27

SeptemberPer Stirling Capital Outlook – September

One of our Directors recently had the distinction of serving on a panel at the 2024 Titan Investors Active Exchange, where the panel addressed macroeconomic “Mega Trends”, such as AI (artificial intelligence), the transition and build-out of the energy grid to accommodate the anticipated surge in demand, and the “reshoring” of the global supply chain. The presentation produced a lively and interesting exchange of ideas and opinions and appeared to generate significant interest among the attendees.

Given the traditional importance of the “innovation economy”, we thought that we would use the first part of this Outlook to present some of the research that we shared with the Titan Investor audience, before shifting to a discussion of last week’s rate cut by the Federal Reserve, and why the Fed opted for a larger than normal rate cut, despite economic growth remaining robust and financial liquidity already being quite high. We will also touch on the potential implications of the rate cut on the markets.

Whether it be the advent of electricity, the introduction of railroads, the development of the automobile, television, personal computers, semiconductors, or the creation of the internet (as examples only), components of the so-called innovation economy have long produced some of the most profitable long-term investment themes, particularly in the U.S.

That has probably never been truer than it is today. Indeed, according to Bloomberg, “the US dominates the industries of the future to an extraordinary degree. Sixty-one percent of global funding for AI start-ups goes to US companies, compared with 17% to Chinese companies and 6% to European companies. The US attracts 50% of global private funding for quantum computing compared with just 5% for Europe. Three giant US companies account for 65% of the global market for cloud computing.”1

The Global Supply Chain and “Reshoring”

Whereas globalization and a growing interdependency of the world’s various economies was a dominant macroeconomic theme from the early 1970s until around 2008, when an array of challenges, including trade wars, tariffs, the COVID pandemic, Russia’s invasion of Ukraine, attacks on Red Sea shipping by the Houthis, and a drought in Panama (which hampered the operations of the Panama Canal), combined to illustrate both the dangers of such an interdependent global economy and the potential benefits of self-reliance.

