27

NovemberPer Stirling Capital Outlook – November

The Elephant in the Room

We live in a world that is heavily influenced by macroeconomic factors and, whether it be the growing array of both current and potential future wars, the historically large stimulus programs in China, the shift toward easier monetary policy and lower interest rates in most of the world, or the increasing cooperation and/or alliance between the world’s autocratic governments (Russia, China, Iran, North Korea, etc.), there is probably no recent event anywhere in the world that is as globally impactful as the just-concluded U.S. elections.

The reaction in the domestic equity markets seems to validate the high importance of not only the Trump victory and the so-called “red sweep”, but also of the fact that the results were definitive, non-contested, and almost immediately known. The Dow surged 1,508 points, or 3.6% on the day after the election, which represented the Dow’s largest post-election gain since it rose 4.5% in November 1896. The S&P 500 rallied 2.5%, the Nasdaq Composite jumped 3% higher, and the small-cap Russell 2000 Index gained a stunning 5.8%. The three large-capitalization indexes finished the day with record closing highs. 1

One of the things that made the rally particularly remarkable is that, since WWII, market performance the day after Presidential elections has typically been negative, with a median decline of 0.4% and positive returns just 42% of the time. The post-election gain was the best ever for the S&P 500, surpassing the prior record of 2.2% from 2020, while the Russell 2000’s gain nearly doubled its 3.1% gain after Trump’s last election victory. 2

While the magnitude of the market’s move was by certain measures historic, the direction of the move was hardly a surprise. As we had noted in our October commentary, “there are many reasons why the equity markets generally favor a Trump presidency, including his platform of lower taxes, greater stimulus, and lower regulation, each of which should boost corporate profitability and presumably allow the markets to support higher valuations (at least over the near term).”

This perspective is echoed by famed economist/market strategist Edgar Yardeni, who recently predicted that Trump will not only quickly lower the corporate tax rate from 21% to 15%, but also that, as a result of the tax cuts, potential deregulation, and faster productivity growth, profit margins on the S&P 500 will reach record highs of 13.9% and 14.9% over the next two years. 3

