and, in particular, farming, where the Department of Agriculture estimates that almost half of all “crop workers” are undocumented immigrants.7

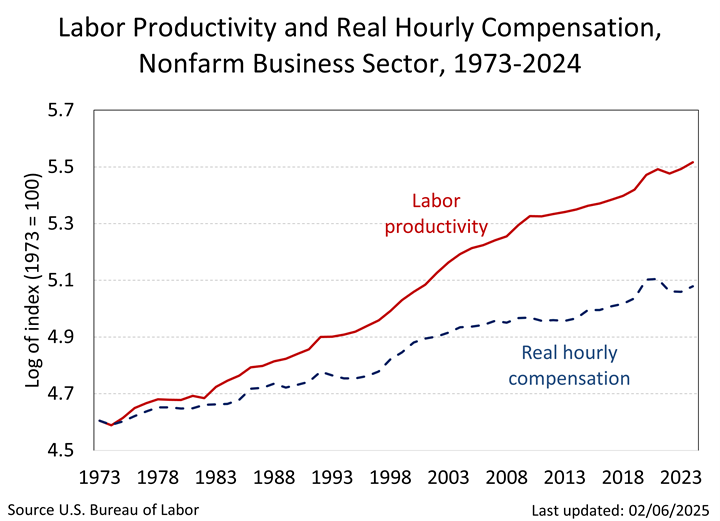

The saving grace for not only inflation and the economy, but potentially even the nation’s massive debt, may be the ongoing surge in worker productivity, which we expect to become an even bigger influence as the use of artificial intelligence becomes more pervasive.

Improvements in productivity should lower inflation, improve corporate profitability, and allow the economy to grow notably faster without exacerbating inflation. This is likely of particular importance, as the most practical means of addressing America’s massive federal debt is for the country to attempt to grow its way out of it.

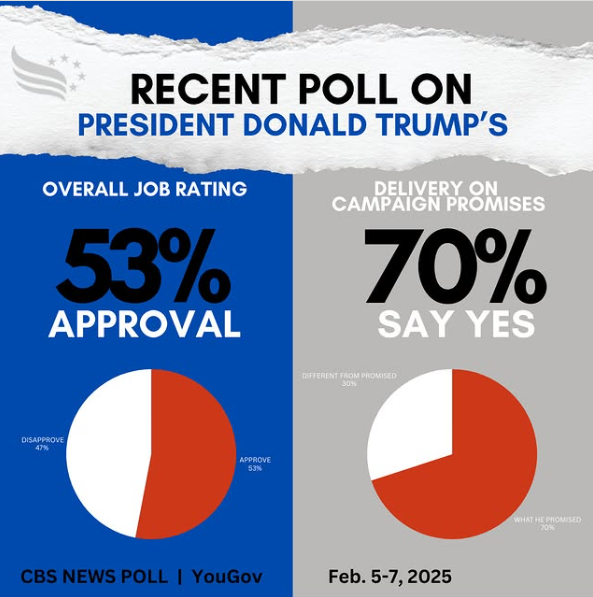

We will conclude with a few comments about what we have observed about the Trump administration through the first four weeks of Trump’s second term. To start with, Trump is getting the highest approval ratings of his political career and is scoring very high marks for following through on his campaign promises. Thus far, his mandate seems intact.

Of note, while President Trump’s management style may seem outwardly chaotic, we are increasingly of the opinion that everything that the Trump administration does is part of a well-orchestrated and comprehensive plan that has been put together over the past four or more years, and which is designed to change the macroeconomic environment in ways that are both far-reaching and enduring.

Indeed, if you make certain assumptions about President Trump’s political perspective, then the “method” behind this perceived “madness” (at least by some) appears not just evident but also arguably well-coordinated and well-planned.

Our first assumption is that, after decades of the American political system making only mild deviations from the status quo, President Trump wants to catalyze seminal changes to the government, global trade, the economy and the political environment.