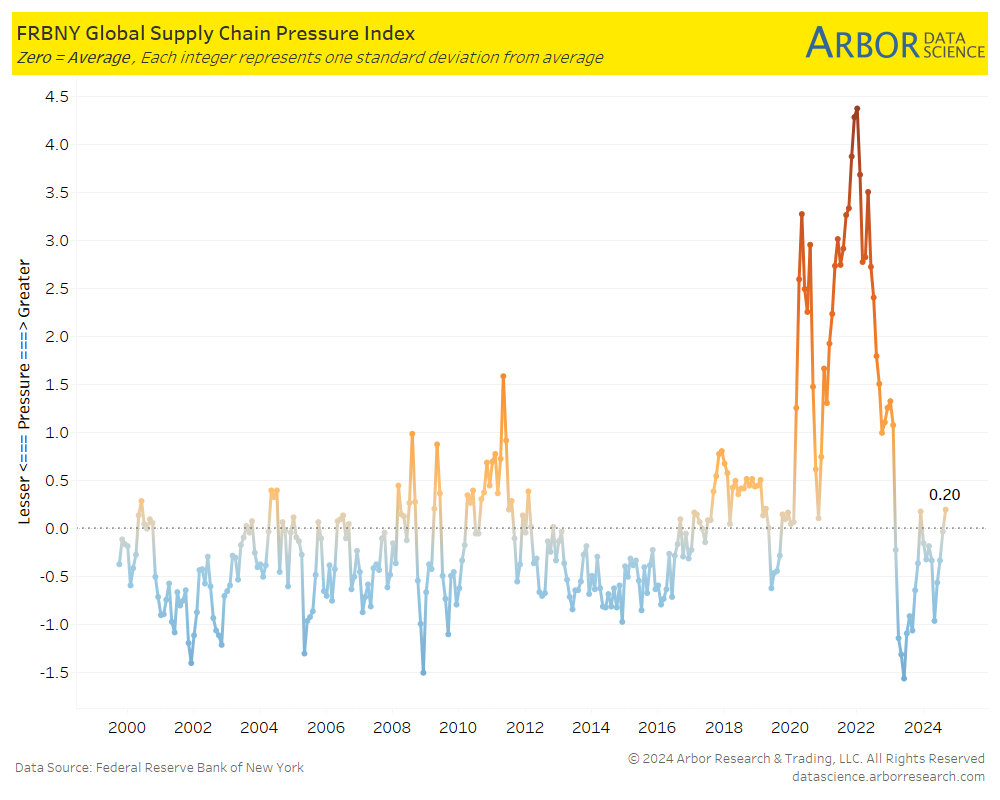

As is illustrated above, pandemic-related issues, in particular, spiked supply chain costs and greatly exacerbated overall inflation throughout most of the world. This has catalyzed the emergence of an anticipated mega trend called “reshoring”, which is basically the movement of the sourcing and production for critical industries to countries that are geographically closer, more politically stable and better politically aligned, and away from countries like China and Russia. Of note, the U.S. is still heavily reliant on both of those countries for a variety of critical materials and industrial components.

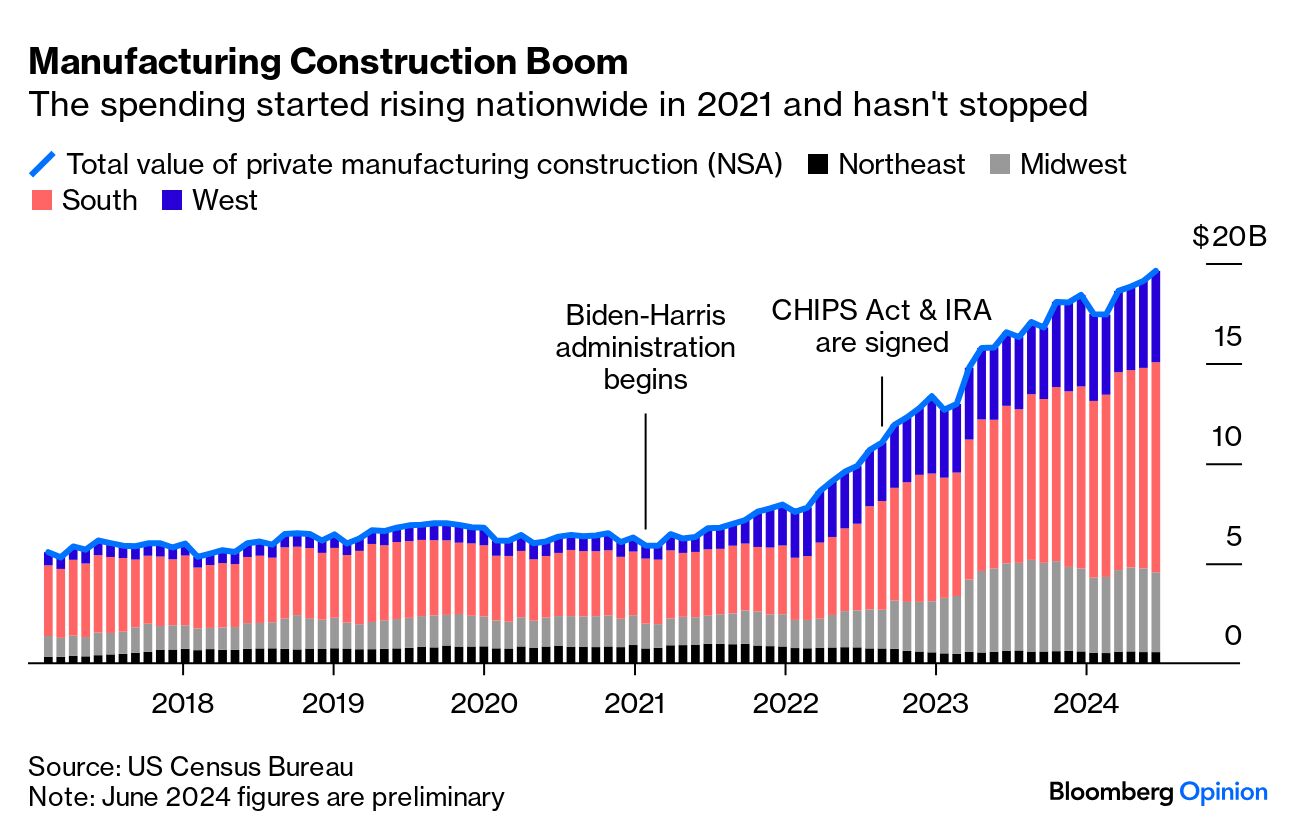

In the years since the pandemic, the U.S. government has actively supported “reshoring” efforts. This includes $1.1 trillion in government funds made available through the Infrastructure Law, the Inflation Reduction Act, the CHIPS Act and the American Rescue Plan, each of which support reshoring initiatives. Interestingly, according to research by Politico and Raymond James, less than 20% of this funding has been spent as of two months ago.2