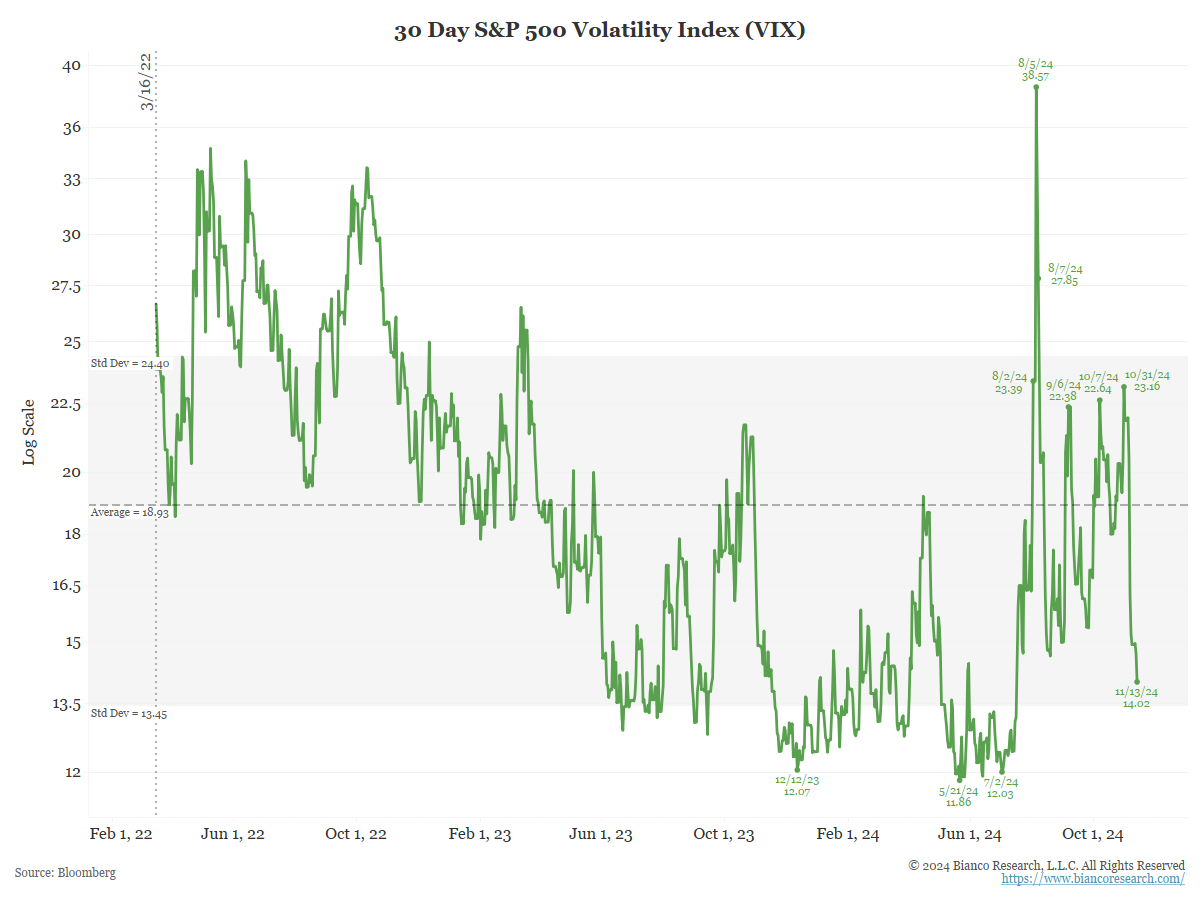

While there is little doubt that much of both the equity market rally and the decline in bond prices are attributable to the implications of the change in leadership, we believe that the quickly resolved and uncontested nature of the election also played a critically important role. You can actually see the impact of this uncomplicated resolution in the above chart of the VIX (a.k.a. the “fear index”), which measures the level of investor fear (as represented by expected market volatility over the next 30 days). It had rallied to very elevated levels in the weeks leading up to the election in anticipation of a disruptive outcome and collapsed once the election was quickly and definitively resolved.

Equity markets traditionally abhor uncertainty, and such a clear and uncontested result took the many “worst-case-scenarios” (a contested election, a constitutional crisis, potential violence in the streets, accusations of election fraud, etc.) off the table. In our opinion, at least a substantial part of both the rally in “risk-on” assets like stocks and Bitcoin and the sell-off in “safe harbor” assets like Treasury bonds were knee-jerk reactions to the fact that the election was definitive, uncontested, and almost immediately resolved. (Of note, that tall spike on August 5th was in response to an unexpected interest rate hike by the Bank of Japan that forced the unwinding of so-called “carry trades”.)

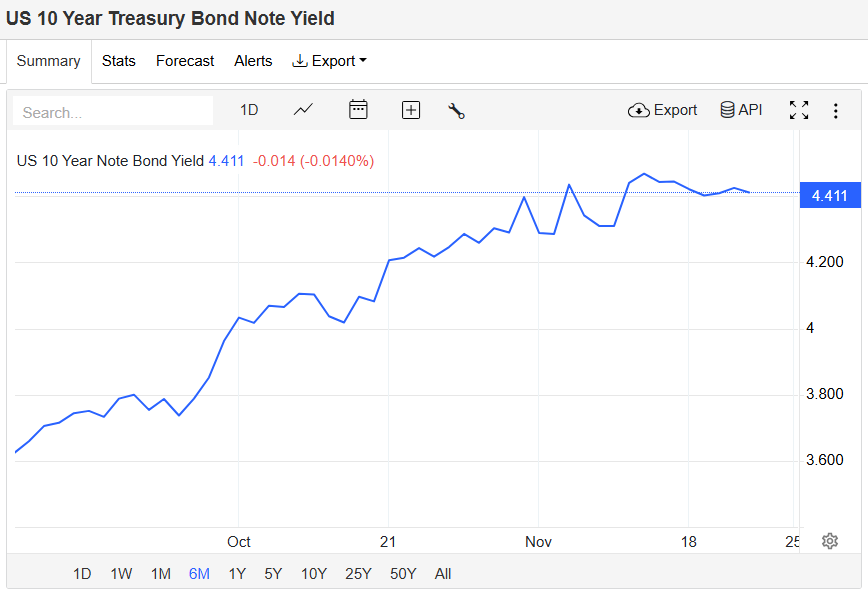

While equity markets celebrated the election results, there has also been a significant decline in bond prices (an increase in 10-year Treasury yields from 3.6% to 4.4%) 4 ever since the election betting markets shifted heavily in Trump’s favor. This is due primarily to the fact that many of Trump’s campaign promises (if implemented) are expected to exacerbate both inflation and the federal deficit, while accelerating economic growth, each of which is expected to drive interest rates higher and thus be a bearish influence on bond prices.

From our perspective, both the magnitude of the election’s impact on the markets and economy, and whether it will be a bullish or bearish influence, will depend largely on whether we get the policies of Trump the political campaigner or Trump the political pragmatist. We believe that the impact of the former could be very bearish, while the latter would have the potential to be very bullish. Unfortunately, the only person who presumably knows that answer to that question is Donald Trump himself and, at least thus far, a review of both his cabinet nominations and his recent comments provides a very mixed message.

