08

JanuaryFourth Quarter 2024 Retrospective

At least on the surface, the fourth quarter of 2024 seemed to echo many of the same capital market trends that had dominated the first three quarters of the year. However, a look under the surface reveals a less homogeneous story, particularly over the last few weeks of the quarter and year.

The quarter witnessed a variety of significant macro-economic events, including rate cuts by most of the world’s major central banks (including the U.S. Fed) and China’s decision to inject massive fiscal and monetary stimulus into its economy. However, while those would normally be hugely impactful, market-moving events, they were dwarfed in importance by two stories coming out of Washington, D.C.—the outcome of the U.S. elections and a notably more hawkish update on future monetary policy by the Federal Reserve.

As was discussed at length in the December Outlook 1, most of the quarter reflected a very “risk-on” environment, which was being driven largely by expectations for a Trump reelection (and associated expectations for stronger economic growth, lower taxes, and deregulation), along with expectations for continued strong earnings growth, and continued rate cuts on the part of the Federal Reserve.

Indeed, it was such a “risk-on” environment that both U.S. stocks and the major cryptocurrencies rallied to new record highs, while “risk off”, safe harbor assets like U.S. Treasury Bonds (down by -8.62% for the quarter) 2 suffered sharp losses.

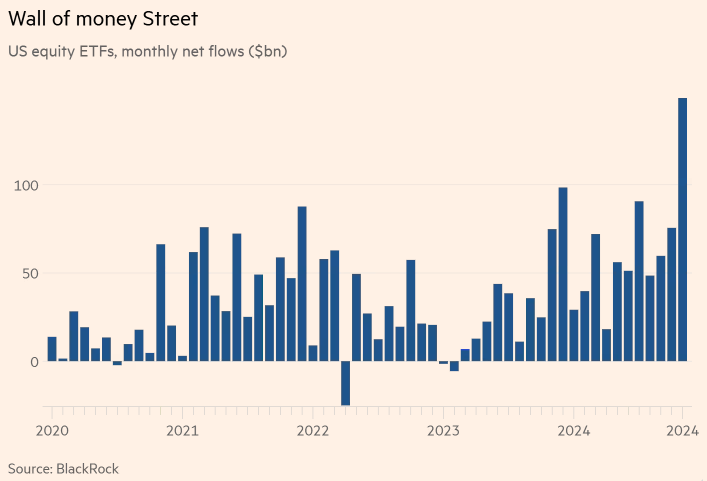

The impact of this surge in optimism was not limited to the rally in stock and crypto market prices or the huge flows of money into risk assets.

It was also reflected in consumer, small business, CEO, and investor sentiment surveys. So broadly euphoric was sentiment that we cautioned in our December Outlook 3 “that equity investors should at least temporarily temper some of their enthusiasm” due to poor “market breadth, [excessively bullish] sentiment, and potential signs of speculative froth.”

The market’s optimistic tone changed rather suddenly in December, due to a combination of the post-election rally running out of steam and the Fed’s unexpectedly hawkish December press release and Chairman Powell’s associated press conference 4 that both significantly diminished guidance for future rate cuts, and specifically made further rate cuts by the Fed contingent on further declines in inflation.

While these shifts did little to slow the decline in bond prices, they did have a significant impact on the equity markets, with the notable exception of the very largest of stocks, which remained quite resilient and thus masked the severity of the underlying weakness.

As examples, while the S&P 500 declined by a modest -2.4% in December, the small-capitalization Russell 2000 Index declined by -8.3%, the S&P 400 Mid-Cap Index declined by -7.1%, and the equally-weighted S&P 500 Index (where all stocks have an equal influence on the value of the index) fell by -6.3%. 5 As noted, only the largest of the large-cap stocks avoided the December decline (the S&P Top 50 Index, which includes only America’s 50 largest public companies, actually managed a 0.6% December gain). 6

So narrow was market breadth (the percent of advancing stocks) on the day of the Fed announcement that “96% of stocks in the S&P 500 finished lower on the day in what was the weakest single day breadth reading of 2024. It was also the S&P 500’s 13th straight day of negative breadth [i.e., more stocks declining than advancing] which ranks as the longest streak of negative daily readings since at least 1990.” 7

By the end of the quarter, the broad-based decline had shifted most investor sentiment indexes from being indicators of bullish euphoria to that of renewed caution, which should hopefully provide the equity markets with a more favorable environment for further gains as they enter into 2025.