Even so, it seems to be having an impact. According to the census bureau, since the start of the Biden administration, the total value of private manufacturing construction has increased from around $7 or $8 billion (where it stood for the previous four years) to around $20 billion today.3

There are other important motivations behind this trend. Just since the beginning of 2020, reshoring has brought back more than 1.1 million jobs to the U.S. and The Economic Policy Institute estimates that every manufacturing job that returns to the U.S. generates seven new jobs in supporting industries.4

There are also important intellectual property-related benefits of near-shoring/friend-shoring and that’s not even to mention the national security and trade-balance benefits of reshoring.

We expect the primary domestic beneficiaries of this trend (and some of the better investment opportunities) to be in the manufacturing, infrastructure, semiconductor, and pharmaceutical sectors. Foreign beneficiaries could include Mexico, Canada, and Europe.

On the downside, the transition should be somewhat inflationary due to there being less competition, higher employment costs and tighter labor markets.

Artificial Intelligence (AI):

We believe that AI can be as impactful as the internet, and that could be a significant understatement.

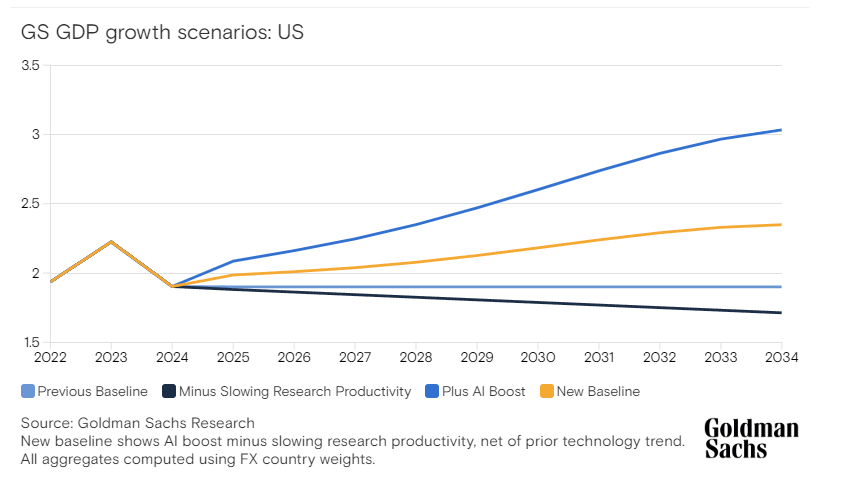

According to Goldman Sachs, “generative artificial intelligence has the potential to automate many work tasks and eventually boost global economic growth”. They believe that AI will start having a measurable impact on US GDP in 2027 and then begin affecting growth in other economies worldwide in the years that follow.5

In terms of investment opportunities, we believe that much of the good news is already priced into many of the AI infrastructure plays, which doesn’t mean that they can’t still be a good investment. We just doubt that they will be as dominant as they have been in the past, particularly if the economy avoids a recession. Further, we worry that some companies that are minimally attached to AI infrastructure are unjustifiably being given premium valuations. That is not to suggest that the opportunity to profit from artificial intelligence has passed.

To the contrary, we think that the majority of companies that will ultimately benefit from AI have yet to be rewarded by the markets. They should benefit from increases in productivity and ultimately increases in profitability. We believe that these downstream beneficiaries could be the next big story, and that the impact of AI could be far-reaching on both the “average stock” and the economy as a whole.

According to Goldman Sachs, “AI could ultimately automate around 25% of labor tasks in advanced economies and 10-20% of work in emerging economies.” They currently estimate a growth boost to GDP (the size of the domestic economy) from AI of 0.4 percentage points in the US.6 That may not seem like much until you consider the $27.36 trillion size of the American economy.7

However, AI benefits have the potential to go well beyond productivity and profitability. Just as an example, consider this month’s Bloomberg story about AI-powered weed-killing robots that are expected to “curb the use of weed-control sprays by as much as 90%. Using artificial-intelligence powered cameras, the new sprayers can identify and target invasive plants while avoiding the cash crops.”8

While we believe that many of the beneficiaries of advancements in AI are yet to be revealed, AI is already a “dinner table topic”, which suggests that much of the “easy money” may have already been made. What is a much less well-known topic is the antiquated state of America’s power grid, and the massive investment in technology and infrastructure that will be required to address the anticipated soaring demand for energy in the near future.