As recently noted by Ian Shepherdson, chief economist at Pantheon Macro, “The potential policy changes are quite gigantic—or it could be a huge bluff.” 5 We would argue that this is particularly true given that Trump considers himself to be an expert negotiator, and that he likes to employ a brinksmanship strategy that requires that he often start negotiations from a very extreme, controversial and/or unacceptable position.

However, one recent cabinet nomination, that of Scott Bessent for the all-important role of Treasury Secretary, gives us some hope that, at least from an economic perspective, Trump the pragmatic politician may be winning that tug-of-war According to a November 22nd article in Barron’s, in choosing Bessent, “Trump is giving many investors what they want: a seasoned markets professional who isn’t afraid to speak his mind. There are already signs that Bessent has succeeded in nudging Trump into more market-friendly positions than he expressed on the campaign trail. That may calm nerves on Wall Street as Trump moves ahead with some of the riskier economic policies he pledged as a candidate, such as tariffs and potentially deficit-inducing tax cuts.” 6

A similar perspective had been reported in The New York Times, specifically that “Trump is especially concerned about the effect of his Treasury pick on the stock market and does not want to interrupt the market’s momentum since his victory. That calculus has ruled out his former trade adviser Robert Lighthizer, whose hardline embrace of tariffs would likely jar the markets. If that reporting is accurate, we are beginning to see a restraint on the Trump Administration’s tariff policies via financial markets.” 7

In the aforementioned article, Barron’s credited Bessent for his ability to translate “what seem like radical economic policies into the language of traditional, deficit-hawk, light-economic-touch Republicanism.” 8

On the downside, Bessent previously advocated setting up a “shadow Fed” run by the presumptive Fed Chairman-in-waiting, as a means of diminishing the importance and influence of the current Chairman and giving Trump an important voice in monetary policy long before the term of current Fed Chairman Powell expires. However, according to the Wall Street Journal, Bessent “no longer thought it was worth pursuing.” 9

Bessent has also made some very market calming comments about how his conversations with Trump have lessened the risk of a clash between the Fed and the White House. As he put it, “I think he [Trump] isn’t going to be happy, but he’s resigned to having Powell.” 10

Also encouraging, particularly in light of Trump’s campaign promises that are estimated to balloon the deficit to 150% of the size of the economy (see last month’s Outlook), Bessent recently stated that “he is aware of these risks, and believes the deficit needs to come down from today’s 7%. He wants the president to aim for a deficit ‘with a three in front of it’ by 2028, which he thinks can be achieved by freezing spending and cutting regulation.” 11

On tariffs, Bessent has said Trump’s hardline plans may be softened during trade negotiations, and he doesn’t believe all countries will ultimately be subject to the 10%-20% universal tariff Trump has described on the campaign trail. 12

Trump has described tariffs as the “most beautiful word in the dictionary,” so Bessent’s ability to moderate the aggressive tariff strategy that Trump campaigned upon may prove all-important.