Our second premise was reinforced during President Trump’s speech at January’s World Economic Forum in Davos, Switzerland, when he made very clear his belief that most of the world has been taking unfair advantage of the United States through trade deficits, unfair tariffs, and the post-World War II role of the United States as the world’s policeman (at the cost of American lives and American taxes). As he noted in that speech, “it was unfair to the United States. But many, many things have been unfair for many years to the United States”.8 From President Trump’s perspective, the “free world” has benefitted unfairly from 80 years of the U.S. providing military protection and safeguarding free trade, and that such inequity will no longer be tolerated under his administration.

Our third premise, and the one that might be the most impactful on portfolio returns, is that the Trump administration seems to view the country as if it is a highly indebted and poorly run company with a bloated workforce, very poor efficiency, a problem with out-of-control spending, and a very inefficient use of its capital assets. Further, President Trump seems to view himself as a Chief Restructuring Officer or turnaround specialist who intends to restructure the company (i.e., country) and return it to profitability.

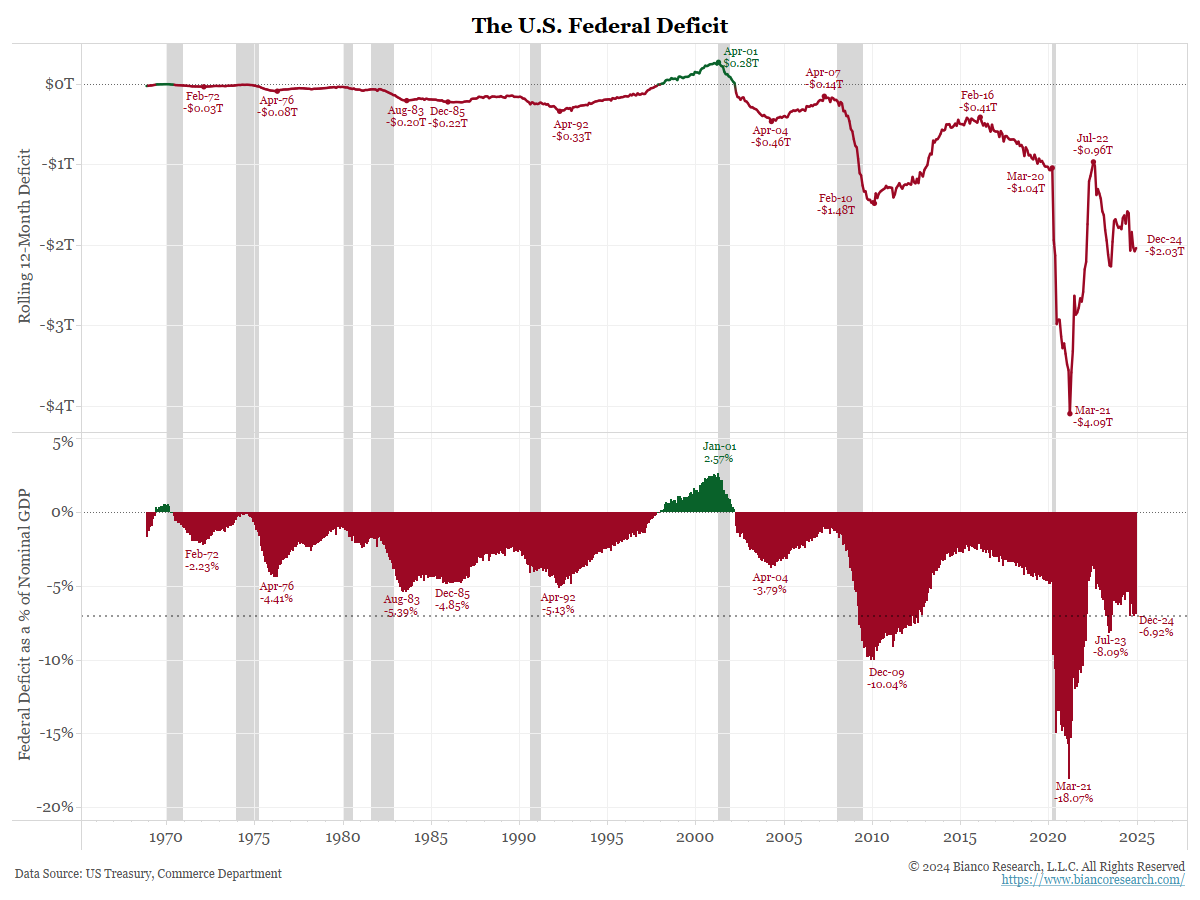

While one can argue whether or not a country should operate like a for-profit company, it is very hard to dismiss the comparison outright. After all, despite the economy growing at a very healthy rate, the country’s budget is so out of control that the U.S. is deficit spending (i.e., stimulating the economy) at a level (as a percent of GDP) previously only seen during World War II and when emerging out of deep recessions (the grey vertical bars above).