Despite the December sell-off, each of the most popular U.S. equity indexes finished the quarter in the black, whether it be the small-cap Russell 2000 Index (0.3%) or the large-cap Dow Jones Industrial Average (0.9%). The best equity performance came from the large-cap indices like the S&P 500 (2.4%), Russell 1000 Index (2.8%) and NASDAQ Composite (6.4%), which are heavily weighted to large-cap growth (primarily technology-oriented) stocks. 8

Foreign equity markets faired nowhere as well, with quarterly losses in Europe, the developed Pacific Region and emerging markets averaging -9.7%, -5.5%, and -8.0% respectively. Excluding the U.S., the average loss in the global markets was -7.4% 9, so it truly was a quarter of American exceptionalism.

Unfortunately, American exceptionalism did not fully extend to the broad bond markets, where U.S. bonds (as represented by the Bloomberg Aggregate Bond Index) averaged losses of just over -3%, while foreign government bonds experienced losses for the quarter averaging -7.4%. 10

Disclosures

Advisory services offered through Per Stirling Capital Management, LLC. Securities offered through B. B. Graham & Co., Inc., member FINRA/SIPC. Per Stirling Capital Management, LLC, DBA Per Stirling Private Wealth and B. B. Graham & Co., Inc., are separate and otherwise unrelated companies.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Per Stirling Capital Management, LLC’s (hereafter PSCM) expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantying future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of PSCM’s Investment Advisor Representatives.

The information presented is not intended to be making value judgements on the preferred outcome of any government decision or political election.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Small capitalization securities involve greater issuer risk than larger capitalization securities, and the markets for such securities may be more volatile and less liquid. Specifically, small capitalization companies may be subject to more volatile market movements than securities of larger, more established companies, both because the securities typically are graded in lower volume and because the issuers typically are more subject to changes in earnings and prospects.

Investments in emerging markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

Definitions

The Standard & Poor’s 500 (S&P 500) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S with each stock’s weight in the index proportionate to its market. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index.

The Russell 2000 Index measures the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

This Standard & Poor’s Midcap 400 Index is a market weighted index that serves as a barometer for the U.S. mid-cap equities sector. To be included in the index, a stock must have a total market capitalization that ranges from roughly $750 million to $3 billion dollars. Stocks in this index represent household names from all major industries including energy, technology, healthcare, financial and manufacturing.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Russell 1000 Index measures the performance of the largest 1000 U.S. companies representing approximately 90% of the investable U.S. equity market.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Gross Domestic Product Price Index (GDP) measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Citations

-

“Per Stirling Capital Outlook – December”, Robert Phipps, Posted 12/20/2024, https://perstirling.com/per-stirling-capital-outlook-december-2024/

-

“Total Return Review”, Bianco Research, Posted 1/2/2025, https://www.biancoresearch.com/visitor-home/

-

“Per Stirling Capital Outlook – December”, Robert Phipps, Posted 12/20/2024, https://perstirling.com/per-stirling-capital-outlook-december-2024/

-

“Transcript of Chair Powell’s Press Conference”, Chair Powel, Posted 12/18/2024, https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20241218.pdf

-

“Total Return Review”, Bianco Research, Posted 1/2/2025, https://www.biancoresearch.com/visitor-home/

-

“Index Dashboard: U.S> December 2024”, S&P Dow Jones Indices, Posted 12/31/2024, https://www.spglobal.com/spdji/en/documents/performance-reports/dashboard-us.pdf

-

“The Stat Sheet”, Bespoke Investment Group, Posted 12/20/2024, https://www.bespokepremium.com/interactive/posts/think-big-blog/bespoke-stat-sheet-2024

-

“Total Return Review”, Bianco Research, Posted 1/2/2025, https://www.biancoresearch.com/visitor-home/

-

“Total Return Review”, Bianco Research, Posted 1/2/2025, https://www.biancoresearch.com/visitor-home/

-

“Total Return Review”, Bianco Research, Posted 1/2/2025, https://www.biancoresearch.com/visitor-home/