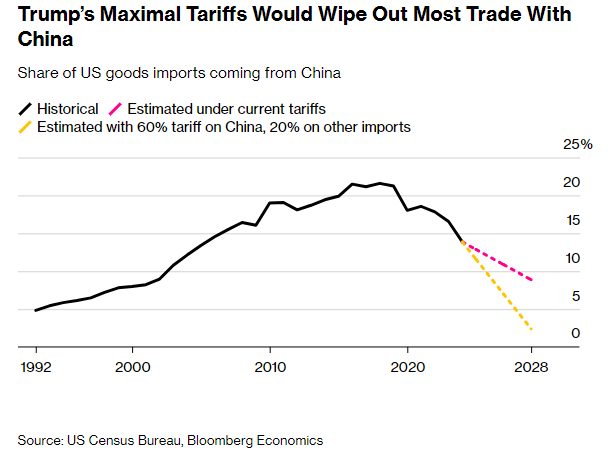

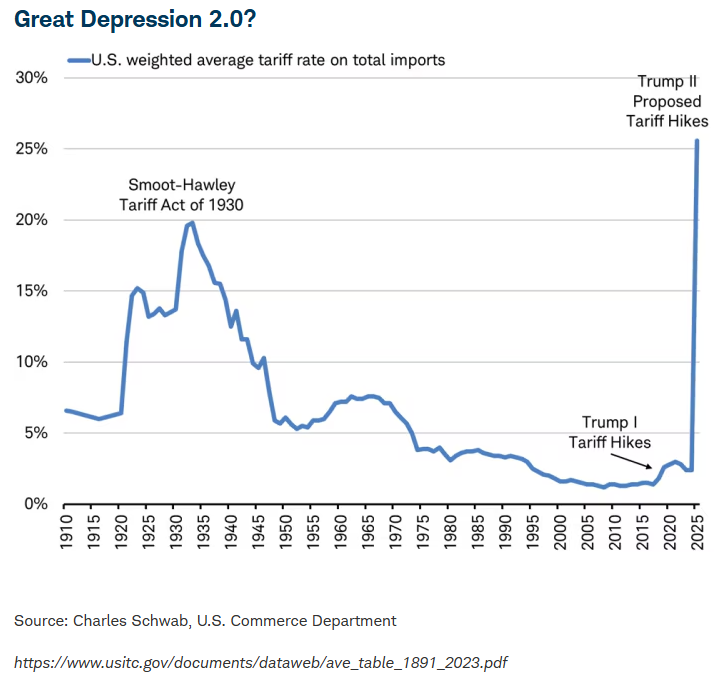

According to a recent report by Charles Schwab, “President-elect Trump has threatened 60% tariffs on all Chinese imports, 10-20% tariffs on imports from all countries excluding China, as well as +100% tariffs on cars assembled in Mexico, 200% on John Deere tractors assembled in Mexico and 100% on imports from countries that “leave the dollar.” Assuming no change in imports, the combination of the proposed 60% China tariff and 20% across-the-board tariff would lead to an overall U.S. weighted average tariff rate of nearly 26%. This is the highest level in over 100 years and even above the rate of the 1930s Smoot-Hawley Tariff Act enacted around the start of the Great Depression”. 13

That said, according to David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, “roughly 38% of goods are imported from countries with whom the United States has a free-trade agreement, most notably Canada and Mexico, which bar this kind of unilateral tariff increase. If we exclude these countries, the average tariff rate on imported goods would rise from roughly 3.0% today to 11.8%, or an increase of 8.8%. However, we assume that because of negotiations with some trade partners, business pressures to exempt some commodities, and foreign suppliers and importers eating some of the cost, the average price of imported goods would only rise by half as much, or 4.4%, starting in the second quarter of 2025. With U.S. goods imports equal to 17% of consumer spending, this could, as a very rough estimate, add 0.7% to CPI inflation next year”. 14

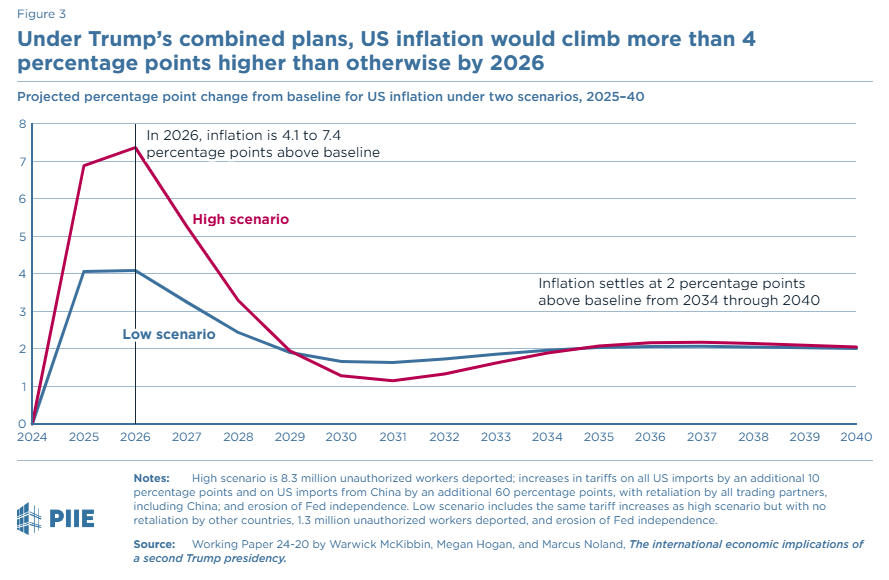

However, not everyone is so optimistic. A recent research piece from the non-partisan Peterson Institute for International Economics 15, estimates that a full implementation of all of Trump’s campaign promises could cause inflation to soar to 6% or above.

Turning to another of Trump’s potentially inflationary proposals, he has promised “the largest deportation in the history of our country.” According to Bloomberg Economics, such an undertaking would cost more than $300 billion and shrink the U.S. economy by 3% by 2028. Of note, Bloomberg disagrees with our assumption that mass deportations will be inflationary, and instead believes that the depressing effect that mass deportations would have on U.S. economic growth would more than offset the inflationary impact of tighter labor markets. 16

Trump’s campaign promises of mass deportation represent another area where J.P Morgan’s David Kelly thinks that the fears are overblown. As he noted, “while campaign rhetoric was extreme, we expect actions to be less so. The newly named “border czar”, Tom Homan, has emphasized that he will prioritize deporting undocumented immigrants with criminal convictions and final deportation orders. This group likely has much lower labor-force participation than other immigrant groups. Consequently, we do not expect a sharp decline in labor force from deportations… for now, we are assuming that a crackdown on immigration cuts labor force growth by 25,000 per month or 300,000 per year – or roughly a quarter of net immigration in the year ended June 2023”. 17