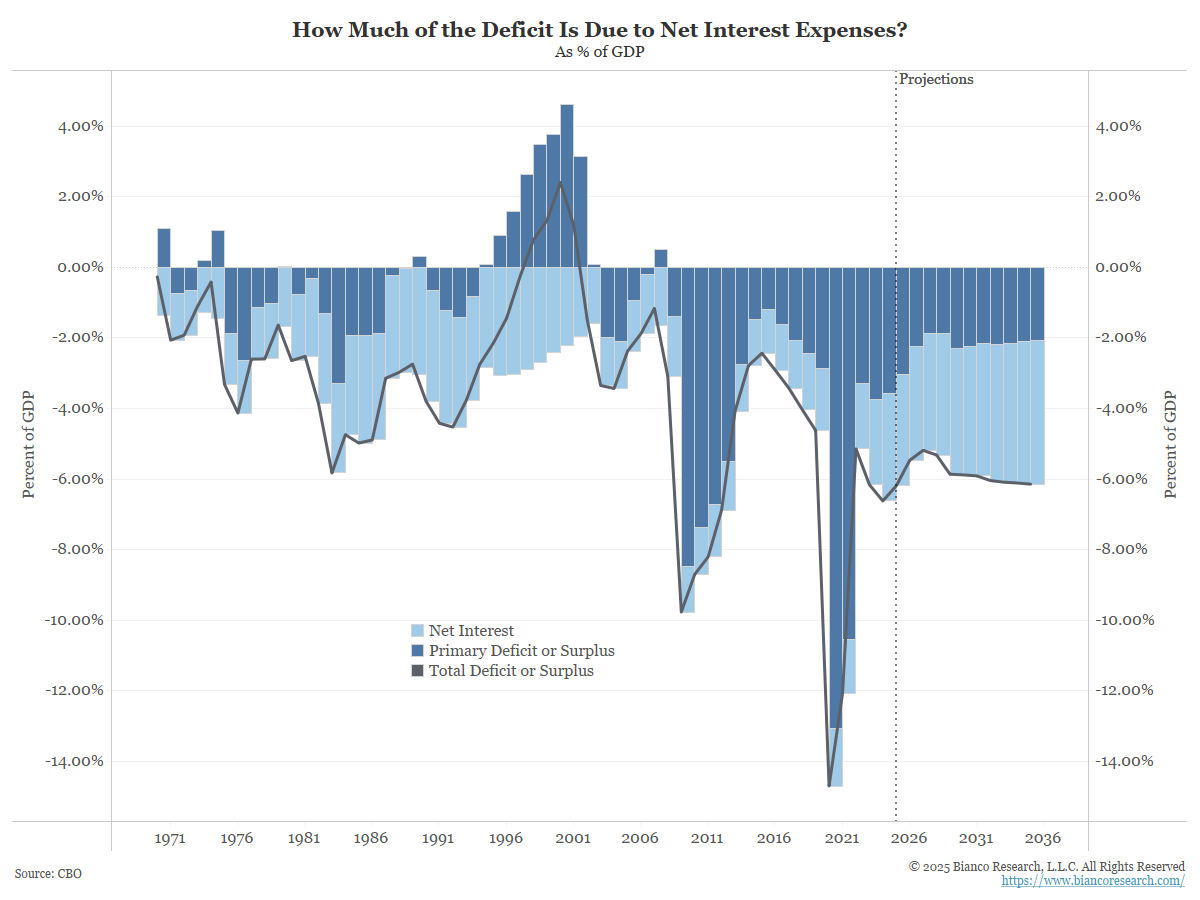

Further, the country’s debt burden is so high that it is estimated that in just a few years, interest payments on the debt (light blue bars above) will represent a larger percentage of the total annual deficit than all other government expenditures combined. Cutting government spending and driving down inflation and interest rates are each critical to addressing this issue (and understandably very high on Trump’s agenda).