Further, this investment will be driven not only by the need to meet future demand, but also the societal and environmental need to move to a net zero emission status (net zero refers to the balance between the amount of greenhouse gas that’s produced and the amount that’s removed from the atmosphere). It has been given a widely accepted target date of 2050.

According to a recent report from McKinsey and Company, “capital spending on physical assets for energy and land-use systems in the net-zero transition between 2021 and 2050 would amount to about $275 trillion, or $9.2 trillion per year on average, an annual increase of as much as $3.5 trillion from today”.9

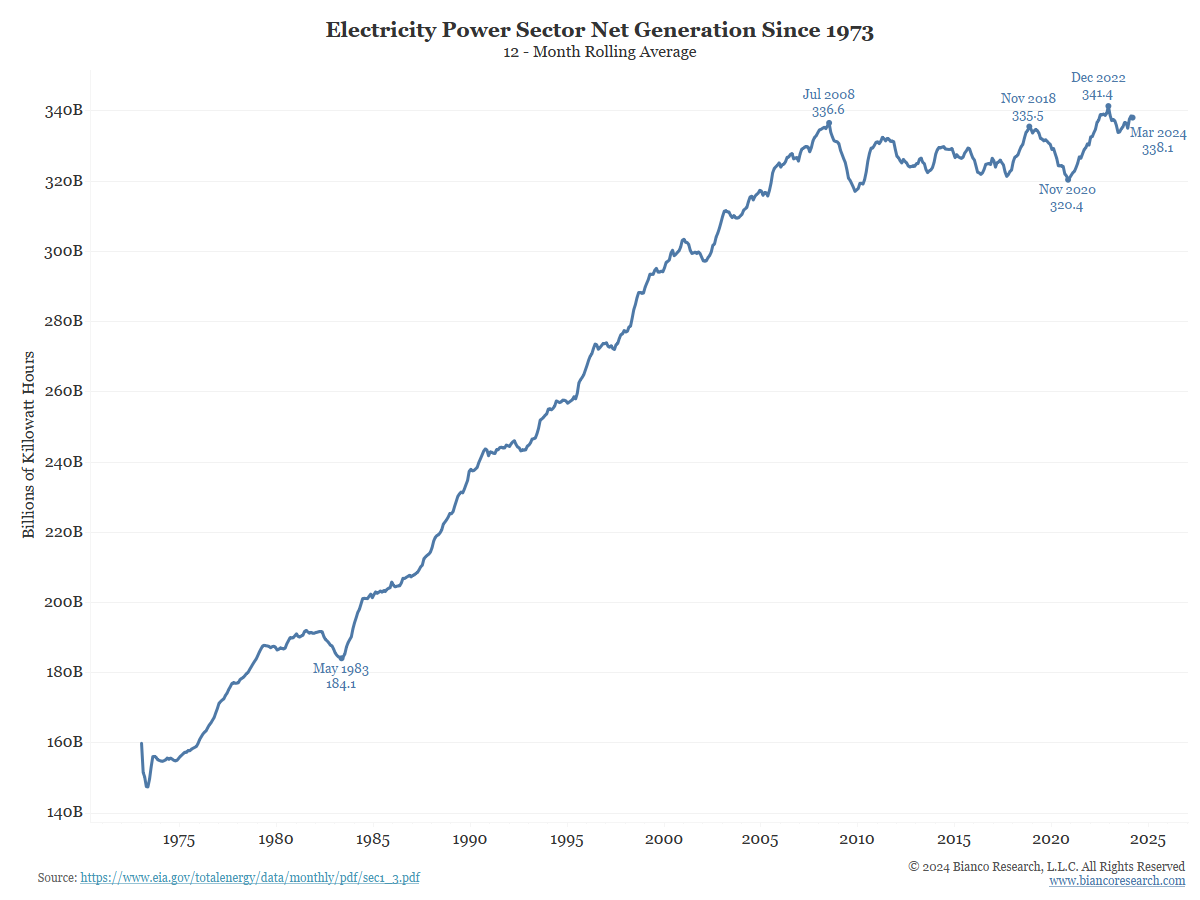

Remarkably, as illustrated above, domestic electric power generation is almost exactly the same now as it was in July of 2008, despite the economy growing over most of that period. This has left the country’s electrical grid capacity constrained to say the least, and the demands on it are predicted to accelerate rather dramatically.