David Kelly also offers some valuable insight into one of Trumps most popular proposals– tax cuts. Specifically, Kelly is expecting a full extension of the 2017 Tax Cuts and Jobs Act tax reductions that were set to expire at the end of 2025. He notes that the President elect has also promised a cut in the capital gains tax from 21% to 15% for domestic production, a restoration of full expensing of R&D and equipment purchases, also for domestic production, removal of the cap on SALT deductions, deductibility of auto loan interest and exemptions from income tax for all social security, tips and overtime income. We doubt that all of these will pass Congress.

Kelly points out that “based on calculations from the Committee for a Responsible Federal Budget, a full implementation of these plans would add more than $5.0 trillion to the federal debt over 10 years, on top of a simple extension of tax policy as it is currently being implemented. This could amount to over $400 billion in additional annual fiscal stimulus and deficit financing, kicking in at the start of 2026.” 18 In total, The Committee for a Responsible Budget estimates that Trump’s plans would increase the debt by $7.75 trillion more than what’s currently projected through fiscal year 2035. 19

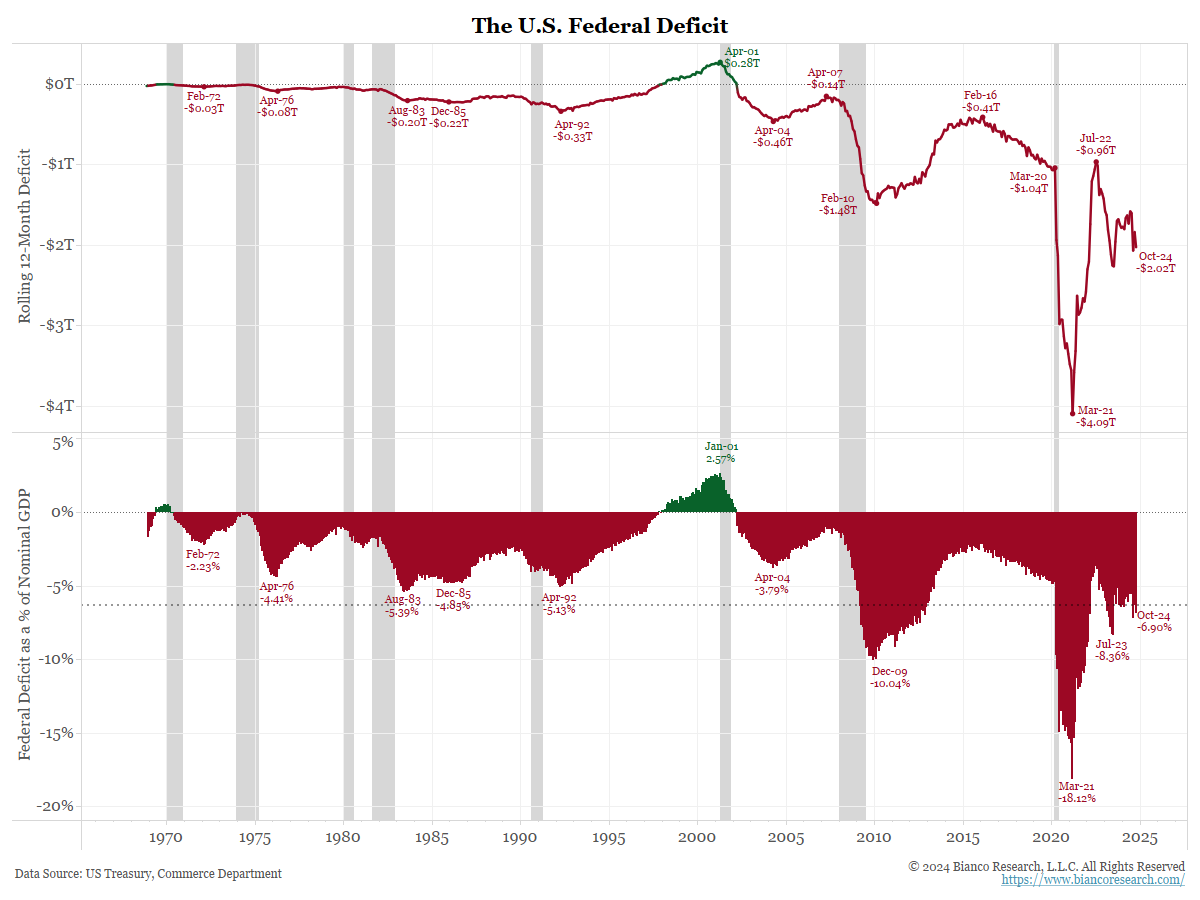

While all of this deficit spending is quite stimulative, it should further exacerbate an already exploding deficit. When asked for his thoughts on the subject, Federal Reserve Chair Jerome Powell replied that, “the level of our debt relative to the economy is not unsustainable. The path is unsustainable. And we see that. And, you know, you’ve got a very large deficit at — you’re at full employment and that’s expected to continue. … It’s ultimately a threat to the economy.” 20