Treasury Secretary Scott Bessent recently stated that “the Trump administration is focusing on lowering interest rates though policy reforms, including limiting fiscal spending, increasing government efficiency and boosting energy production”.9

Bessent is specifically promoting what he calls his 3-3-3 plan, which refers to “getting the fiscal deficit down to 3% of gross domestic product from above 6% in recent years, boosting oil production by 3 million barrels a day, and sustaining economic growth at 3%”.10

Regardless of what one thinks about Trump’s politics, that is a set of policy priorities that, if enacted, are likely to be endorsed by both the stock market and the bond market. The wild card remains the potential impact of tariffs and stricter immigration policies on inflation, and that is yet to be determined.

For the time being, investors appear willing to look beyond those risks, and to instead concentrate on President Trump’s more investor-friendly proposals, such as lower corporate taxes, a less onerous regulatory environment and an array of pro-business policies.

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

The information presented is not intended to be making value judgements on the preferred outcome of any government decision or political election.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“As Goes January, So Goes the Rest of the Year: Market Mantra or Myth?”, Merlin Rothfeld, Posted 12/30/2024, https://www.tradingacademy.com/culture/article/as-goes-january-so-goes-the-rest-of-the-year-market-mantra-or-myth

-

“New York Fed Staff Nowcast”, Federal Reserve Bank of New York, As of 2/20/2025, https://www.newyorkfed.org/research/policy/nowcast#/nowcast

-

“America Still Leads the World in All the Ways That Matter”, Hal Brands, Posted 1/3/2025, https://www.bloomberg.com/opinion/articles/2025-01-03/america-still-leads-the-world-in-all-the-ways-that-matter?utm_medium=email&utm_source=ne&sref=YfRIauRL

-

“America Still Leads the World in All the Ways That Matter”, Hal Brands, Posted 1/3/2025, https://www.bloomberg.com/opinion/articles/2025-01-03/america-still-leads-the-world-in-all-the-ways-that-matter?utm_medium=email&utm_source=ne&sref=YfRIauRL

-

“America Still Leads the World in All the Ways That Matter”, Hal Brands, Posted 1/3/2025, https://www.bloomberg.com/opinion/articles/2025-01-03/america-still-leads-the-world-in-all-the-ways-that-matter?utm_medium=email&utm_source=ne&sref=YfRIauRL

-

“America Still Leads the World in All the Ways That Matter”, Hal Brands, Posted 1/3/2025, https://www.bloomberg.com/opinion/articles/2025-01-03/america-still-leads-the-world-in-all-the-ways-that-matter?utm_medium=email&utm_source=ne&sref=YfRIauRL

-

“A Trump-Voting Farmer’s Warning: Mass Deportations Would Be a Disaster”, Michael Smith, Posted 1/17/2025, https://www.bloomberg.com/news/features/2025-01-17/will-trump-remove-illegal-immigrants-farmers-say-deportations-raise-food-prices?sref=YfRIauRL

-

“REMARKS BY PRESIDENTTRUMP AT THE WORLDECONOMIC FORUM”, President Trump, Posted 1/23/2025, https://www.whitehouse.gov/remarks/2025/01/remarks-by-president-trump-at-the-world-economic-forum/

-

“Trump Administration to Focus On 10-Year, Not Fed”, Jose Torres, Posted 2/6/2025, https://www.interactivebrokers.com/campus/traders-insight/trump-administration-to-focus-on-10-year-not-fed/?src=tiPlus020625us&eid=8792083&blst=NL-TI_cps_ftrTtl

-

“Bessent Says Trump Wants Lower 10-Year Yields, Not Fed Cuts”, Viktoria Dendrinou, Posted 2/5/2025, https://www.bloomberg.com/news/articles/2025-02-05/bessent-says-he-trump-focus-on-10-year-yields-not-pushing-fed?sref=YfRIauRL