To start with, there is an ongoing shift from the use of traditional search algorithms to using ChatGPT-like queries that are driven by AI, and which require about 10 times the electricity of traditional Google searches.10

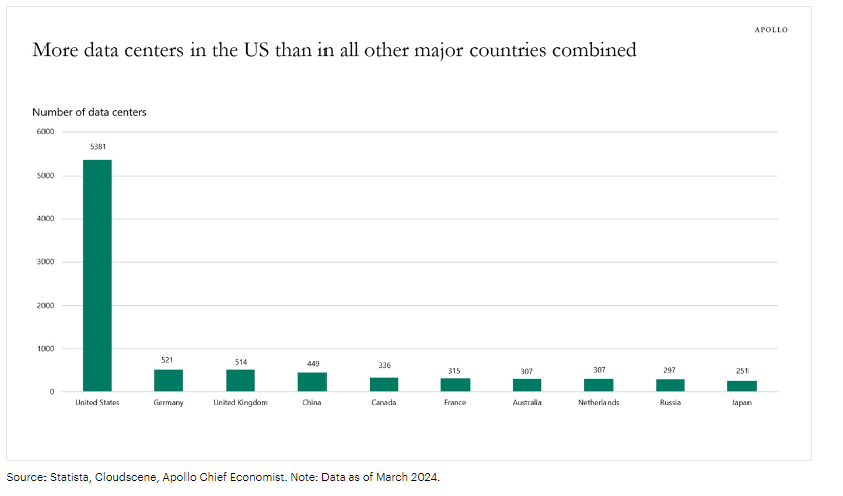

Then consider that the public is just starting to use AI. Specifically, while ChatGPT currently has about 180 million users, there are approximately 5.3 billion internet users globally. Imagine what would happen if only 20% or 30% of them switched to AI-driven queries. Incidentally, all of ChatGPT’s servers are located in the U.S.11 Then add in data center electricity consumption, which the Electric Power Research Institute estimates could more than double by 2030 to 9% of all US electricity production.12

On a global basis, data center power consumption is expected to grow even faster, and by 2026 could equal the amount of electricity consumed by the country of Japan.13

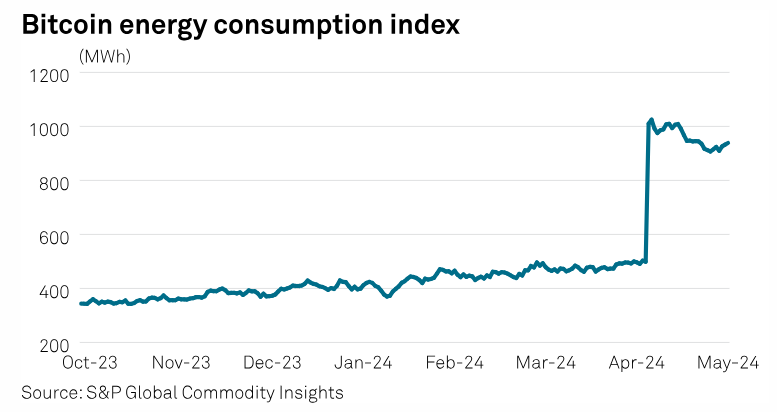

Then there is crypto mining:

Based on the estimated five-year growth rate of 23%, Bitcoin electricity consumption could surpass Sweden in 2024, Spain in 2027, the U.K. in 2028, and France in 2030. Combining the 2026 forecasts for both cryptocurrency mining and artificial intelligence, electricity consumption could double between 2022 and 2026.14

Finally, there are electric cars: According to International Energy Agency forecasts, EVs could account for 6-8% of global electricity consumption by 2035, compared to only 0.5% of consumption in 2023.15

So, who might the longer-term beneficiaries of this mega trend be?