Chairman Powell’s point is well taken, as the U.S. is currently running deficits as a percent of the size of the economy (bottom half of the above chart) that are almost never employed except when the government is trying to stimulate the economy out of a deep recession, and that is despite today’s tight labor markets, high levels of capacity utilization and above-average economic growth of between 2% and 3%.

This is where the proposed Department of Government Efficiencies (DOGE) is supposed to play its part. Elon Musk and Vivek Ramaswamy, who have been selected to lead DOGE, are targeting $2 trillion in annual federal spending cuts, which will be quite a challenge when you consider that, of $6.1 trillion in annual federal outlays, only $1.7 trillion is discretionary spending, and that non-discretionary spending, especially interest paid on the national debt, is currently soaring. 21

Further, deficit spending issues are not likely to be solved by the proposed massive reductions in the federal workforce when you consider that total government wages and salaries are only a little over $800 billion annually and that, according to Barron’s, the only way to have a substantial impact on federal spending would be for Trump to “impound” congressionally appropriated funds.

“Essentially, Trump would choose not to spend money that Congress had said should be spent. After a similar attempt by then-President Richard Nixon, Congress passed a law specifically to thwart most future attempts at impoundment.” 22 Granting Trump this power would require either that Congress agrees to give up control of the budget or that Trump gets the Supreme Court to declare the current impoundment prohibition unconstitutional.