To start with, the operators of nuclear reactors and uranium miners could be prime beneficiaries. The world will need to more than double its nuclear-energy capacity to achieve the aforementioned net zero carbon emissions by 205016 and, as was noted just a week ago in Barron’s “the stars are aligning for a nuclear power revival”.17

When you consider that copper is the only mineral critical to each of artificial intelligence, electric vehicles, solar cells, and wind power, it is very possible that copper miners could be winners over the longer term.18

While natural gas prices are currently extremely depressed due to excess supply, the natural gas industry could also be a significant long-term beneficiary of this trend. Indeed, according to Goldman Sachs, natural gas is expected to supply 60% of the demand growth from AI and data centers, with renewables providing the remaining 40%.19 Wind and solar do not serve as well in this capacity, as data centers need power 24 hours a day and 365 days per year, which renewable energy sources cannot provide.

We consider each of the above energy-related investment themes to be longer-term in nature, and arguably even speculative over the near term. However, there is a beneficiary of this mega trend that we consider to be very investable today, and that is electrical utilities, which have traditionally been known as safe (and even boring) equity-income investments, but which suddenly have growth stock attributes and continue to be among the year’s best performers. They also tend to be quite interest rate-sensitive, which provides a great segue for this commentary’s last topic.

In last month’s commentary, we discussed the concept of “perfect balance” from a monetary policy perspective, and how the Federal Reserve appears set to achieve both of their policy mandates: maximum employment and low inflation. As a result, the Fed cut interest rates as expected on September 18th.

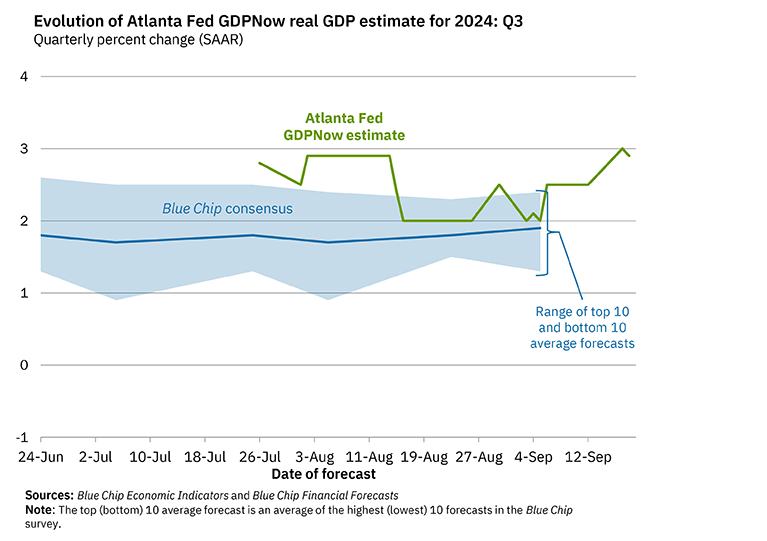

What was a little surprising was that they cut interest rates by 0.50%, which is twice as much as the more traditional 0.25% rate cut, and that they opted for the larger cut despite the fact that the economy is estimated to be growing at a very healthy 2.9% pace (according to the above Atlanta Fed GDP Nowcast from September 18th).

From our perspective, this was a rather unusual rate cut because it was not driven by the normal motivations of either stimulating the economy out of recession or addressing dysfunction in the financial system. Instead, the Fed has clearly signaled their belief that the economy remains healthy, that the job market remains relatively strong, and that inflation is returning to the Fed’s 2% target range. In other words, rather than the rate cut being an attempt to rescue the economy from trouble, the Fed has stated that it is simply “normalizing” monetary policy to keep the economy healthy.

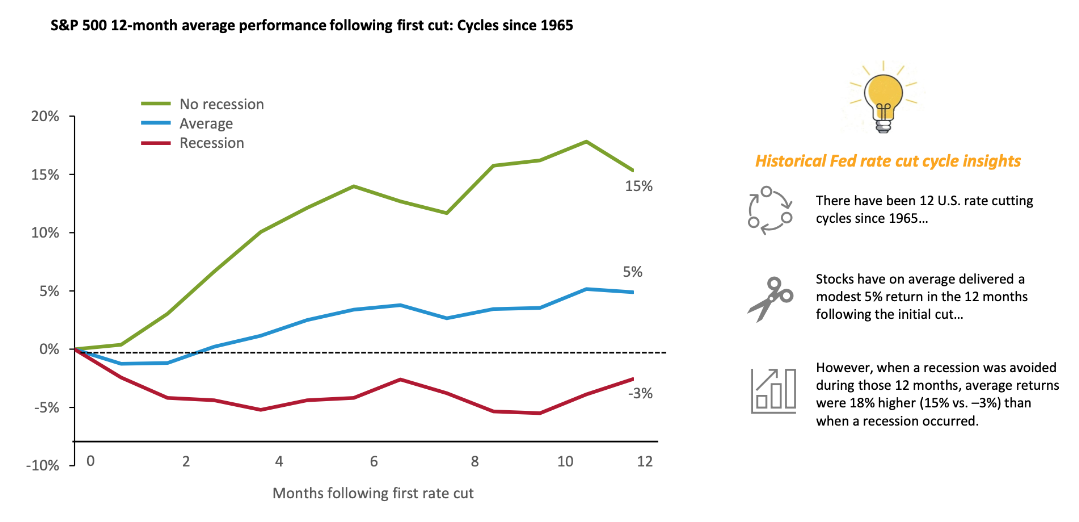

History suggests that this distinction should be of critical importance to investors in general and equity investors in particular, as was noted in last month’s commentary, as periods of monetary policy easing (rate cuts) that are not immediately followed by a recession have historically been quite bullish for equities.

Specifically, as is illustrated in the below chart from Advisorpedia20, there have been 12 rate cutting cycles in the U.S. since 1965. The average return for the Standard & Poor’s 500 Index in the 12 months after the first cut has actually been very sub-par at only 5% per year. The biggest determinant of performance appears to have been whether the economy managed to stay out of recession over that 12-month period. The difference in average annual return between recession (-3% average) and no recession (+15%) is a whopping 18%.

The late economist Rudi Dornbusch famously noted that “economic expansions do not die of old age; they are murdered by the Federal Reserve”. We view this rate cut as a concerted effort on the part of the Fed to accomplish what they have very rarely done, which is to raise interest rates just high enough and for just long enough to quell inflation, and to reverse course in time to avoid “murdering” the economy.

While history suggests that this could be great news for equities, it may not be as good for the bond markets (particularly higher quality bonds), as most bonds historically love recessions, which tend to crush inflation and catalyze aggressive easing on the part of central banks like the Fed. That said, we do not view it as particularly negative either, as the Fed does seem to have accomplished what bond holders will likely view as the single most important objective, which is to bring inflation under control.

While our outlook is generally quite bullish, we will close with a few cautionary points to ponder. First, due to the considerable lag between when rates change and when the change impacts the economy, a recession is still possible albeit, we believe, relatively unlikely. Second, the last time that the U.S. experienced prolonged high inflation (the early 1960s to the early 1980s), each rate cut produced an unwanted surge in inflation. While probably less likely this cycle, history could repeat itself. Finally, the jobs market has been weakening for some time, and over the past year or so, the ratio of available jobs to available workers has shrunk from over two jobs per worker to almost exactly one job per worker.21 In other words, the weakening to date has only removed unfilled jobs. Further weakening would result in actual job losses.

When you consider that consumer spending accounts for 69% of the economy (GDP)22, substantial job losses could ultimately impact consumer spending, slow the economy, and weigh on corporate profits. The period around the elections could also introduce a lot of uncertainty and volatility. Even so, we think that the bulls have the upper hand.

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

FRBNY Global Supply Chain Pressure Index integrates transportation cost data and manufacturing indicators to provide a gauge of global supply chain conditions. The Global Supply Chain Pressure Index (GSCPI) does not represent official estimates of the Federal Reserve Bank of New York, its President, the Federal Reserve System, or the Federal Open Market Committee.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

The Bitcoin Energy Consumption Index provides the latest estimate of the total energy consumption of the Bitcoin network.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“A US Soft Landing Will Rest on Increasing Shaky Ground”, Adrian Wooldridge, Posted 9/19/2024, https://www.bloomberg.com/opinion/articles/2024-09-20/a-us-soft-landing-will-rest-on-increasingly-shaky-ground?utm_medium=email&utm_source=newsletter&utm_term=240920&utm_campaign=sharetheview&sref=YfRIauRL

-

“Reborn in the USA: How Reshoring May Benefit Small-Cap Stocks”, Mike Rode, Posted 7/15/2024, https://www.americancentury.com/insights/reborn-in-the-usa/?utm_activ=ao&utm_bunit=b2b&utm_channel=int&utm_audienc=all-intm&utm_invest=na&utm_program=pm&utm_campaign=pmadvnews&utm_source=email&utm_medium=email&utm_content=bttn&j=1029276&sfmc_sub=16340807&l=40_HTML&u=19433091&mid=100008681&jb=3001&utm_campaign=newsletter_intm_wealth_no-si_no-fs_Aug16_no-camp_082024&utm_source=sfmc&utm_medium=email&utm_term=003a0000023QVajAAG&partnerref=sfmc