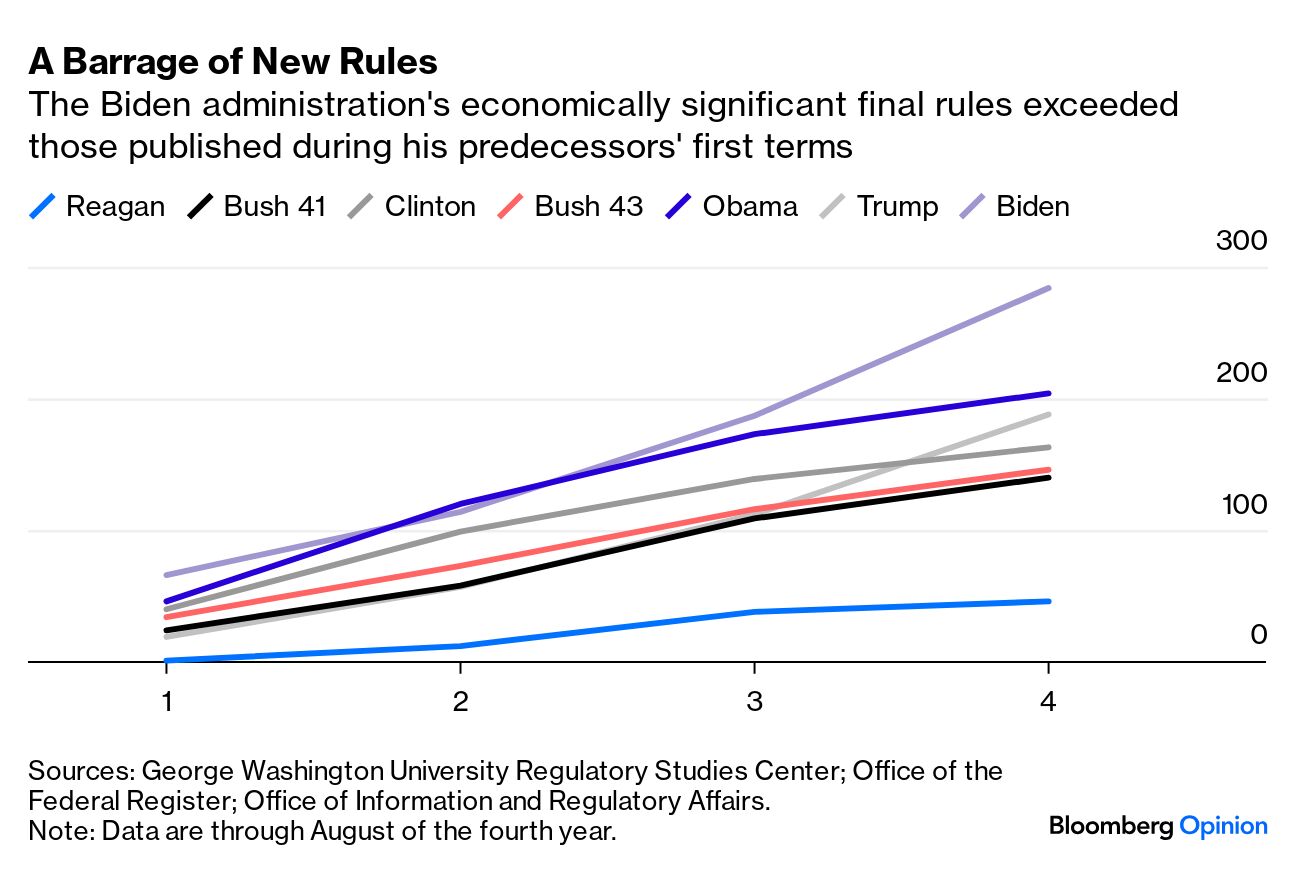

Trump’s more bullish proposals from the perspective of the equity markets is his promise to pursue the “most aggressive regulatory reduction” in the country’s history and to eliminate at least 10 rules for every new one created. 23

American corporations are likely to celebrate such a change after four years of the Biden administration imposing a historically very heavy-handed regulatory structure. Such a change should improve efficiency and enhance corporate profitability.

Since the resolution of the elections, we have heard an array of market commentators looking back at Trump’s first term in office and extrapolating that past history into the future. While past performance is never a perfect guide to the future, such extrapolation may be a particularly dangerous exercise this time, and the economic and capital markets environment is very different today than it was seven or eight years ago.

To quote Barron’s, during Trump’s first term, “inflation was lower, with the core consumer price index near 2%. The federal deficit as a percentage of gross domestic product, now at 6.3%, was less than half that. And the S&P 500 traded at an undemanding 16.5 times earnings before the election in 2016, versus nearly 22 times now”. 24

Bloomberg pointed out a number of other important differences, such as the fact that, when Trump first took office in 2017, “the S&P 500 was coming off a 9.5% gain in 2016 and a slight dip in 2015. This time, the index has been on a two-year tear, leaping 53% since the end of 2022…Interest rates were also much lower in 2017, with the fed funds rate between 0.5% to 0.75% compared with a range 4.5% to 4.75% today. 25

In addition, Trump is returning to the White House at a time when the European economy is very week, China is turning to massive stimulus in an attempt to offset their real estate and banking crises, and Japan is raising interest rates for the first time in decades as it attempts to address increasingly problematic inflation. It is a very different world today, and the proposed tariffs are MUCH larger than those of Trump’s first term.

So, if history is likely to be an even worse guide to the future than it has been in the past, and much of the future outlook is dependent on whether Trump decides to adhere closely to his campaign promises or opts to pursue a more pragmatic course, how are we adjusting client portfolios?

In many ways, we are following the same approach that is being employed by the Federal Reserve. As per Chairman Powell, “We don’t know what the timing and substance of any policy changes will be. We therefore don’t know what the effects on the economy would be—specifically whether and to what extent those policies would matter for the achievement of our goals…We don’t guess, we don’t speculate, and we don’t assume”. 26

For the most part, we are adopting a similar “wait and see” approach before making any substantial changes. That said, we are making a few assumptions, starting with our expectation that Trump’s second term is likely to ramp up market volatility and uncertainty. In response, as in the case of a hurricane, the safest place to be is in the eye of the storm, and we expect for the U.S. to be the epicenter of what could be a very disruptive financial and economic tempest.

As such, while foreign equity valuations are generally much lower, we view the potential economic risks as substantially higher, and we are very inclined to maintain higher than normal weightings to the domestic equity markets. In addition, we take some comfort from the fact that, in the past, Trump has used the stock market as a sort of “report card” on his administration. If that remains the case, he may not want to upset the equity markets, which may help to limit the implementation of certain of his more controversial initiatives.

Finally, we expect for continued improvement in equity market breadth to be a bullish influence, while geopolitical risks may prolong the rally by keeping a “wall of worry” in place. By the second half of next year, we expect for the excitement of tax cuts, deregulation and greater fiscal stimulus to wane somewhat, and for concerns about market valuations, higher inflation, less dovish Fed policy, and potential trade wars to slow the pace of the market’s advance. In the meantime, we think that the outlook for domestic stocks looks quite bullish, while the outlook for higher quality domestic debt, in particular, looks very challenged.