-

“Quick Comments/What We’re Reading”, Alex Malitas, Posted 9/6/2024, https://www.biancoresearch.com/visitor-home/

-

“Reborn in the USA: How Reshoring May Benefit Small-Cap Stocks”, Mike Rode, Posted 7/15/2024, https://www.americancentury.com/insights/reborn-in-the-usa/?utm_activ=ao&utm_bunit=b2b&utm_channel=int&utm_audienc=all-intm&utm_invest=na&utm_program=pm&utm_campaign=pmadvnews&utm_source=email&utm_medium=email&utm_content=bttn&j=1029276&sfmc_sub=16340807&l=40_HTML&u=19433091&mid=100008681&jb=3001&utm_campaign=newsletter_intm_wealth_no-si_no-fs_Aug16_no-camp_082024&utm_source=sfmc&utm_medium=email&utm_term=003a0000023QVajAAG&partnerref=sfmc

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Gross Domestic Product, Fourth Quarter and Year 2023 (Advance Estimate)”, bea, Posted 1/25/2024, https://www.bea.gov/news/2024/gross-domestic-product-fourth-quarter-and-year-2023-advance-estimate#:~:text=Current%2Ddollar%20GDP%20increased%206.3,(tables%201%20and%203)

-

“AI-Powered Weed-Killing Robots Threaten a $37 Billion Market”, Michael Hirtzer, Posted 9/17/2024, https://www.bloomberg.com/news/articles/2024-09-17/weed-killers-like-bayer-s-roundup-face-ai-threat-in-new-deere-sprayers?cmpid=BBD092124_W%E2%80%A6

-

“The net-zero transition”, McKinsey & Company, Posted 1/2022, https://www.mckinsey.com/~/media/mckinsey/business%20functions/sustainability/our%20insights/the%20net%20zero%20transition%20what%20it%20would%20cost%20what%20it%20could%20bring/the-net-zero-transition-executive-summary.pdf

-

“Artificial intelligence needs so much power it’s overwhelming the electrical grid”, The Conversation, Ayse Coskun, Boston University, Posted 7/14/2024, https://studyfinds.org/artificial-intelligence-needs-so-much-power-its-destroying-the-electrical-grid/

-

“Data Centers Are Driving An Electricity Demand Surge From AI Platforms Like ChatGPT”, Frank Holmes, Great Speculations, Posted 6/3/2024, https://www.forbes.com/sites/greatspeculations/2024/06/03/data-centers-are-driving-an-electricity-demand-surge-from-ai-platforms-like-chatgpt/

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Inside First Trust ETFs”, Ryan Issakainen, Andrew Hull, Posted 7/2024, ftportfolios.com

-

“Inside First Trust ETFs”, Ryan Issakainen, Andrew Hull, Posted 7/2024, ftportfolios.com

-

“Inside First Trust ETFs”, Ryan Issakainen, Andrew Hull, Posted 7/2024, ftportfolios.com

-

“Get Ready for the New Nuclear Age. It Could Help Solve America’s Electricity Problems.”, Avi Salzman, Posted 9/6/2024, https://www.barrons.com/articles/ai-evs-nuclear-energy-electricity-a4198583?mod=djem_b_This

-

“Get Ready for the New Nuclear Age. It Could Help Solve America’s Electricity Problems.”, Avi Salzman, Posted 9/6/2024, https://www.barrons.com/articles/ai-evs-nuclear-energy-electricity-a4198583?mod=djem_b_This

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Electricity Demand May Cure Debt Concerns”, Lance Roberts, 6/1/2024, https://www.advisorpedia.com/strategists/electricity-demand-may-cure-debt-concerns/

-

“Markets React To Less Than Stellar Jobs Data; Consumers Are Driving On Empty”, Robert Barone, Great Speculations, Posted 9/7/2024, https://www.forbes.com/sites/greatspeculations/2024/09/07/markets-react-to-less-than-stellar-jobs-data-consumers-are-driving-on-empty/

-

“You’re Only as Good As Your Weakest Assumption”, Jim Bianco, Posted 8/26/2024, https://www.biancoresearch.com/visitor-home/