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

The information presented is not intended to be making value judgements on the preferred outcome of any government decision or political election.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“The Dow Surges 1,500 Points in Biggest Post-Election Gain in 128Years”, Connor Smith, Posted 11/06/2024, https://www.barrons.com/livecoverage/stock-market-election-trump-harris-today-110624/card/the-dow-surges-1-500-points-in-biggest-post-election-gain-in-128-years-vCfitsqoB9E4gqhokyxT

-

“Bespoke’s Morning Lineup”, Bespoke Investments, Posted 11/7/2024, https://www.bespokepremium.com/category/morning-lineup/

-

“Yardeni Sees S&P 500 at 10,000.‘Animal Spirits Are Back’ After TrumpWin.”, Karishma Vanjani, Posted 11/11/2024, https://www.barrons.com/articles/yardeni-sp-500-10000-stocks-1b962ec2

-

“US 10 Year Treasury Bond Note Yield”, Trading Economics, As of 11/25/2024, https://tradingeconomics.com/united-states/government-bond-yield

-

“Trump’s Trade War Will BeDiff erent This Time. HowChina Will Respond.”, Reshma Kapadia, Posted 11/15/2024, https://www.barrons.com/articles/trump-trade-war-china-tariffs-2ba9d7e3?mod=bol-social-tw

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“The Closer”, Bespoke Investment Group, Posted 11/19/2024, https://www.bespokepremium.com/category/the-closer/

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“Trump Taps Wall Street Vet ScottBessent to Run the TreasuryDepartment”, Matt Peterson, Posted 11/22/2024, https://www.barrons.com/articles/trump-scott-bessent-treasury-secretary-4d5525f1

-

“Five InvestingImpacts of a TradeWar”, Jeffrey Kleintop, Posted 11/18/2024, https://www.schwab.com/learn/story/five-investing-impacts-trade-war

-

“Policy Changes and the Macro Outlook” JPMorgan, Posted 11/2024, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/notes-on-the-week-ahead/policy-changes-and-the-macro-outlook

-

“How much would Trump’s plans for deportations, tariffs, and the Fed damage the US economy?”, Warwick J. McKibbin, Megan Hogan, Marcus Noland, Posted 9/26/2024, https://www.piie.com/blogs/realtime-economics/2024/how-much-would-trumps-plans-deportations-tariffs-and-fed-damage-us

-

“Your Guide to Trump’s Day-One Agenda— From Taxes to Tariffs”, Mike Dorning, Eric Martin, Tom Orlik, Posted 11/8/2024, https://www.bloomberg.com/features/2024-trump-day-one-agenda/

-

“Policy Changes and the Macro Outlook” JPMorgan, Posted 11/2024, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/notes-on-the-week-ahead/policy-changes-and-the-macro-outlook

-

“Policy Changes and the Macro Outlook” JPMorgan, Posted 11/2024, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/notes-on-the-week-ahead/policy-changes-and-the-macro-outlook

-

“Bond Market on Risky Path as Traders Regroup FromWild Week”, Liz Capo McCormick, Michael Mackenzie, Posted 11/10/2024, https://www.bloomberg.com/news/articles/2024-11-10/bond-market-on-risky-path-as-traders-regroup-from-turbulent-week

-

“Hold Up. Fed Chair Powell Just Issued a Dour Warning on the Economy. Is the Bull Market in Trouble?”, Jeremy Bowman, Posted 11/12/2024, https://www.msn.com/en-us/money/markets/hold-up-fed-chair-powell-just-issued-a-dour-warning-on-the-economy-is-the-bull-market-in-trouble/ar-AA1tVYoI

-

“DOGE Team’s $2 Trillion of PlannedSpending Cuts Is Too Tall an Order” Randall W. Forsyth, Posted 11/15/2024, https://www.barrons.com/articles/doge-musk-spending-cuts-tall-order-c76499a0

-

“Why Elon Musk’s DOGE Eff ort to Cutthe Federal Budget Under TrumpRelies On the Supreme Court”, Joe Light, Posted 11/21/2024, https://www.barrons.com/articles/elon-musk-trump-doge-budget-supreme-court-f57d1b80

-

“Trump vows anti-reg blitz”, Robin Bravender, Posted 11/4/2024, https://www.eenews.net/articles/trump-vows-anti-reg-blitz/

-

“Review 7 Review”, Alex Eule, Posted 11/8/2024, https://www.barrons.com/

-

“Trump’s Scoreboard Is the S&P 500, and It’s WallStreet’s Best Hope”, Carmen Reinicke, Esha Dey, Posted 11/17/2024, https://www.bloomberg.com/news/articles/2024-11-17/trump-s-scoreboard-is-s-p-500-and-it-s-wall-street-s-best-hope

-

“Election Results Will Have No Effect on Fed’s Policy Decisions”, Megan Leonhardt, Posted 11/7/2024, https://www.barrons.com/livecoverage/fed-november-meeting-interest-rate-decision-today/card/election-results-will-have-no-effect-on-fed-s-policy-decisions-0aDb2mJBwo9AjShoiGyY